Teachings From Commodities Corp (CC)

Today I wanted to share a little nugget with you guys and gals that I pulled from our internal library that’s available to members of our Collective.

It’s about Commodities Corp. The training grounds for many of the best traders alive today. Inside, you’ll find some back story on CC along with a host of documents on market theory and practical trading tips that CC published internally and which you almost certainly haven’t seen before. There’s some great stuff in here, so enjoy…

For those of you not familiar with Commodities Corporation, I suggest giving this Fortune article from 1981 a quick read and then pick up a copy of Mallaby’s bookMore Money Than God, which does a good job detailing the story of this unique outfit, as well as that of many other early pioneers in the hedge fund industry.

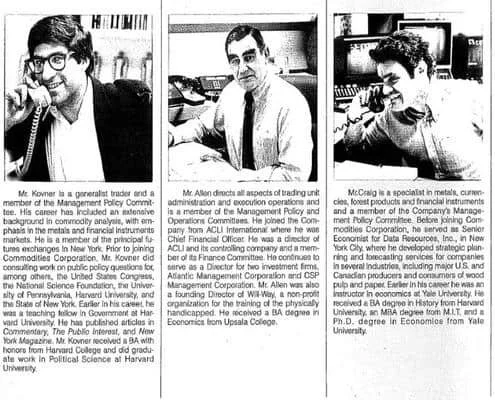

CC was a trading operation founded by Helmut Weymar and Amos Hostetter during 1977 in Princeton, N.J. The firm was established to raise money which it would then use to trade in the commodities market and hopefully profit.

In many ways, CC was one of the very first hedge funds. Its story is so incredibly impressive not just because of the unbelievable returns the fund produced (which were astronomical) but even more so because of the long list of legendary traders who came out of it. The CC alumni list reads like a 20th-century trader hall of fame inductee roll. Some of these names include:

Grenville Craig

Craig Witt

Louis Bacon

Anyways, the other day I was going down the internet rabbit hole and came across some pretty unbelievable finds.

The first one is a short (43 page) internal booklet prepared by another trader named Morry Markovitz at CC that summarizes Hostetter’s teachings and approach to trading. The booklet is titled Amos Hostetter; A Successful Speculators Approach to Commodities Trading. You can find the pdf link here.

The booklet is jam-packed with timeless trading wisdom from one of the greats. Paul Samuelson, Nobel Prize-winning economist and early backer of CC said Hostetter was “the most remarkable investor I know, he made money in commodities 50 years straight.” That’s tall praise coming from a man who was also one of the first investors in a young Buffett.

I suggest you read the booklet in full, but I’m going to share with you one of my favorite takeaways from the piece, which is fantastic in its simplicity and truth. If you were to follow this advice on every trade I guarantee you would see a significant amount of improvement.

To follow are the screenshots of Hostetter’s section on “questions to ask before entering and exiting a trade”:

Now here’s the second trading nugget I found in the far-nether regions of the dark web. This one written by an unknown. I don’t think he ever gives his name, but apparently he worked at a broker that filled orders for traders at CC and may have even worked at CC itself for a time.

This one is a 10-page document titled Commodity Corporation: The Michael Marcus Tape. It’s apparently a compilation of some of Marcus’ trading notes along with the author’s commentary; including some of his stories about working with Marcus. The PDF link is here.

For those of you not familiar with Marcus, he was profiled in Schwager’s original Hedge Fund Market Wizards. He’s a legendary commodities trader who is said to have turned his initial $30,000 investment into over $80 million in under 20 years — not bad. He also got his start at CC and is part of the most famous mentor/trader lineage which started with Hostetter, who trained Seykota, who taught Marcus, and who then taught Kovner. Talk about having a mentor advantage — that’s just unfair. And who knows, Hostetter could’ve trained under Livermore and Baruch for all we know.

Again, read the entire document. It’s short and well worth your time. Here are some of my favorite takeaways from the piece (bolding is mine):

Comm. Corp was essentially a trading university where traders learned to trade and perfect their skills. In the course of their employment, the traders were asked to prepare their trading philosophy which was archived. Commodities Corporation also made traders do write-ups when they lost money or “got knocked out-of-the-box.” These “knocked out-of-the-box” papers focused on how they failed and how they were going to correct their problems. All of these were archived and available to read or watch. In my opinion, these were an invaluable resource for all traders to learn from. I just wish they were now available on a website. I will discuss some of these in a later post.

I think the “knocked out-of-the-box” papers are a great idea and “hot damn!” what I’d give to be able to go through those.

Somebody has to know where those docs are and side note: it’s really strange that a more in-depth book hasn’t been written about CC. I have Schwager’s number — I used to call him years and years ago under the guise that I was writing an interview style book and wanted to learn tips on how to give a proper interview, but I’d just end up pestering him for trading stories (he was cool about it) — I should phone him up and see if he knows anything... But I digress… here’s another one.

Trading has two types of capital that must be managed – financial capital and mental capital. In this case, losing a lot or being unsure of your system drains you of your mental capital. You don’t want to do that. Losing either your financial or mental capital will knock you out of business. So protect both equally well.

So true. Both are equally important and you have to protect one to protect the other. And finally:

Comm. Corp. taught me to see the signal, like the signal, follow the signal. If you follow your system /methodology then over time your edge will kick-in and you’ll end up ahead.

“See the signal, like the signal, follow the signal” was an oft used phrase amongst traders at CC, as well as “ride your winners and sell your losers” which was coined by Hostetter. Simple, yet powerful. There’s also some great stuff in there on adding at “danger points”, something we refer to as inflection points and a good discussion on the importance of developing market feel. Take 10 minutes and read through it.

Lastly, here’s a document (for you more wonkish types) that summarizes and advances Weymar’s original Ph.D. dissertation on forecasting cocoa prices (the theory was the primary reason for CC being created). Here’s the link. I used to have Weymar’s original dissertation, but I seemed to have misplaced it — but this is close enough.