Sylvania Platinum (SLP.L): For The Love of Hate

I like finding stocks that have multiple layers of hate. Where the more you analyze it, the more you hate it, and the more likely you are to unfollow me out of principle.

I think Sylvania Platinum (SLP.L) is that stock. It has myriad layers of hate. It's a South African mining company. Not only that, it mines PGMs, which is one of the most hated, bombed-out commodities out there. Oh, and it trades on the LSE with a <£200M market cap.

Are you triggered yet???

I pitched SLP.L to our Collectiveon April 3rd. Since then, the stock has been roughly unchanged, as it is rather illiquid and PGM is trying to find a bottom.

Please note that we/I own shares in SLP.L. Do your own work. None of this is investment advice ... Re-read the above ... this is a South African PGM miner that trades on the LSE.

If you're still interested for some strange reason, let's get after it!

Sylvania Platinum (SLP.LSE) is a South African PGM miner that produces ~74,000oz of PGMs annually from various chrome tailings deposits and other Run-of-Mine (or ROM) materials.

The company checks every box.

It has half its market cap in cash with zero debt, generates positive profits even at cycle-low PGM basket prices, pays a healthy dividend, and is hammering buybacks on the open market.

Finally, the company hasn’t raised money from public markets since 2009.

SLP trades at a £73M EV as of this writing. They’re one of the few PGM miners making money at these prices, which provides downside protection along with its balance sheet.

However, you don’t buy mining stocks because you think commodity prices stay low.

We believe PGM prices will rebound significantly higher over the next few years (we’ll explain a few catalysts below) to around its 3YR average of $2,900/oz.

If that happens, SLP.L would generate over 140% of its current EV in free cash flow annually.

I know what you’re thinking … Why does this opportunity exist?? I see six main reasons:

The stock trades on the LSE, and nobody wants to invest in LSE companies

It’s a PGM miner at cycle lows

It’s a smaller company with a £157M market cap

Its operations are in South Africa

Did I mention it was a miner??

And did I mention it was in South Africa??

Opportunities like SLP exist for those willing to roll up their sleeves and do fundamental work in bombed-out, capital-starved markets.

But first, let’s unpack the latest PGM catalyst: emissions standards.

Biden Admin Triggers PGM Catalyst

I wrote about the macro bull case for PGMs in February’s Sibanye-Stillwater (SBSW) write-up, so I won’t repeat it here.

But the TL;DR bull case goes something like this.

On the demand side … ICE cars will survive longer than people think, plug-in hybrid demand will increase, and EV growth will stall as governments reduce subsidies and OEMs halt production due to rising costs and unfavorable economics.

On the supply side … low PGM prices will force miners to stop production, put mines on care and maintenance, and reduce workforces.

All of which we’ve seen.

Then, Biden added more fuel to the PGM bull fire. On March 20, the Biden Administration released the most stringent tailpipe emissions standards ever (emphasis added).

“The rule delivers the “strongest-ever vehicle pollution” standards in US history as he touted the measure inside the Washington, DC, armory surrounded by electric vehicles.

‘These technology-neutral and performance-based standards give the auto industry the flexibility to choose the combination of pollution control technologies best suited for their customers.’”

Did you catch that last part … Pollution control technologies … that’s PGMs!

Here’s what those new rules look like.

“Under the rule, tailpipe emissions of carbon dioxide are capped at 85 grams per mile in 2032 — down from 170 grams per mile for model year 2027. But much of those stringency gains would come after 2030.

The requirements could nearly halve fleet average emissions over existing standards for 2026.

The measure also sets limits on soot and smog-forming pollution, with mandates the administration said would deliver cleaner air for overburdened communities near major thoroughfares.”

And here’s the smoking gun for PGM prices …

“The standards are technology neutral, giving automakers options for complying with a mix of models, including hybrids, battery electrics, and advanced gasoline vehicles.”

Suppose you’re the CEO of a major auto OEM, and I’m some government environmental lobbyist (even typing that sounds awful).

I present you with these new emissions standards and say:

“You’ve got three options. Option 1: you make more plug-in hybrids. Consumers love them, and you have the infrastructure/supply chain to make them profitable.

Option 2: you put more PGMs in your catalytic converters to reduce emissions. PGMs are a fraction of total COGS, and you don’t need to change anything about what you’re doing. Keep making those tree-killing ICE engines.

Option 3: you phase out ICE cars and plug-in hybrids to make EVs. Now I know you don’t have the infrastructure to make them. And I know it would cost billions and jeopardize your entire company. And I know that China makes them for half the price. But think about how happy you’d make Greta Thunberg. What’s that worth?”

You’d choose Options 1 and 2. If you’ve made enough money and your shareholders are rich with capital gains, you’d try Option 3.

Both options are bullish for PGMs and should increase prices to incentivize new mine supply (or turn on previously closed mines).

I pitched this idea to Octavio, who asked, “What happens if Trump gets elected and rolls back these initiatives?”

It’s a “heads I win, tails I don’t lose” situation.

A Trump victory is probably net-bullish for ICE cars, plug-in hybrids, and net-bearish for EVs. Regardless, Trump will have more significant issues than tailpipe emissions standards in his first 90-180 days.

If you remember anything from this update, make it this: PGM prices are at cycle lows with firm catalysts to increase demand. New supply cannot quickly meet this increased demand unless we see higher PGM prices.

SLP’s Simple Operating Strategy

As I mentioned earlier, SLP produces PGMs via “dump operations.”

Their latest investor presentation states, “The Sylvania Dump Operations (SDO) comprise of six chrome beneficiation and PGM processing plants, treating a combination of ROM and current and historical chrome tailings at host mine-sites.”

Here’s how it works.

SLP goes to “host” mines and says, “You’re not doing anything with these tailings and waste rock from your chrome mines. Let us pay you to take these tailings and waste off your hands. You keep your chrome, make some money from a byproduct you don’t need, and we produce PGMs.”

It’s a simple and low-cost model compared to digging a giant open pit or cave blocking underground. And it puts SLP at the lowest end of the PGM cost curve (see below).

The company generates ~74,000oz of PGMs annually and plans to increase production to 85,000oz by 2026. For reference, SLP produced 6,000oz in its first year of operations in 2006.

Thaba JV: SLP’s Path To 85,000oz/yr

Last August, SLP announced a 50/50 JV with Limberg Chrome Mine (LMC) to build the Thaba JV Chrome & PGM tailings operation.

The 2Moz dump resource will produce 13,600oz of 4E PGMs and 420,000oz of chromite concentrate annually. Since it’s a 50/50 JV, SLP.L will be entitled to half of the above production or ~6,800oz/year of PGMs and 210Koz of chromite concentrate.

Thaba's initial mine life is 10 years.

Call Options on PGM Production Growth: Volspruit & Far Northern Limb

Two call option exploration projects, Volspruit and Far Northern Limb, could also further expand PGM production beyond 2026. Which we get for free at the current market cap.

Volspruit is a large, opencast resource with both PGMs and base metals. It’s also near mature mining infrastructure. The company is currently conducting PEA and metallurgical testing and is in the process of permitting.

The project has ~2Moz of Indicated & Inferred platinum and palladium split between its North and South bodies (see below).

SLP.L estimates that it could produce ~70-100Koz/year from this deposit.

Then there’s the Far Northern Limb deposit, which is another potential opencast mine with resources at depth (>200m). The deposit has 1.38Moz of Measured, Indicated, and Inferred platinum and palladium (see below).

The company estimates they can produce ~89-120Koz/year from this deposit.

Remember, we get these deposits “for free” at the current market price.

Estimating SLP’s Production & Cash Flows

SLP will generate ~75Koz this year and plans to reach 85Koz by 2026. The company has upfront capex requirements of $30M/year for 2024 and 2025 as it builds the Thaba JV and upgrades its SDO facilities.

This will obviously reduce near-term free cash flow, assuming PGM prices stay around $1,500-$1,800/oz (note: net revenue is ~83% of nameplate 4E basket price due to payabilities, etc.). But even then, the company generates positive FCF.

SLP will generate ~$80M in cumulative profits by 2025, or ~110% of its current EV, and £20M in FCF by 2025 (27% yield).

The real fun begins in 2026 when the company only needs to spend $3.5M on maintenance capex.

Why is that exciting? SLP will likely produce 85Koz at higher PGM prices while its capex requirements plummet.

The result is over £50M in annual free cash flow for a 73% yield (see below).

Of course, all of this could change. It’s mining, so the 2026 capex could be much higher. But 2025 capex could be smaller, depending on the PGM environment.

The point is that by 2026, SLP.L should have everything in place to generate a ton of free cash flow.

Then they’ll do what they’ve always done … return it to shareholders via buybacks and dividends.

How We Make Money: Dividends & Buybacks

SLP returns capital to shareholders via ordinary dividends and opportunistic buybacks.

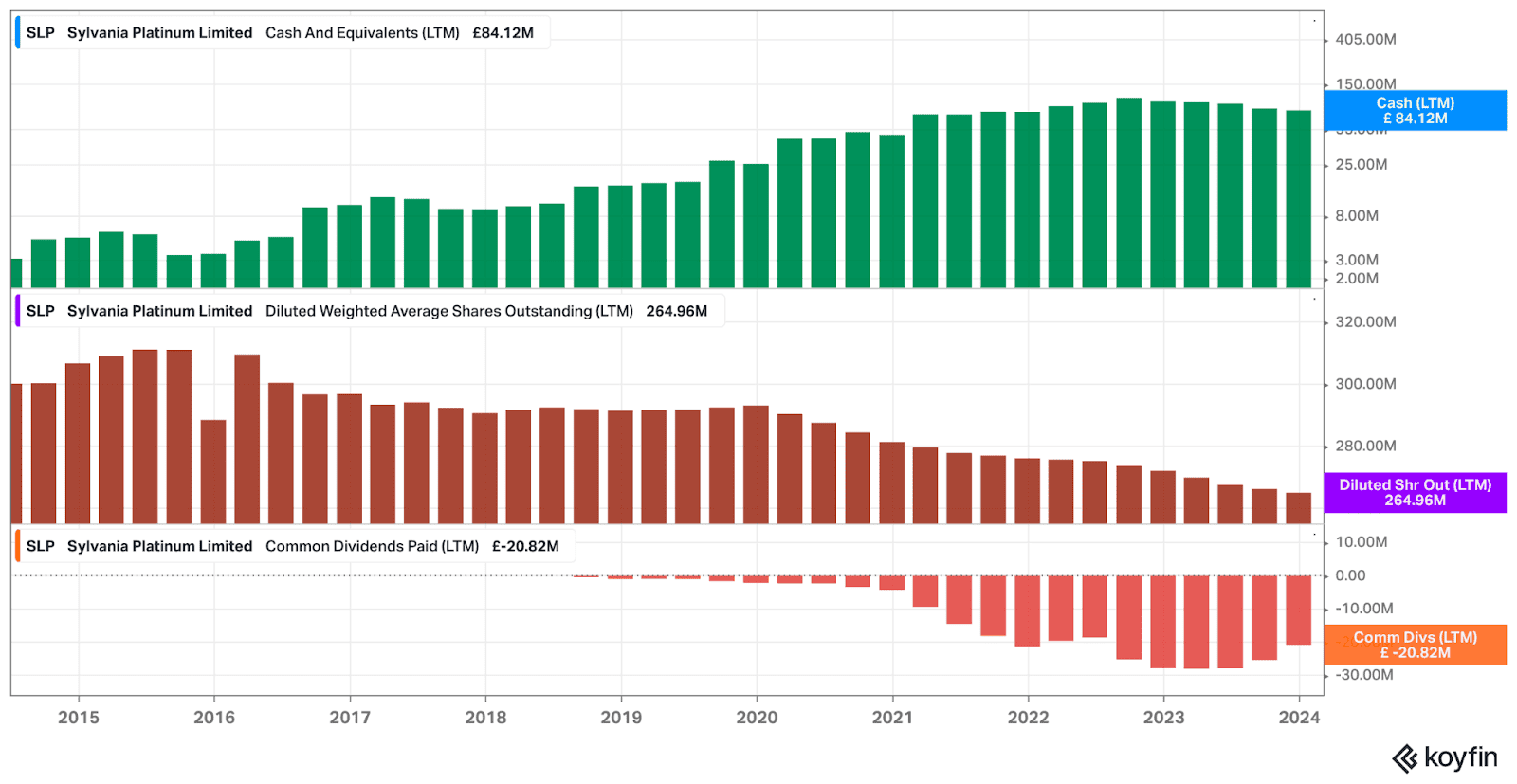

The company has paid ~£86M in cumulative dividends since 2018 and bought back 46M shares since 2015 (see below).

In its latest Annual Report, management said it would return ~£26M in dividends this year, but that’s it.

Over the next three years, I assume that SLP will pay ~£83M in dividends and buy back ~£14M of stock or ~22M shares (see below).

Over the last ten years, SLP has averaged ~£39M in cash on the balance sheet. Carrying more cash in a trough PGM pricing environment as margins squeeze makes sense.

But what if we get a PGM bull market? How much cash do they need on the balance sheet? Probably not £84M.

Suppose they returned 100% of every dollar above their 10YR average balance of £39M, or another £45M. By 2026, shareholder returns would increase to £143M for a 195% yield.

Conclusion: Buying Cash Flow At Left-For-Dead Prices

SLP is a textbook example of buying cash-flowing assets at left-for-dead prices. The company has a runway of producing 75,000/oz+ of PGMs over the next few years and makes 50% of their EV in cash at depressed PGM 4E basket pricing.

There’s virtually zero bankruptcy risk as 53% of its market cap is in cash with no debt.

The company has a history of returning cash to shareholders via dividends and buybacks.

Finally, the monthly chart offers a great entry point for getting long. Please note that this stock is illiquid, so be patient while accumulating your position.

SLP is a Trifecta Setup:

Fundamentals: 50% FCF yield at trough PGM prices with a history of capital returns.

Sentiment/Positioning: PGMs remain one of the most hated corners of commodity markets, yet supply/demand market inflecting bullish as traders stay largely short.

Technicals: A failed bear breakout on the monthly chart offers an ideal risk/reward setup for a long-term hold.