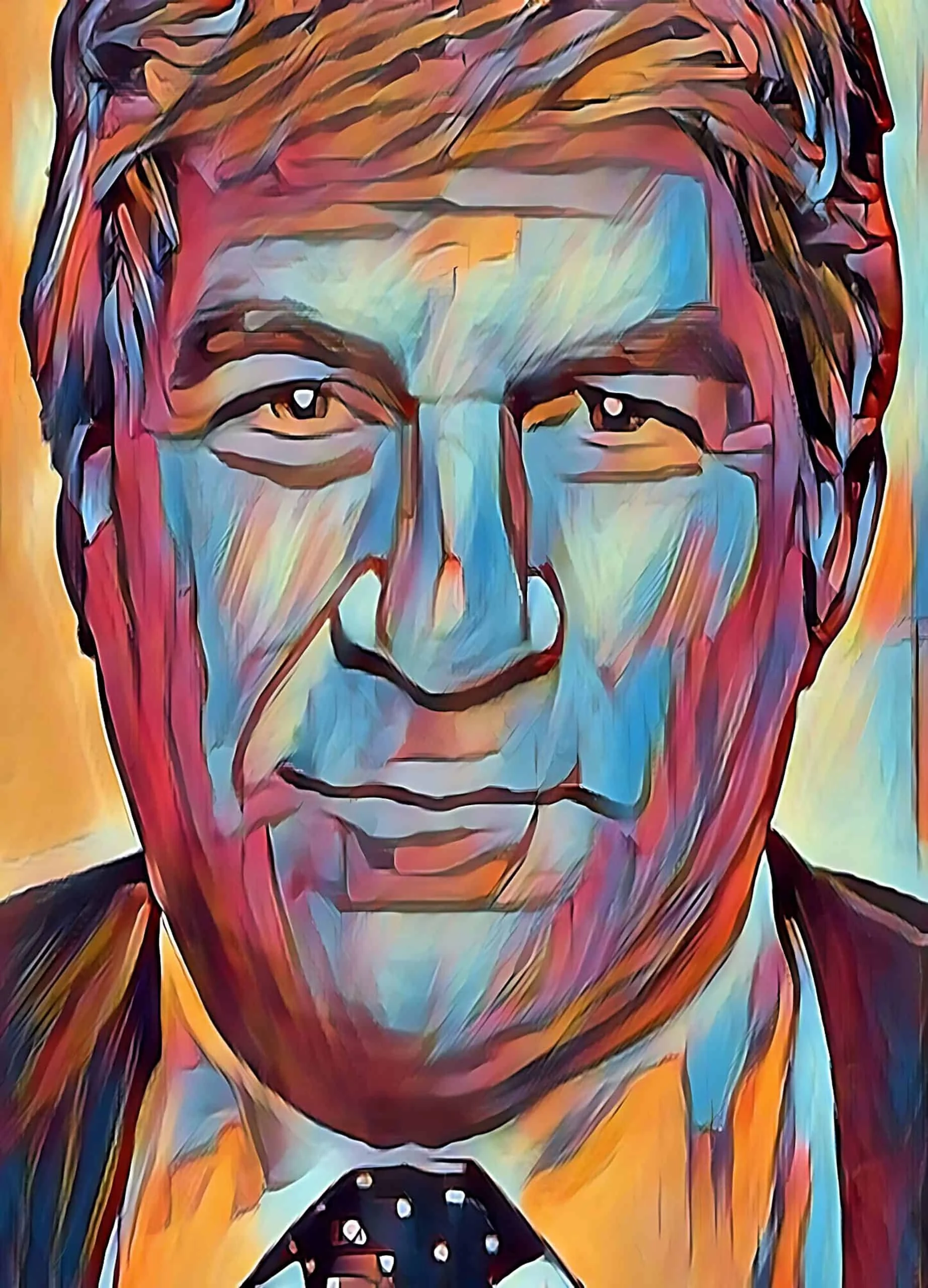

Bruce Kovner's Trading Strategy Explained

Bruce Kovner has every attribute you’d want in a great trader.

He generated a ~90% CAGR during his ten years at Commodities Corp. After that, he opened his own shop and compounded capital at ~21% for 28 years.

Peter Brandt – one of the greatest traders of all time – calls Kovner “probably the best trader I’ve ever known.”

Kovner trained under Michael Marcus, who learned under Ed Seykota and Amos Hostetter (founder of Commodities Corp).

But you wouldn’t hear any of this from Kovner himself. Despite being arguably the best trader alive, he keeps a low profile.

There are only three publicly available speech transcripts from him. He doesn’t do any podcasts (though he’s welcome on Value Hive anytime) and he’s not on Twitter. Most Google searches showcase Bruce Kovner’s philanthropy or political think-tank donations.

But we want the good stuff — the stuff that took Kovner from a borrowed $20,000 trading stake to a $6B+ net worth.

That’s why we created this Bruce Kovner Case Study.In the following report, we’ll break down Kovner’s trading strategy by analyzing his views on risk management, position sizing, market timing, technical and fundamental analysis, and emotional temperament.

Bruce Kovner's Trading Strategy Explained

Kovner On Getting Your Mind Right

Michael Marcus taught Bruce Kovner the most critical lesson in trading: making millions of dollars is possible. Kovner started with $20,000 of borrowed money… so the idea that he could turn that into millions wasn’t exactly ingrained:

Michael [Marcus] taught me one thing that was incredibly important… He taught me that you could make a million dollars. He showed me that if you applied yourself, great things could happen. It is very easy to miss the point that you really can do it. He showed me that if you take a position and use discipline, you can actually make it.”

Trading is a unique profession in that earnings power is infinitely scalable. The more profitable you are, the more money you have to trade. And the more money you have to trade, the more you can make.

A great trader can go from making a few thousand dollars a month to a few hundred thousand dollars a month, all thanks to scale.

Kovner eventually generated hundreds of millions in profits annually. He made over $300M in 1987 alone. But that was after he blew up a few accounts and learned the next extremely valuable trading lesson…

The Big Idea: The first step to making millions in the market is to believe that it’s possible.

Kovner On Not Losing Money

The best way to start making money is to ruthlessly focus on not losing it. Kovner is a master risk manager. His number one goal is to never lose money. And the way he does that is by managing his emotional equilibrium and sizing his positions correctly.

How Kovner Manages His Emotional Equilibrium

Average traders trade much too large position sizes. Kovner, on the other hand, never risks more than he can emotionally tolerate (emphasis added):

“My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks. The emotional burden of trading is substantial; on any given day, I could lose millions of dollars. If you personalize these losses, you can’t trade.”

Overtrading is a common mistake new traders make. They think they have to take big swings and risk 10-20% of their accounts per trade because “that’s how the whales did it!”But 99% of traders can’t handle the wild PnL swings that come with monstrous 10-20% positions. And more importantly, that’s not how the professionals made their fortunes.

Peter Brandt once said that “trading is an upstream swim against human emotions.” Trading too large (or too many) positions makes the swim impossible.Kovner solves this problem by trading small (emphasis added):

“Risk management is the most important thing to be well understood. Undertrade, undertrade, undertrade is my second piece of advice. Whatever you think your position ought to be, cut it at least in half.”

Al Brooks, who many consider the best price action educator ever, suggests new traders risk an amount so small that they don’t care if they lose the money. Brooks calls this the “I don’t care” sizing guide.

Trading small prevents significant losses, which destroys what Kovner calls his emotional equilibrium. When his equilibrium feels off, Kovner stops trading and cuts all positions.

“To this day, when something happens to disturb my emotional equilibrium and my sense of what the world is like, I close out all positions related to that event.”

Kovner highlights an essential dichotomy in trading: you don’t need to risk a lot to make money. Instead, Kovner leverages position sizing to take massive positions with little actual risk.This is something that most new traders miss, so let’s use an example to demonstrate.

How Kovner Sizes His Trading Positions

Suppose we have $20,000 to trade. We spot Apple (AAPL) forming a tight consolidation pattern ready to break out. The stock currently trades at $95, but if it advances past $100, it would blow out any prior highs.

We set a buy stop at $100, pulling us into this trade if triggered.

Here’s the most crucial part of Kovner’s process: Kovner always knows his exit point.

In the above example, we don’t want the price to fall below $90. That’s the point at which our technical pattern fails and our bet is wrong.So we’ve got our entry point ($100) and our exit point if we’re wrong ($90). That $10 difference between our entry and our stop is the per-share dollar risk we can take on the trade. We’ll lose $10 on each of our shares if we’re wrong.

Kovner suggests traders risk ~1-2% of trading capital on any one trade. That means we can risk at most $400 buying AAPL (2% of our $20,000 account).

But since we want to follow Kovner’s advice and under trade, we’ll risk only 1% or $200.

We determine how many shares to buy by dividing our risk per trade ($200) by the per-share dollar risk of that trade ($10).

That gets us 20 AAPL shares.This trading math is why greats like Kovner (or Druckenmiller or Soros) can hold significant notional position sizes while only risking a small actual percentage of their account.

In the above example, we’re putting a notional 10% of our account in one trade. But we’re only risking 1% of our actual trading capital thanks to our predetermined exit point.

The Big Idea: Trade small enough that you don’t care if you win or lose the money. Keep your emotional equilibrium in balance. And if you’re ready to trade larger sizes, risk no more than 1-2% of your account on any trade.

Kovner On Using Price Action

Bruce Kovner keeps broad macro views of global economies. He has opinions on where interest rates will be and which currency pairs might benefit from a global trade deal.He constantly holds alternative scenarios in his head and waits for the market to confirm or deny these views (emphasis added):

“One of the jobs of a good trader is to imagine alternative scenarios. I try to form many different mental pictures of what the world should be like and wait for one of them to be confirmed.

You keep trying them on one at a time. Inevitably, most of these pictures will turn out to be wrong — that is, only a few elements of the picture may prove correct. But then, all of a sudden, you will find that in one picture, nine out of ten elements click. That scenario then becomes your image of the world's reality.”

Holding all these scenarios together sounds impossible, but there are two ways to do it:

Hire a legion of analysts to cover every aspect of the global economy and alert you when one of your “alternative scenarios” occurs.

Use price action to determine when your alternative scenario might come true.

Kovner has more money than God and uses both of the above options.But for those with smaller means, the best option is to master price action and use it as a thermometer for the alternative scenarios we create. Kovner explains how to do that below (emphasis mine):

“I almost always trade on a market view; I use technical analysis a great deal and it is terrific, but I can’t hold a position unless I understand why the market should move. Every position I take has a fundamental reason behind it. But I would add that technical analysis can often clarify the fundamental picture.

Technical analysis is like a thermometer. If you are a responsible participant in the market, you always want to know where the market is – whether it is hot and excitable, or cold and stagnant. You want to know everything you can about the market to give you an edge.

Technical analysis reflects the vote of the entire marketplace and therefore, does pick up unusual behavior. It is very important for me to study the details of price action to see if I can observe something about how everybody is voting. Studying the charts is absolutely crucial and alerts me to existing disequilibria and potential changes.”

Kovner must trade on a fundamental market view. If he’s buying soybean futures, he has a fundamental idea of why soybeans should move higher. If he’s shorting bond futures, he’s betting on a fundamental reason why bond futures should trade lower.

But he doesn’t stop there, Kovner always marries his fundamental views with technical analysis to confirm or deny his bets.

Let’s use our soybeans example. Kovner might have a fundamental bullish take on why soybean prices should rise. But he won’t take the trade until he sees confirming price action (i.e., soybeans breaking out of a base or hitting new highs).

Many investors ignore technical analysis, viewing it as a pseudo-Scientology practice without the celebrity perks.

But according to Kovner, those that ignore price action do so at their own expense (emphasis added):

“Fundamentalists who say they are not going to pay any attention to the charts are like a doctor who says he’s not going to take a patient’s temperature.”

I love Kovner’s analogy of technicals as a market thermometer because it perfectly describes the role of what technical analysis should be. Kovner admits that technical analysis isn’t a “future prediction” machine, but a footprint of where market participants have been (emphasis added):

“Technical analysis tracks the past; it does not predict the future. You have to use your own intelligence to draw conclusions about what the past activity of some traders may say about the future activity of other traders.”

You’ve heard the phrase “catching a falling knife”. It’s where investors buy a falling stock because it’s a “bargain”, but discover that the stock becomes an even better “bargain” a few months later.

According to Bruce Kovner, falling knives are the market’s way of telling you that a stock is sick and you shouldn’t buy it.

You might have a particular fundamental bull case on the company’s addressable market and competitive positioning, but none of that matters if the technicals don’t confirm your fundamental view.

Check out my Technical Analysis for Fundamental Investors primer to learn more about technicals and how to read the market’s temperature.

The Big Idea: Use technicals to confirm your fundamental views and trade when your fundamental and technical analysis aligns.

We practice Bruce Kovner’s principles at Macro Ops daily. It’s one of the reasons we’ve beaten the market repeatedly.

If you'd like more lessons from market legends like Bruce Kovner, check out our free “Trading Greats” report here.