The #1 Source For Global Macro Trading Research

If you’re reading this, you’re probably an investor or trader that wants to learn more about Global Macro Trading Research.

Maybe you’ve spent the past year getting burned by unprofitable tech companies. Only to see “Energy Bros” on Twitter victory lap like a pack of killer whales surrounding a baby seal.

You thought you had a differentiated investment philosophy. You could predict technological changes, consumer habit transformations, and entire industry upheavals.

In reality, you benefited from a decade of zero-interest rate policy. Now that the Federal Reserve has tightened its belt, you’re left wondering where you’ll find any alpha. That’s why you’re here. You want to learn about Global Macro Trading. And that’s good because Global Macro Trading will save you from a decade (or more) of massive underperformance.

We’re in a new market regime. One dominated by physical (read: tangible) assets. From bits to atoms. A market where inflationary pressures from a higher energy, food, and labor costs destroy the profit margins and business models of a few industries. While simultaneously enriching the industries, companies, and investors that take advantage of such changes.

You’ve come to the right place. This blog post explains everything you need to know about Global Macro Trading. By the end, you’ll learn what Global Macro Trading is, how and where to understand it, and why it’s essential for the current market regime shift.

Let’s get started.

What is Global Macro Trading?

Global Macro Trading sounds daunting in theory, but it’s simple in practice. Global Macro Traders scour the globe to find highly asymmetric risk/reward bets. Ideas where they can risk $1 to make $5 or $10.

Global Macro Traders have zero restrictions on where they find and place trades. That’s the real secret. A Global Macro Trader can short soybean futures one day, go long the Nasdaq 100 the next day, and short the US Dollar / Euro pair the next.

The only thing restricting the Global Macro Trader is their mind.

Macro Traders have extensive, 30,000-foot views of markets like corn or cotton. They develop this view based on “macro” data points like crop yields (for agriculture) or inventory, reserves, and global oil demand.

From here, the Global Macro Trader finds the best instrument to express their view on a given market.

For example, suppose a Macro Trader thinks Russia will withhold 100,000+ barrels of oil from production. In that case, he might go long oil futures as a way to play the supply side shock. Or suppose the S&P 500 is trading over 30x current earnings, the economy is running hot, and consumers are stretched thin, maxing out credit cards and falling behind on loans. The Macro Trader takes that information and uses the futures market to express his views by shorting S&P 500 futures.

There’s no need to overcomplicate what Global Macro Trading is. It’s developing a differentiated view of a specific market, then finding the most appropriate instrument to express that bet.

Of course, you need good macro research to develop those differentiated market views. Let’s address that next.

What is Macro Research?

Individual stock investors research companies by studying their industry's balance sheets, income statements, cash flow statements, and competitive positioning. They talk to customers, vendors, suppliers, former employees, and anyone who can give them insight into the company's inner workings.

Global Macro Research is 100x (maybe 1,000x) larger in scope than individual stock research. Which makesThise when you’re scouring the globe and betting on things like currency crises, oil shocks, and stock market crashes.

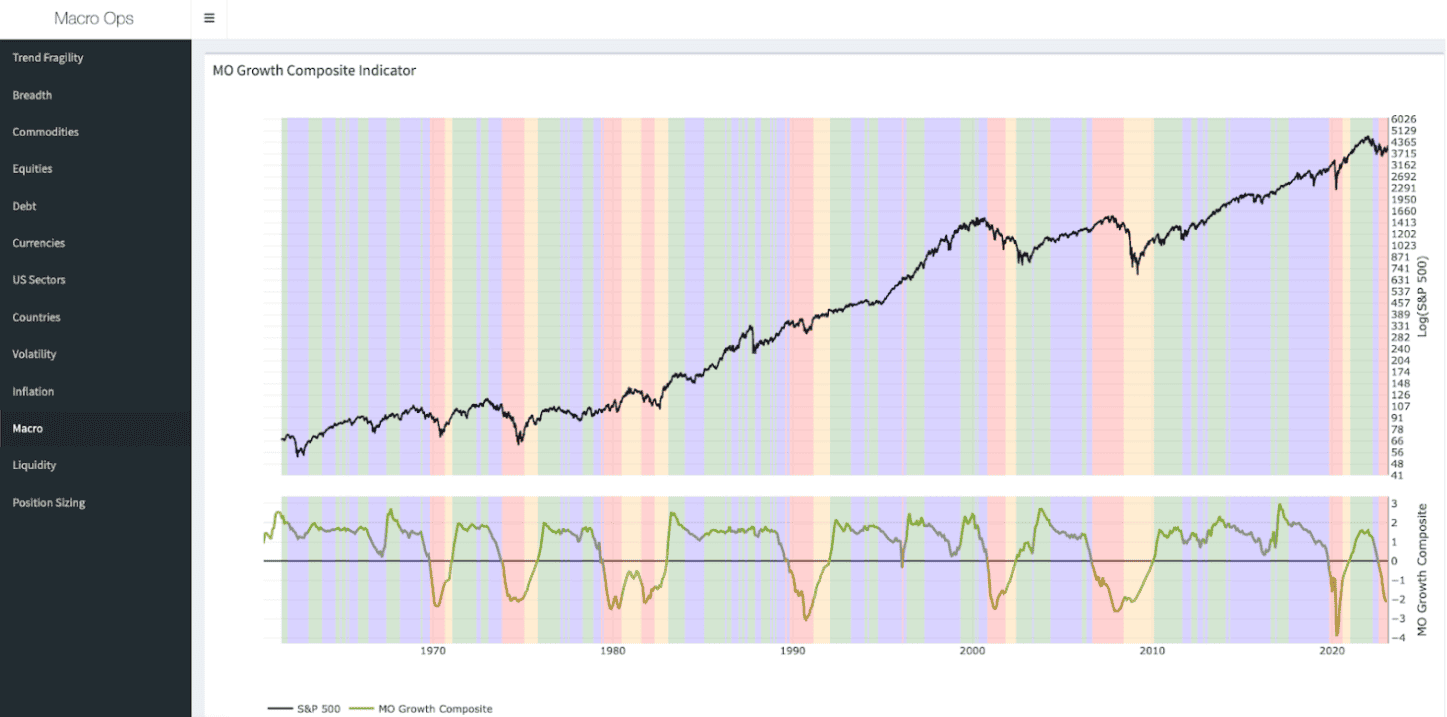

We simplified Macro Research at Macro Ops by creating the HUD. The HUD is our global macro research dashboard that houses the most relevant (read: high signal, low noise) data for investment decisions. You can check out a screenshot of the HUD below.

The HUD highlights crucial elements of macro research like:

Breadth

Debt

Volatility

Inflation

Liquidity

This is the most crucial part of Macro Research. A great macro trader uses all of these inputs to create a range of potential realities.

There are a few ways to obtain this information if you’re not a Macro Ops Collective member. You can get financial data from the Federal Reserve, oil data from OPEC and the US Department of Energy, and agricultural reports from the US Department of Agriculture and the Chicago Board of Trade.

Another great way to research macro is by reading the Financial Times (or FT) and global commodity trade magazines or currency exchange newsletters.

Finally, study the futures markets. It’s where you’ll spend most of your time expressing macro views through futures contracts on stock indices, commodities, precious metals, and more.

By now, you know what Global Macro Trading is and the research tools to find and develop your own views on the world. So how do you get into macro trading?

How To Get Into Global Macro Trading

The first thing you should do is paper trade your newly unboxed Global Macro Trading strategy. Macro trading involves highly leveraged instruments like futures, options, and currencies. You can lose everything if you’re not careful trading these instruments.

By paper trading, you’ll learn the basics of risk management, setting proper stop-losses, identifying profit targets, and the importance of position sizing. All without risking any of your actual hard-earned money.

While doing that, join Twitter and follow other global macro traders. Follow us @MacroOps! Join discussions and ask questions.

Also, listen to global macro podcasts and read books about investing and international macro trading.

Global Macro Trading sounds intimidating. Traders are drowning in endless noise with little signal value. It’s no wonder most investors will fail to transition as we enter this new market regime. One that will be dominated by global macro traders and their “go-anywhere” mentality.

Are you ready to become one of the few that make it to the other side? If so, check out our free global macro trading course here.