The Macro Ops Collective

The Premiere Investment Research, Training, And Community Platform For Institutions And Retail Investors

The Macro Ops Collective

The Premiere Investment Research, Training, And Community Platform For Institutions And Retail Investors

There's a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this '66 to '82 time period…

~ Stanley Druckenmiller (8/16/2022)

My mentor used to tell me that the most amount of money is made and lost during paradigm shifts. This is where the prevailing zeitgeist is shattered as the markets enter an entirely new regime — with new rules, new drivers, new losers, and new winners…

The majority of investors get steamrolled during these tectonic shifts. They’re unprepared and unconscious of the new game and its new rules. They’ve spent their entire careers looking through the rearview mirror. They’ve over-optimized for what has been while not giving a thought to what may be…

At Macro Ops, we live for these regime shifts. They’re our bread and butter, our kolache and coffee, our T-bone and lager… you get the point.

Nothing is more stimulating and profitable than quickly adapting to a new regime. And what makes us excited for the next 10-years is that there isn’t just one regime change afoot… no, we’re at the nexus of multiple major shifts in how the world works. We’re talking economically, politically, technologically, and in the Great Game of geopolitics.

We call this new period Panta Rhei, Extremus… to steal and alter a phrase from the Greek philosopher Heraclitus. It means Life is Flux. And we’ve entered a period of extreme flux…

This decade will be a golden age for macro. Gone are the days of passive indexing, momentum/growth chasing, and yolo’ing into a HODL crypto 15x P/S Bankman-fried ARKK ponzi — that’s old zeitgeist stuff.

The new zeitgeist will be dominated by:

Financial repression as the developed world’s policy du jour

Structurally higher inflation

Changing power dynamics between capital and labor

An increasingly tenuous Cold War 2 between rising and falling powers

A cambrian explosion of new AI tools and their rippling and unforeseen consequences

Climate change and ill-contrived policy responses by half-witted leaders

And so, so much more…

It may be a sideways market for 10-years straight like Druck thinks. And the prospect for such should scare most investors. They simply don’t have the knowledge, tools, or community to deftly navigate what’s on the horizon.

But lucky for us at Macro Ops, we thrive on volatility. We have everything we need to profit in a decades-long sideways volatile regime.

We saw this Fed-induced sh*t show coming. We went to cash and added shorts to the book. We turned our attention to uncorrelated assets. We loaded up on wheat before the Russian invasion of Ukraine (we were one of the few shops to correctly predict it — link here). We went long USDCNH in the beginning of the summer. We shorted ETHUSD when financial conditions started to dramatically turn this year.

Now of course we’ve had plenty of losers too… that’s the price of doing business in this game. But we have a hard-tested process and framework for managing risk which is why our losers are always small.

We teach this approach in the Macro Ops Collective – our premium subscription service. We share all our market tools along with our research and insights in real-time as we execute our various strategies.

The Collective exists to help you synthesize this changing market so you can block out the noise and focus on the few critical inputs, risks, and trends that matter. The idea is to help you become a calculating, ruthlessly efficient, and consistently profitable investor.

So if you’ve struggled to manage this regime change because of a lack of time or resources… and if you believe there’s untapped potential in your portfolio… then joining the Collective is the most asymmetrical trade you can make this year.

We know there are hundreds of newsletters nowadays. And most of them collect dust in your inbox because they don’t provide any actual value to your trading process.

The Collective is different.

We cut through the noise to show you exactly what’s affecting the market and how to respond to it. The heavy lifting is done for you so that you’re prepared for anything with just a few minutes of reading per week.

Our goal is to save you time while simultaneously making you more money.

But that’s just the research aspect of the Collective…

We also provide in-depth training so you’ll learn step-by-step how to do what we do.

Collective members come into our service and immediately learn the Macro Ops process from start to finish. Some fully adopt our strategies, while others modify them and combine them with their own approach. Either way, all our members develop a consistent, repeatable way to extract profits from the market.

The Collective is basically a fly-wheel of potential — a full-suite, soup-to-nuts program for empowering you to evolve and thrive in every market environment.

And as we continue into this new regime of extreme flux, the power of our Collective has never been more essential.

Joining us is a question of whether you want to fly blind and hope for the best… or walk into battle clear-eyed and prepared for whatever the market gods bring to bear.

“We subscribe to a range of research publications and Macro Ops is head and shoulders above the rest... Alex’s weekly note is a must-read in our shop.”

“I’m a portfolio manager with over 20 years of experience. I’ve read a lot of commentary in that time, both institutional and retail, but yours is about the best I’ve seen. I learn something new all the time.”

The Macro Ops Advantage

Our team’s “go anywhere” macro strategy gives us ultimate flexibility and a huge advantage.

If stocks are tanking, we trade commodities.

Bonds not working? We jump into the currency markets.

While most investors are victims to a single market, our ability to trade every asset class gives us a robust edge.

And on top of multiple asset classes, we also deploy multiple portfolio strategies depending on the market regime.

If we think there’s an imminent risk of a crash, we have a hedging strategy for that.

If conditions are overly choppy and we aren’t sure of a market direction, we have a volatility strategy for that.

We have a plan to protect and grow our capital in every situation.

This is only possible because we’ve studied nearly every investment approach. We aren’t like other research services that focus solely on value investing or quantitative or macro, etc…

We’ve examined it all, adopting what works, discarding what doesn’t, and combining it all into an exponentially better process.

We call our process the Trifecta Approach — in a respectful nod to the Market Wizard Michael Marcus who helped popularize it. This is the method used by many of the greats including Livermore, Kovner, Soros, Druck, and more.

The Trifecta Approach combines sentiment, fundamental, and technical analysis.

Using a deep understanding of fundamentals to express trades, sentiment to spot intermediate-term price dislocations (+EV entry/exit points), and technicals to ruthlessly manage risk… we’re able to stack conditional edges and produce a vastly more asymmetric process for tackling markets.

A Brief Overview Of The Trifecta Approach

Step 1: Identify The Market Narrative

The first step in the Trifecta Approach is to identify the current market narrative.

At its core, the market is a complex information transmission system.

All acting participants make bets using their individual knowledge sets, which in aggregate, set the new market price.

The new market price in turn provides new information for participants’ decision-making process, which once again leads them to make new bets.

The result of this process is a never ending feedback loop of:

Information → Assessment → Action → New Information

These infinite feedback loops, when combined with group psychology and crowd dynamics, create the constant back and forth we see in markets.

Each rally sows the seeds for a reversal and each reversal sows the seeds for a rally — ad infinitum.

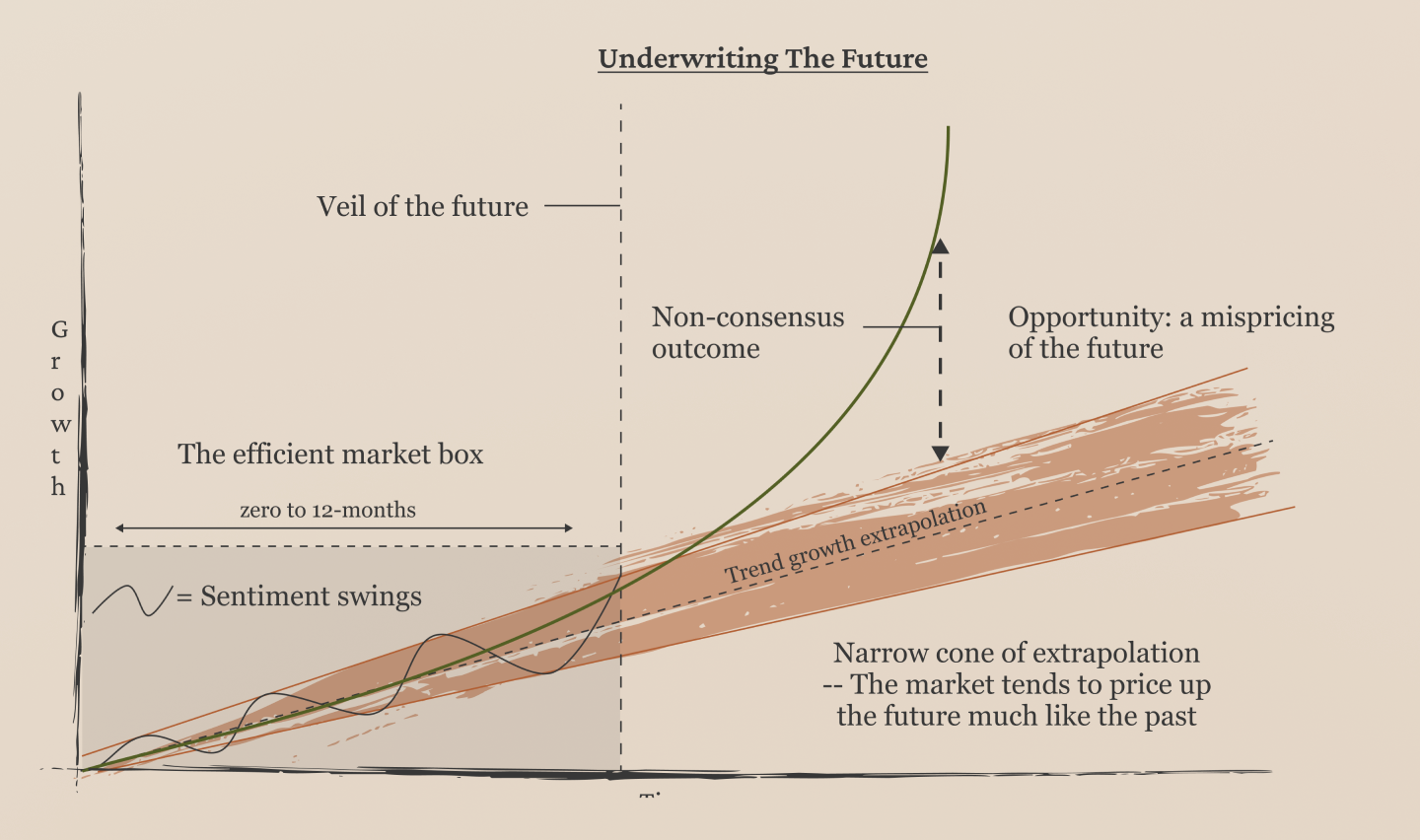

The key is to identify the narrative that’s perpetuating the current cycle. This is what drives market prices.

Step 2: Play The Player

Once the market narrative is identified, we can start to understand investors’ expectations:

Where do they think prices will go and how have they positioned their portfolios for it?

This is what we call the consensus view.

To truly outperform in this game you need to bet against the consensus view.

As traders, we make our money on price movement. But for price to move, the current market price must be wrong. Betting on a trend means betting that the market is currently wrong and that prices will adjust to correct that.

By disagreeing with the market, you’re disagreeing with the consensus view. You’re being a contrarian.

Hedge fund legend Ray Dalio put it like this: “You can’t make money agreeing with the consensus view, which is already embedded in the price.”

This is a process we describe as Playing The Player. And it’s the key to unlocking superior returns.

Step 3: Build A Position

Once we’ve identified the market narrative with the consensus view and we know how to bet against it, we can deploy our quant tools to efficiently build a position.

We’re big believers in Garry Kasparov’s (the chess Grandmaster) idea that unique human intelligence, combined with powerful machine learning and quantitative tools, is vastly superior to employing just one or the other. He calls this the centaur approach — named after the mythological half-man / half-horse creatures.

This is the exact approach Palantir uses. It’s why their software easily outperforms A.I. and machine learning in intelligence work and fraud detection. A skilled user paired with powerful quantitative tools is a force to be reckoned with.

Our quant/risk models help us take our contrarian view and combine it with price signals to surgically snipe entries and exits for our portfolio positions.

These models also make it possible to run a multi-strategy portfolio that benefits from unlimited asset classes, all in the pursuit of alpha. We’re able to hunt for superior returns with enough flexibility to minimize our risk in all market conditions.

Below is a screenshot of just a few of the tools in our proprietary MO Quant HUD:

“You guys are next level, there’s no other way to put it. I only wish I’d found you guys earlier.”

“Macro-ops is by far the best global macro research service out there - period. Alex and Brandon are able to hit notes that others simply can’t, and they do it while remaining extremely humble and accessible to their members. The MO team has had a monster year in terms of their performance, but as a student of the market they have also helped me refine & polish my own investment framework which will continue to pay dividends for years to come. The returns from this service (ideas, updates, investment philosophy, investment education, killer Slack community) will far outweigh anything that you spend here. ”

Here’s How We Can Help You:

The Trifecta Approach we described above takes guts, imagination, and a hard-tested process… but that’s how we make a killing.

And by joining the Collective we’ll show you how you can do the same.

We’ll not only teach you how to identify a market narrative and play against the consensus view, but we’ll give you all the tools you need to do it.

A Macro Ops Collective subscription will grant you access to all our models along with the step-by-step instructions you need to create a bulletproof process for analyzing and profiting from the market.

We founded Macro Ops to foster as many high-level traders and investors as possible. Our goal is to share everything we know with our community, so we can learn and grow together while making a ton of money and creating positive change in the world. And of course, we want to have a helluva good time doing it all.

We accomplish this through better research, better process, and better training. That’s how hundreds of investors have already been able to consistently beat the market by implementing our investment process.

Here’s exactly what you get by joining the Collective:

1) Institutional Level Research

It’s mind-blowing to think about how much information is available now versus 20 years ago, or even just 5 years ago.

It’s created a data deluge.

It’s incredibly tempting to be distracted by useless information… or to pay undue attention to the wrong information… or to self-select news sources and get trapped in an echo chamber — all of which are part-and-parcel for the middling average.

As the flow and volume of information increases, the ability to parse and sort that information becomes an ever more valuable skill.

In the Collective our team takes down multiple firehoses of information per day, digesting it all, and then distilling it into what you need to know right now to make money in the market.

In just a few minutes per week, you’ll be up to speed on everything that’s happening in the global markets with a strategy for how to extract profits from it all.

Here’s a look at our rough research schedule and what you’ll receive in your inbox each week after joining the Collective…

Weekly Reports:

Sunday – Market Note: Our weekly pre-market prep. You’ll get a PDF with general market commentary from me (Alex), along with a rundown of all the important charts we’re looking at that week.

Monday – The Dirty Dozen: Our chart pack shows you the most relevant and insightful charts in the market, adding more color to what we discussed in the Market Note.

Wednesday – Value Letter Recaps: We comb through other investors’ best ideas and break them down into an easy and digestible format. This piece is great for idea generation.

Saturday – Portfolio Recap: Short and quick updates on any important news regarding our portfolio holdings.

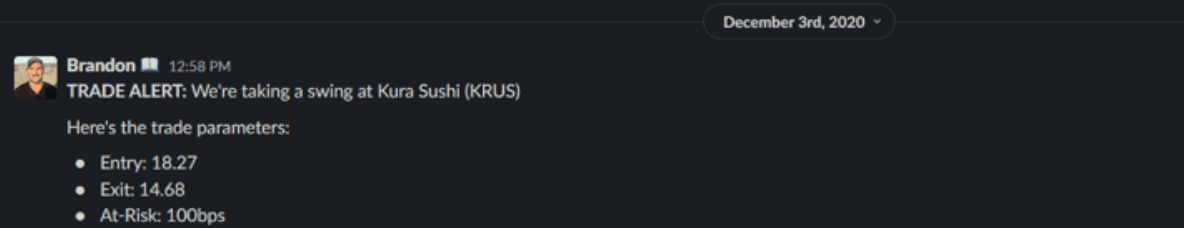

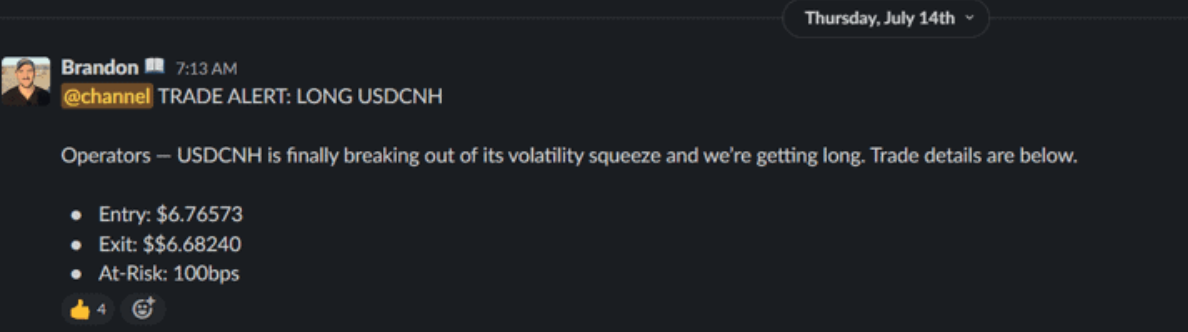

As Needed – Trade Alerts: You’ll be alerted every time we make a new trade in the Macro Ops portfolio. You’ll get entry prices, risk points, and position sizing.

Bi-Weekly / Monthly Reports:

Macro Deep Dives: We’ll discuss a macro thematic our team is tracking and break down the trade opportunities resulting from it.

Equity Deep Dives: An in-depth research report on an equity name that’s usually related to the broader macro theme we’re following.

2) Superior Process With The MO Portfolio

We share our entire portfolio with our Collective members.

Every trade, win or lose, is shown with 100% transparency.

This is beneficial because members can follow along with our trades and profit while also seeing our process up close.

When we take on new positions, we provide trade structure, sizing, and exit information. We know full-well that stock picks are a dime a dozen and are as good as wet toilet paper if they don’t include the above.

Our core portfolio is comprised of 5 multi-timeframe allocation blocks:

Futures/Bonds/FX: This includes any futures, bonds, and forex positions.

Strategic Equities: These are our fundamental long term bets. We focus on mispriced businesses trading at massive discounts to their intrinsic value. These positions have 3-5 year time horizons without hard stop-losses — perfect for longer term investors.

Thematic Equities: This is our industry trend-following book. It contains our favorite bets in the highest returning industries. Think of it as going long the strongest relative strength names in the market.

Tactical Equities: These are our technical-only trades including FVBOs, VBOs, and classical charting patterns. (We’ll teach you how they all work.) These are short-term holds anywhere from a few days to a few weeks/months. They’re perfect for active traders and follow specific trade entry, exit, and profit target guidelines.

Options: This bucket includes all our options strategies.

3) Profitable Time-Tested Strategies

Real students of the game never stop learning…

We can’t. We don’t want to.

One of the great things about markets is that they’re always changing. This forces our skills and knowledge to evolve if we want to stay competitive. What works in one type of market, doesn’t work in another.

That’s why our team runs multiple strategies in our portfolio depending on the market regime we’re currently in.

In our Collective’s Vault, you’ll get step-by-step guides on how to execute every one of these different market strategies. Every single theory, strategy, and process piece we’ve ever written sits in the Vault.

We also have influential white papers, webinars, and video courses on everything from our DOTM strategy, to analyzing emerging market currencies, and more.

4) Community: Iron Sharpens Iron

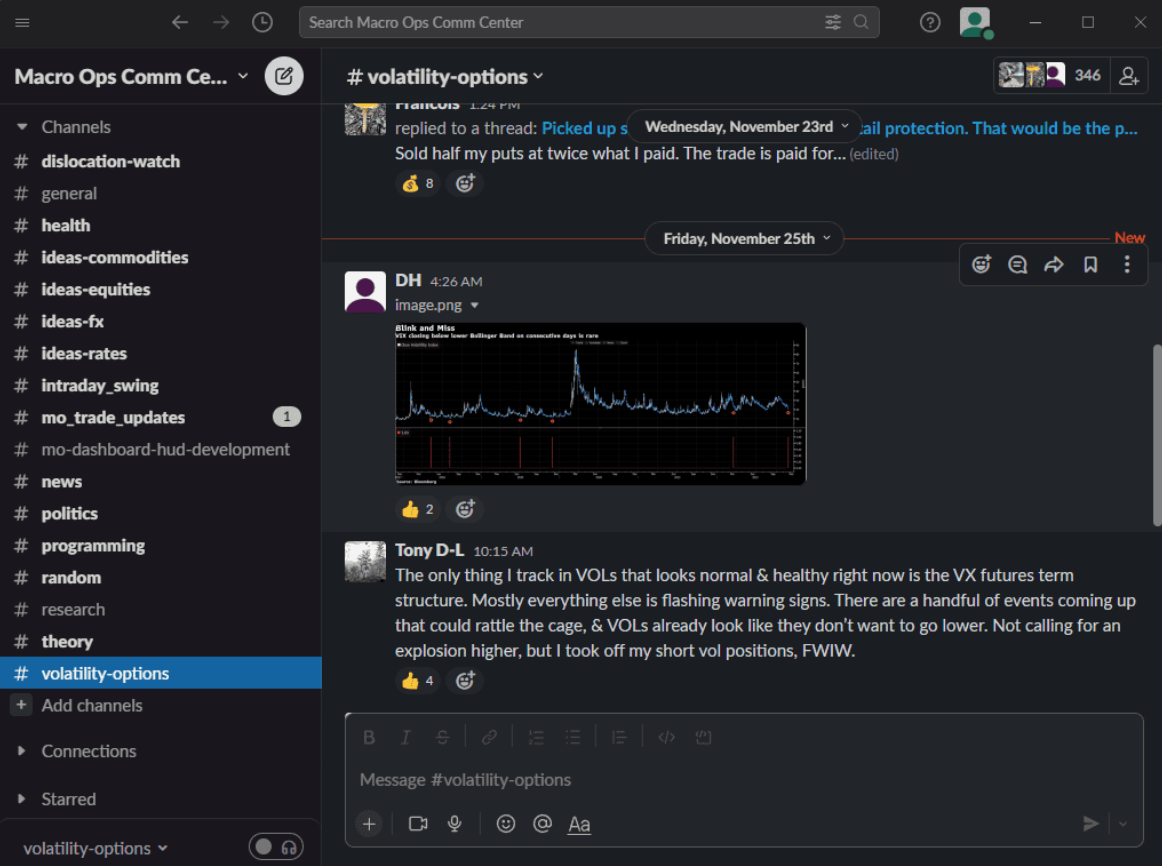

The Collective gives you full access to our private Slack group where the Macro Ops team and fellow traders from around the world spend each day discussing everything from the latest macro research and trade ideas, to health hacks and local meetups.

Once a month our Collective members also jump on live Q&A sessions with myself and the rest of the Macro Ops team.

We cover everything from portfolio updates and theory breakdowns, to gaming market scenarios, conducting strategy dissections, and more.

We can say with 100% conviction that our community of traders and investors is THE BEST on the internet and it’s not even close.

We’re a firm believer in the idea that we’re the product of the people we choose to surround ourselves with. Through the Collective, we’ve met fellow traders and money managers who’ve now become dear friends, and from whom we learn from daily.

It’s amazing and humbling to be able to serve such an incredibly talented group. Each day we all work together to learn, improve, and evolve as traders and human beings

“The Collective is an amazing reservoir of ideas and provides access to great folks — helped me tremendously grow as an investor and a person... My one regret is chasing all the shiny things and not finding MO sooner.

”

The Best Asymmetric Trade Of The Year

Here’s a few examples of how the Collective can quickly pay for itself:

Trade 1: Kura Sushi (KRUS)

We bought KRUS at $18.27 per share on December 3rd, 2020. Brandon (one of our MO team members) sent the following trade alert to our Collective members:

We sold that same position in June of 2021 for $37.23, locking in over 100% profit.

If you invested $5,000 in KRUS, it would have turned into almost $10,200.

That more than covers the cost of a Collective subscription.

Some of our Collective members even decided to hold KRUS longer.

The stock is now at $80/share, more than 4x the initial price.

They made out pretty well…

But we don’t just invest in stocks. We trade every asset class.

Trade 2: USD/CNH

We bought our first long position in the currency pair USD/CNH on July 14th, 2022.

The team sent the following trade alert to our Collective members:

We’re still in this trade and are currently up nearly 10x our risk.

If you risked $500, you would have made $5,000.

That’s once again more than enough to pay for your Collective subscription.

Trades like these contribute to our winning portfolio performance year after year.

Of course past results don’t guarantee future performance, but considering we trade real money in the market, we’ll continue to focus on consistently managing our risk while growing our capital.

In 2020, the MO Portfolio made over 66%.

That means a $50,000 account would’ve returned $33,000 in profits.

That’s enough profit to pay for ten years of a Collective membership.

In 2021, we only returned 6.39%.

It was a volatile year and we were pleased with how we managed our risk. And as always, we shared every trade, win or lose, with our Collective members.

This year we’re up nearly 15% while the Nasdaq is down almost 30%.

This wide margin of outperformance is because of our multi-strat, multi-asset approach — the same one you’ll learn when you join the Collective.

“l hesitated about a year before joining Macro Ops. I enjoyed reading their free emails on markets and investment ideas, but I wondered how much better their paid service could be. I can now say that joining the collective has been the best single decision I’ve made for my portfolio in 20+ years of investing. The Four Pillars model portfolio is the result of Alex and Brandon’s incredible stock picking abilities, always backed by thorough research and smatt risk management, and the trade alerts make it very easy to manage. The collective of Macro Ops members also form a supportive community that point out many very smatt investment ideas and resources. Before joining the collective, my greatest challenge was finding good ideas so / could allocate capital with confidence and get decent returns. Now my biggest challenge is choosing...there are just so many profitable ideas that are floated on the Slack channels that I’m having trouble not investing in them all. I most highly recommend Macro Ops.

”

So Why Wait? Join Our Team Now.

Markets are only getting wilder.

You need the strategies, tools, and community to support you through one of the most dangerous market environments we’ve faced in decades.

Join our team now.

To beat a market like this, you need to be proactive rather than reactive.

You need to efficiently filter out the deluge of noise and have a tested process for getting at the truth.

You need to have backtested trade structure and sizing methodologies as the basis of your approach.

You need the Collective. It’s your tool for doing ALL of this…

We work day and night to filter the key information for you… to give you signals for when to pare back risk and when to go for the jugular… to give you the tools and process to excel beyond your peers… no matter if you’re a 20-year veteran hedge fund manager or a maniacally devoted recent MBA grad.

We exist to support your trading and investing success.

Join our team now and let’s crush these dangerous markets together.

“MacroOps is a premium research, analysis, education, and community-based service start to finish. The majority of what Alex and Brandon produce is in-depth, sophisticated research into global macro and market trends, company-specific analyses, and thought-provoking essays on a wide range of topics that can shift your perspective on markets, philosophy, geo-po/itical goings on, and much more.

Their understanding of the complicated and intertwined dynamics of markets is the foundation of their approach to investing and speculation. Their ability to balance the scientific / analytic / quantitative component of investing with the necessary art and finesse that comes from years of experience, backtesting, and lessons learned, has led to a truly unique and insightful approach to markets. The Collective is a powerful community of investors of all stripes and experience levels, many of whom participate daily in the sharing of information, research, trading ideas, and non-market related content. As with anything in life, you will get out of MacroOps what you’re willing to put in. Alex and Brandon are all in, so the choice is yours.

”

There's a high probability in my mind that the market, at best, is going to be kind of flat for 10 years, sort of like this '66 to '82 time period…

~ Stanley Druckenmiller (8/16/2022)

My mentor used to tell me that the most amount of money is made and lost during paradigm shifts. This is where the prevailing zeitgeist is shattered as the markets enter an entirely new regime — with new rules, new drivers, new losers, and new winners…

The majority of investors get steamrolled during these tectonic shifts. They’re unprepared and unconscious of the new game and its new rules. They’ve spent their entire careers looking through the rearview mirror. They’ve over-optimized for what has been while not giving a thought to what may be…

At Macro Ops, we live for these regime shifts. They’re our bread and butter, our kolache and coffee, our T-bone and lager… you get the point.

Nothing is more intellectually stimulating and profitable than quickly adapting to a new regime. And what makes us excited for the next 10-years is that there isn’t just one regime change afoot… no, we’re at the nexus of multiple major shifts in how the world works. We’re talking economically, politically, technologically, and in the Great Game of geopolitics.

We call this new period Panta Rhei, Extremus… to steal and alter a phrase from the Greek philosopher Heraclitus. It means Life is Flux. And we’ve entered a period of extreme flux…

This decade will be a golden age for macro. Gone are the days of passive indexing, momentum/growth chasing, and yolo’ing into a HODL crypto 15x P/S Bankman-fried ARKK ponzi — that’s old zeitgeist stuff.

The new zeitgeist will be dominated by:

Financial repression as the developed world’s policy du jour

Structurally higher inflation

Changing power dynamics between capital and labor

An increasingly tenuous Cold War 2 between rising and falling powers

A cambrian explosion of new AI tools and their rippling and unforeseen consequences

Climate change and ill-contrived policy responses by half-witted leaders

And so, so much more…

It may be a sideways market for 10-years straight like Druck thinks. And the prospect for such should scare most investors. They simply don’t have the knowledge, tools, or community to deftly navigate what’s on the horizon.

But lucky for us at Macro Ops, we thrive on volatility. We have everything we need to profit in a decades-long sideways volatile regime.

We saw this Fed-induced sh*t show coming. We went to cash and added shorts to the book. We turned our attention to uncorrelated assets. We loaded up on wheat before the Russian invasion of Ukraine (we were one of the few shops to correctly predict it — link here). We went long USDCNH in the beginning of the summer. We shorted ETHUSD when financial conditions started to dramatically turn this year.

Now of course we’ve had plenty of losers too… that’s the price of doing business in this game. But we have a hard-tested process and framework for managing risk which is why our losers are always small.

We teach this approach in the Macro Ops Collective – our premium subscription service. We share all our market tools along with our research and insights in real-time as we execute our various strategies.

The Collective exists to help you synthesize this changing market so you can block out the noise and focus on the few critical inputs, risks, and trends that matter. The idea is to help you become a calculating, ruthlessly efficient, and consistently profitable investor.

So if you’ve struggled to manage this regime change because of a lack of time or resources… and if you believe there’s untapped potential in your portfolio… then joining the Collective is the most asymmetrical trade you can make this year.

We know there are hundreds of newsletters nowadays. And most of them collect dust in your inbox because they don’t provide any actual value to your trading process.

The Collective is different.

We cut through the noise to show you exactly what’s affecting the market and how to respond to it. The heavy lifting is done for you so that you’re prepared for anything with just a few minutes of reading per week.

Our goal is to save you time while simultaneously making you more money.

But that’s just the research aspect of the Collective…

We also provide in-depth training so you’ll learn step-by-step how to do what we do.

Collective members come into our service and immediately learn the Macro Ops process from start to finish. Some fully adopt our strategies, while others modify them and combine them with their own approach. Either way, all our members develop a consistent, repeatable way to extract profits from the market.

The Collective is basically a fly-wheel of potential — a full-suite, soup-to-nuts program for empowering you to evolve and thrive in every market environment.

And as we continue into this new regime of extreme flux, the power of our Collective has never been more essential.

Joining us is a question of whether you want to fly blind and hope for the best… or walk into battle clear-eyed and prepared for whatever the market gods bring to bear.

“We subscribe to a range of research publications and Macro Ops is head and shoulders above the rest... Alex’s weekly note is a must-read in our shop.”

“I’m a portfolio manager with over 20 years of experience. I’ve read a lot of commentary in that time, both institutional and retail, but yours is about the best I’ve seen. I learn something new all the time.”

The Macro Ops Advantage

Our team’s “go anywhere” macro strategy gives us ultimate flexibility and a huge advantage.

If stocks are tanking, we trade commodities.

Bonds not working? We jump into the currency markets.

While most investors are victims to a single market, our ability to trade every asset class gives us a robust edge.

And on top of multiple asset classes, we also deploy multiple portfolio strategies depending on the market regime.

If we think there’s an imminent risk of a crash, we have a hedging strategy for that.

If conditions are overly choppy and we aren’t sure of a market direction, we have a volatility strategy for that.

We have a plan to protect and grow our capital in every situation.

This is only possible because we’ve studied nearly every investment approach. We aren’t like other research services that focus solely on value investing or quantitative or macro, etc…

We’ve examined it all, adopting what works, discarding what doesn’t, and combining it all into an exponentially better process.

We call our process the Trifecta Approach — in a respectful nod to the Market Wizard Michael Marcus who helped popularize it. This is the method used by many of the greats including Livermore, Kovner, Soros, Druck, and more.

The Trifecta Approach combines sentiment, fundamental, and technical analysis.

Using a deep understanding of fundamentals to express trades, sentiment to spot intermediate-term price dislocations (+EV entry/exit points), and technicals to ruthlessly manage risk… we’re able to stack conditional edges and produce a vastly more asymmetric process for tackling markets.

A Brief Overview Of The Trifecta Approach

Step 1: Identify The Market Narrative

The first step in the Trifecta Approach is to identify the current market narrative.

At its core, the market is a complex information transmission system.

All acting participants make bets using their individual knowledge sets, which in aggregate, set the new market price.

The new market price in turn provides new information for participants’ decision-making process, which once again leads them to make new bets.

The result of this process is a never ending feedback loop of:

Information → Assessment → Action → New Information

These infinite feedback loops, when combined with group psychology and crowd dynamics, create the constant back and forth we see in markets.

Each rally sows the seeds for a reversal and each reversal sows the seeds for a rally — ad infinitum.

The key is to identify the narrative that’s perpetuating the current cycle. This is what drives market prices.

Step 2: Play The Player

Once the market narrative is identified, we can start to understand investors’ expectations:

Where do they think prices will go and how have they positioned their portfolios for it?

This is what we call the consensus view.

To truly outperform in this game you need to bet against the consensus view.

As traders, we make our money on price movement. But for price to move, the current market price must be wrong. Betting on a trend means betting that the market is currently wrong and that prices will adjust to correct that.

By disagreeing with the market, you’re disagreeing with the consensus view. You’re being a contrarian.

Hedge fund legend Ray Dalio put it like this: “You can’t make money agreeing with the consensus view, which is already embedded in the price.”

This is a process we describe as Playing The Player. And it’s the key to unlocking superior returns.

Step 3: Build A Position

Once we’ve identified the market narrative with the consensus view and we know how to bet against it, we can deploy our quant tools to efficiently build a position.

We’re big believers in Garry Kasparov’s (the chess Grandmaster) idea that unique human intelligence, combined with powerful machine learning and quantitative tools, is vastly superior to employing just one or the other. He calls this the centaur approach — named after the mythological half-man / half-horse creatures.

This is the exact approach Palantir uses. It’s why their software easily outperforms A.I. and machine learning in intelligence work and fraud detection. A skilled user paired with powerful quantitative tools is a force to be reckoned with.

Our quant/risk models help us take our contrarian view and combine it with price signals to surgically snipe entries and exits for our portfolio positions.

These models also make it possible to run a multi-strategy portfolio that benefits from unlimited asset classes, all in the pursuit of alpha. We’re able to hunt for superior returns with enough flexibility to minimize our risk in all market conditions.

Below is a screenshot of just a few of the tools in our proprietary MO Quant HUD:

“You guys are next level, there’s no other way to put it. I only wish I’d found you guys earlier.”

“Macro-ops is by far the best global macro research service out there - period. Alex and Brandon are able to hit notes that others simply can’t, and they do it while remaining extremely humble and accessible to their members. The MO team has had a monster year in terms of their performance, but as a student of the market they have also helped me refine & polish my own investment framework which will continue to pay dividends for years to come. The returns from this service (ideas, updates, investment philosophy, investment education, killer Slack community) will far outweigh anything that you spend here. ”

Here’s How We Can Help You:

The Trifecta Approach we described above takes guts, imagination, and a hard-tested process… but that’s how we make a killing.

And by joining the Collective we’ll show you how you can do the same.

We’ll not only teach you how to identify a market narrative and play against the consensus view, but we’ll give you all the tools you need to do it.

A Macro Ops Collective subscription will grant you access to all our models along with the step-by-step instructions you need to create a bulletproof process for analyzing and profiting from the market.

We founded Macro Ops to foster as many high-level traders and investors as possible. Our goal is to share everything we know with our community, so we can learn and grow together while making a ton of money and creating positive change in the world. And of course, we want to have a helluva good time doing it all.

We accomplish this through better research, better process, and better training. That’s how hundreds of investors have already been able to consistently beat the market by implementing our investment process.

Here’s exactly what you get by joining the Collective:

1) Institutional Level Research

It’s mind-blowing to think about how much information is available now versus 20 years ago, or even just 5 years ago.

It’s created a data deluge.

It’s incredibly tempting to be distracted by useless information… or to pay undue attention to the wrong information… or to self-select news sources and get trapped in an echo chamber — all of which are part-and-parcel for the middling average.

As the flow and volume of information increases, the ability to parse and sort that information becomes an ever more valuable skill.

In the Collective our team takes down multiple firehoses of information per day, digesting it all, and then distilling it into what you need to know right now to make money in the market.

In just a few minutes per week, you’ll be up to speed on everything that’s happening in the global markets with a strategy for how to extract profits from it all.

Here’s a look at our rough research schedule and what you’ll receive in your inbox each week after joining the Collective…

Weekly Reports:

Sunday – Market Note: Our weekly pre-market prep. You’ll get a PDF with general market commentary from me (Alex), along with a rundown of all the important charts we’re looking at that week.

Monday – The Dirty Dozen: Our chart pack shows you the most relevant and insightful charts in the market, adding more color to what we discussed in the Market Note.

Wednesday – Value Letter Recaps: We comb through other investors’ best ideas and break them down into an easy and digestible format. This piece is great for idea generation.

Saturday – Portfolio Recap: Short and quick updates on any important news regarding our portfolio holdings.

As Needed – Trade Alerts: You’ll be alerted every time we make a new trade in the Macro Ops portfolio. You’ll get entry prices, risk points, and position sizing.

Bi-Weekly / Monthly Reports:

Macro Deep Dives: We’ll discuss a macro thematic our team is tracking and break down the trade opportunities resulting from it.

Equity Deep Dives: An in-depth research report on an equity name that’s usually related to the broader macro theme we’re following.

2) Superior Process With The MO Portfolio

We share our entire portfolio with our Collective members.

Every trade, win or lose, is shown with 100% transparency.

This is beneficial because members can follow along with our trades and profit while also seeing our process up close.

When we take on new positions, we provide trade structure, sizing, and exit information. We know full-well that stock picks are a dime a dozen and are as good as wet toilet paper if they don’t include the above.

Our core portfolio is comprised of 5 multi-timeframe allocation blocks:

Futures/Bonds/FX: This includes any futures, bonds, and forex positions.

Strategic Equities: These are our fundamental long term bets. We focus on mispriced businesses trading at massive discounts to their intrinsic value. These positions have 3-5 year time horizons without hard stop-losses — perfect for longer term investors.

Thematic Equities: This is our industry trend-following book. It contains our favorite bets in the highest returning industries. Think of it as going long the strongest relative strength names in the market.

Tactical Equities: These are our technical-only trades including FVBOs, VBOs, and classical charting patterns. (We’ll teach you how they all work.) These are short-term holds anywhere from a few days to a few weeks/months. They’re perfect for active traders and follow specific trade entry, exit, and profit target guidelines.

Options: This bucket includes all our options strategies.

3) Profitable Time-Tested Strategies

Real students of the game never stop learning…

We can’t. We don’t want to.

One of the great things about markets is that they’re always changing. This forces our skills and knowledge to evolve if we want to stay competitive. What works in one type of market, doesn’t work in another.

That’s why our team runs multiple strategies in our portfolio depending on the market regime we’re currently in.

In our Collective’s Vault, you’ll get step-by-step guides on how to execute every one of these different market strategies. Every single theory, strategy, and process piece we’ve ever written sits in the Vault.

We also have influential white papers, webinars, and video courses on everything from our DOTM strategy, to analyzing emerging market currencies, and more.

4) Community: Iron Sharpens Iron

The Collective gives you full access to our private Slack group where the Macro Ops team and fellow traders from around the world spend each day discussing everything from the latest macro research and trade ideas, to health hacks and local meetups.

Once a month our Collective members also jump on live Q&A sessions with myself and the rest of the Macro Ops team.

We cover everything from portfolio updates and theory breakdowns, to gaming market scenarios, conducting strategy dissections, and more.

We can say with 100% conviction that our community of traders and investors is THE BEST on the internet and it’s not even close.

We’re a firm believer in the idea that we’re the product of the people we choose to surround ourselves with. Through the Collective, we’ve met fellow traders and money managers who’ve now become dear friends, and from whom we learn from daily.

It’s amazing and humbling to be able to serve such an incredibly talented group. Each day we all work together to learn, improve, and evolve as traders and human beings

“The Collective is an amazing reservoir of ideas and provides access to great folks — helped me tremendously grow as an investor and a person... My one regret is chasing all the shiny things and not finding MO sooner.

”

The Best Asymmetric Trade Of The Year

Here’s a few examples of how the Collective can quickly pay for itself:

Trade 1: Kura Sushi (KRUS)

We bought KRUS at $18.27 per share on December 3rd, 2020. Brandon (one of our MO team members) sent the following trade alert to our Collective members:

We sold that same position in June of 2021 for $37.23, locking in over 100% profit.

If you invested $5,000 in KRUS, it would have turned into almost $10,200.

That more than covers the cost of a Collective subscription.

Some of our Collective members even decided to hold KRUS longer.

The stock is now at $80/share, more than 4x the initial price.

They made out pretty well…

But we don’t just invest in stocks. We trade every asset class.

Trade 2: USD/CNH

We bought our first long position in the currency pair USD/CNH on July 14th, 2022.

The team sent the following trade alert to our Collective members:

We’re still in this trade and are currently up nearly 10x our risk.

If you risked $500, you would have made $5,000.

That’s once again more than enough to pay for your Collective subscription.

Trades like these contribute to our winning portfolio performance year after year.

Of course past results don’t guarantee future performance, but considering we trade real money in the market, we’ll continue to focus on consistently managing our risk while growing our capital.

In 2020, the MO Portfolio made over 66%.

That means a $50,000 account would’ve returned $33,000 in profits.

That’s enough profit to pay for ten years of a Collective membership.

In 2021, we only returned 6.39%.

It was a volatile year and we were pleased with how we managed our risk. And as always, we shared every trade, win or lose, with our Collective members.

This year we’re up nearly 15% while the Nasdaq is down almost 30%.

This wide margin of outperformance is because of our multi-strat, multi-asset approach — the same one you’ll learn when you join the Collective.

“l hesitated about a year before joining Macro Ops. I enjoyed reading their free emails on markets and investment ideas, but I wondered how much better their paid service could be. I can now say that joining the collective has been the best single decision I’ve made for my portfolio in 20+ years of investing. The Four Pillars model portfolio is the result of Alex and Brandon’s incredible stock picking abilities, always backed by thorough research and smatt risk management, and the trade alerts make it very easy to manage. The collective of Macro Ops members also form a supportive community that point out many very smatt investment ideas and resources. Before joining the collective, my greatest challenge was finding good ideas so / could allocate capital with confidence and get decent returns. Now my biggest challenge is choosing...there are just so many profitable ideas that are floated on the Slack channels that I’m having trouble not investing in them all. I most highly recommend Macro Ops.

”

So Why Wait? Join Our Team Now.

Markets are only getting wilder.

You need the strategies, tools, and community to support you through one of the most dangerous market environments we’ve faced in decades.

Join our team now.

To beat a market like this, you need to be proactive rather than reactive.

You need to efficiently filter out the deluge of noise and have a tested process for getting at the truth.

You need to have backtested trade structure and sizing methodologies as the basis of your approach.

You need the Collective. It’s your tool for doing ALL of this…

We work day and night to filter the key information for you… to give you signals for when to pare back risk and when to go for the jugular… to give you the tools and process to excel beyond your peers… no matter if you’re a 20-year veteran hedge fund manager or a maniacally devoted recent MBA grad.

We exist to support your trading and investing success.

Join our team now and let’s crush these dangerous markets together.

“MacroOps is a premium research, analysis, education, and community-based service start to finish. The majority of what Alex and Brandon produce is in-depth, sophisticated research into global macro and market trends, company-specific analyses, and thought-provoking essays on a wide range of topics that can shift your perspective on markets, philosophy, geo-po/itical goings on, and much more.

Their understanding of the complicated and intertwined dynamics of markets is the foundation of their approach to investing and speculation. Their ability to balance the scientific / analytic / quantitative component of investing with the necessary art and finesse that comes from years of experience, backtesting, and lessons learned, has led to a truly unique and insightful approach to markets. The Collective is a powerful community of investors of all stripes and experience levels, many of whom participate daily in the sharing of information, research, trading ideas, and non-market related content. As with anything in life, you will get out of MacroOps what you’re willing to put in. Alex and Brandon are all in, so the choice is yours.

”

The Macro Ops Collective

The Premiere Investment Research, Training, and Community Platform for Institutions and Retail Investors

By joining the Collective you’ll get:

Institutional Level Research: Each week you’ll receive market analysis, portfolio breakdowns, equity deep dives, and alerts of every trade we make. We do all the heavy lifting for you and share everything with 100% transparency.

Proprietary Quant Tools: You’ll have access to the MO dashboard — our own version of the Bloomberg terminal — that contains all the tools we use to find highly profitable trades.

Profitable Time-Tested Strategies: We provide in-depth training videos to teach you how to identify the current market regime, find the best entries, manage risk, and more. You’ll be able to confidently trade any asset class under any condition.

Superior Macro Process: You’ll gain an edge with our professional level trading process that has given our members a consistent, repeatable way to extract profits from the market.

Community: You’ll be able to join our private Slack group where traders from around the world share their best ideas. You’ll also get a live Q&A session with Alex and the rest of the Macro Ops team once a month.

NEW: Here at Macro Ops, we’re all about helping our subscribers navigate the complexities of markets and investing.That’s why we’re excited to announce our partnership with Koyfin, a leading financial data and analytics platform.

As part of our commitment to providing exceptional value, we’re offering Macro Ops Collective members a 20% discount on Koyfin subscriptions.

Redeeming your 20% discount with Koyfin as a Macro Ops Collective subscriber is simple. Just follow these easy steps:

Sign up or log in to your Macro Ops Collective account.

Access the exclusive Koyfin discount in your subscriber dashboard.

Visit the Koyfin website and select your preferred subscription plan,Your discount is automatically applied.

Proceed to the checkout to enjoy 20% off your Koyfin subscription

Don’t miss out on this incredible opportunity to elevate your market research and analysis with Koyfin’s powerful tools while saving money as a Macro Ops Collective subscriber. Join us today to take advantage of this exclusive partnership and unlock a world of financial insights.

Enrollment Period Ends On November 3rd at 11:59PM!

The Macro Ops Collective

The Premiere Investment Research, Training, and Community Platform for Institutions and Retail Investors

By joining the Collective you’ll get:

Institutional Level Research: Each week you’ll receive market analysis, portfolio breakdowns, equity deep dives, and alerts of every trade we make. We do all the heavy lifting for you and share everything with 100% transparency.

Proprietary Quant Tools: You’ll have access to the MO dashboard — our own version of the Bloomberg terminal — that contains all the tools we use to find highly profitable trades.

Profitable Time-Tested Strategies: We provide in-depth training videos to teach you how to identify the current market regime, find the best entries, manage risk, and more. You’ll be able to confidently trade any asset class under any condition.

Superior Macro Process: You’ll gain an edge with our professional level trading process that has given our members a consistent, repeatable way to extract profits from the market.

Community: You’ll be able to join our private Slack group where traders from around the world share their best ideas. You’ll also get a live Q&A session with Alex and the rest of the Macro Ops team once a month.

NEW: Here at Macro Ops, we’re all about helping our subscribers navigate the complexities of markets and investing.That’s why we’re excited to announce our partnership with Koyfin, a leading financial data and analytics platform.

As part of our commitment to providing exceptional value, we’re offering Macro Ops Collective members a 20% discount on Koyfin subscriptions.

Redeeming your 20% discount with Koyfin as a Macro Ops Collective subscriber is simple. Just follow these easy steps:

Sign up or log in to your Macro Ops Collective account.

Access the exclusive Koyfin discount in your subscriber dashboard.

Visit the Koyfin website and select your preferred subscription plan,Your discount is automatically applied.

Proceed to the checkout to enjoy 20% off your Koyfin subscription

Don’t miss out on this incredible opportunity to elevate your market research and analysis with Koyfin’s powerful tools while saving money as a Macro Ops Collective subscriber. Join us today to take advantage of this exclusive partnership and unlock a world of financial insights.

The Collective Subscription

Are you ready to join? Sign up now.

Step 1 Enter Your Account Details > Step 2 Choose Your Plan > Step 3 Enter your payment info

Quarterly Collective Access

Price: $995 every 3 months (recurring)

Yearly Collective Access

Price: $3,495 every year (recurring)

Subscription plans

Note: The Subscriptions will automatically renew unless canceled prior to the renewal date.