As iron sharpens iron,

so one person sharpens another

Join over 350 CIOs, portfolio managers, and dedicated private investors in our Collective pursuit of mastery both in Markets and in Life

As iron sharpens iron,

Join over 350 CIOs, portfolio managers, and dedicated private investors in our Collective pursuit of mastery both in Markets and in Life

so one person sharpens another

Endorsed by some of the best in the game…

350+

Members & over 175+ hedge funds/family offices

5

Living Market Wizards

147%

3yr Total Return for MO Portfolio

Featured in:

Shokunin

A global community of investors dedicated to “Shokunin” (職人), a Japanese concept representing a profound commitment to one’s craft and a continuous striving for perfection. Members of our Collective receive:

Unmatched Research

High-Level Theory & Training

A Proprietary Macro Dashboard

An Engaging Online Community

Exclusive In-person Events

A differentiated approach

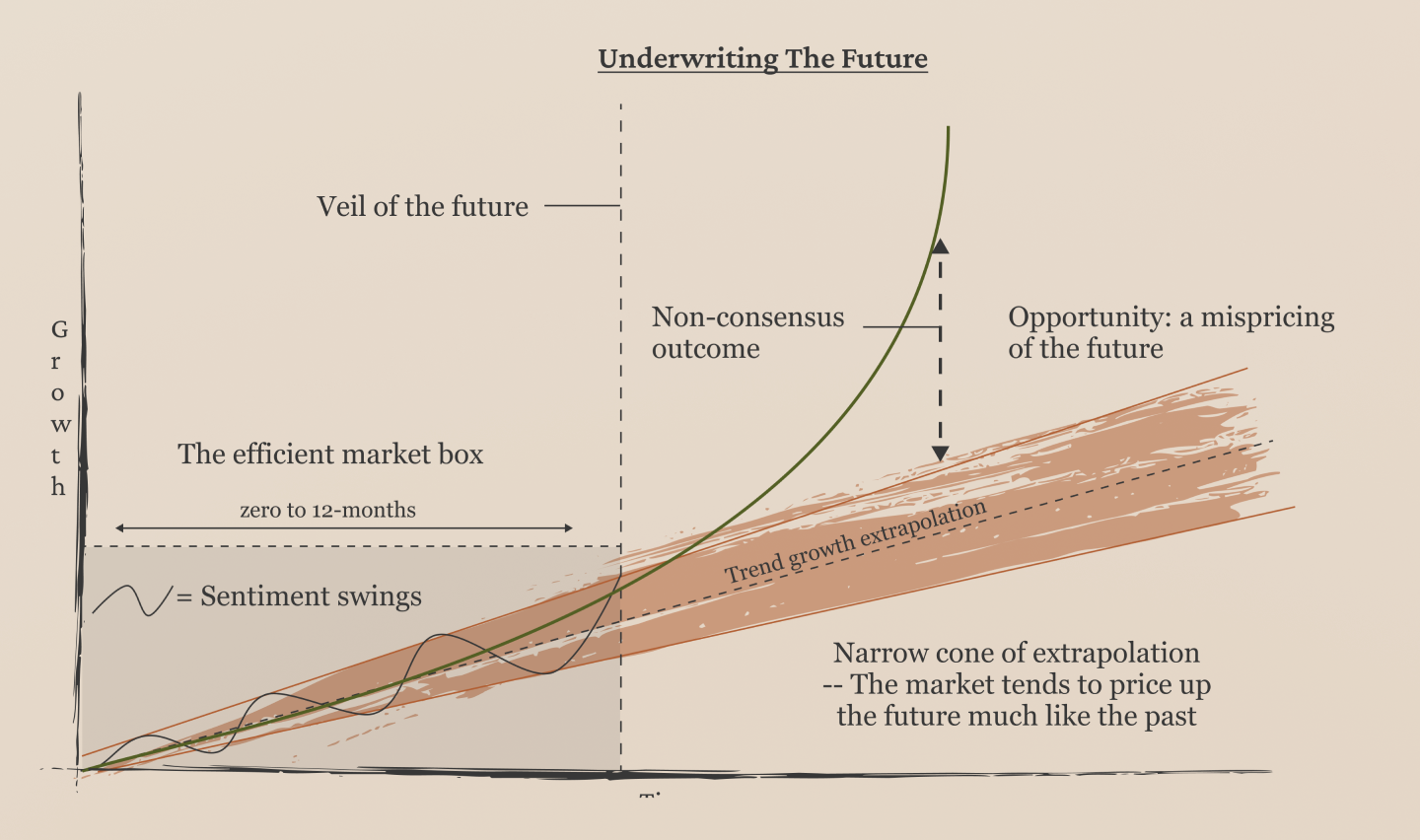

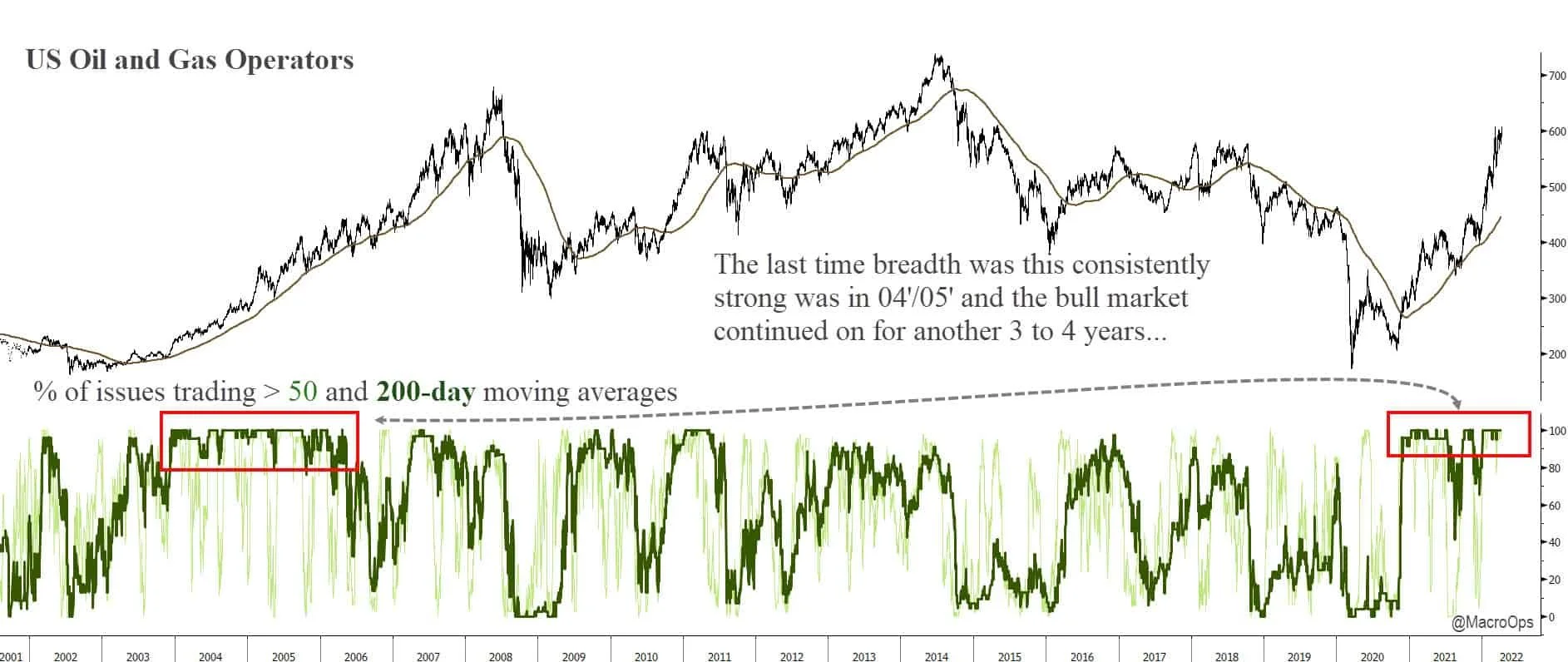

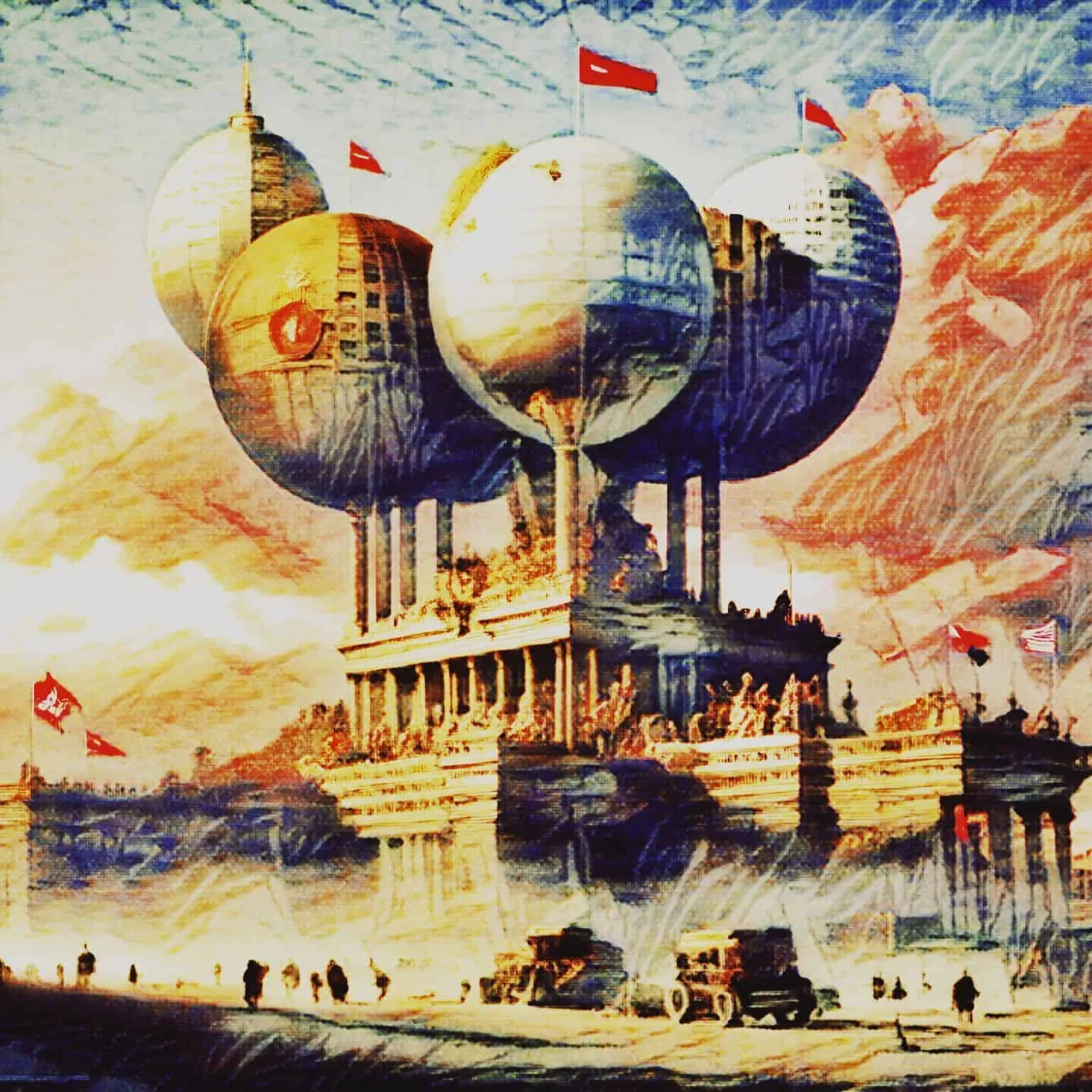

Triangulating to better outcomes

We operate at the intersection of macro/fundamentals, sentiment/positioning, and technicals. We do not pigeonhole ourselves to a singular approach but rather use any and all effective means in order to generate high risk-adjusted returns.

Endorsed by some of the best in the game…

350+

Members & over 175+ hedge funds/family offices

5

Living Market Wizards

147%

3yr Total Return for MO Portfolio

Shokunin

A global community of investors dedicated to “Shokunin” (職人), the Japanese concept representing a profound commitment to one’s craft and an continuous striving for perfection. Members of our Collective receive:

Unmatched Research

High-Level Theory & Training

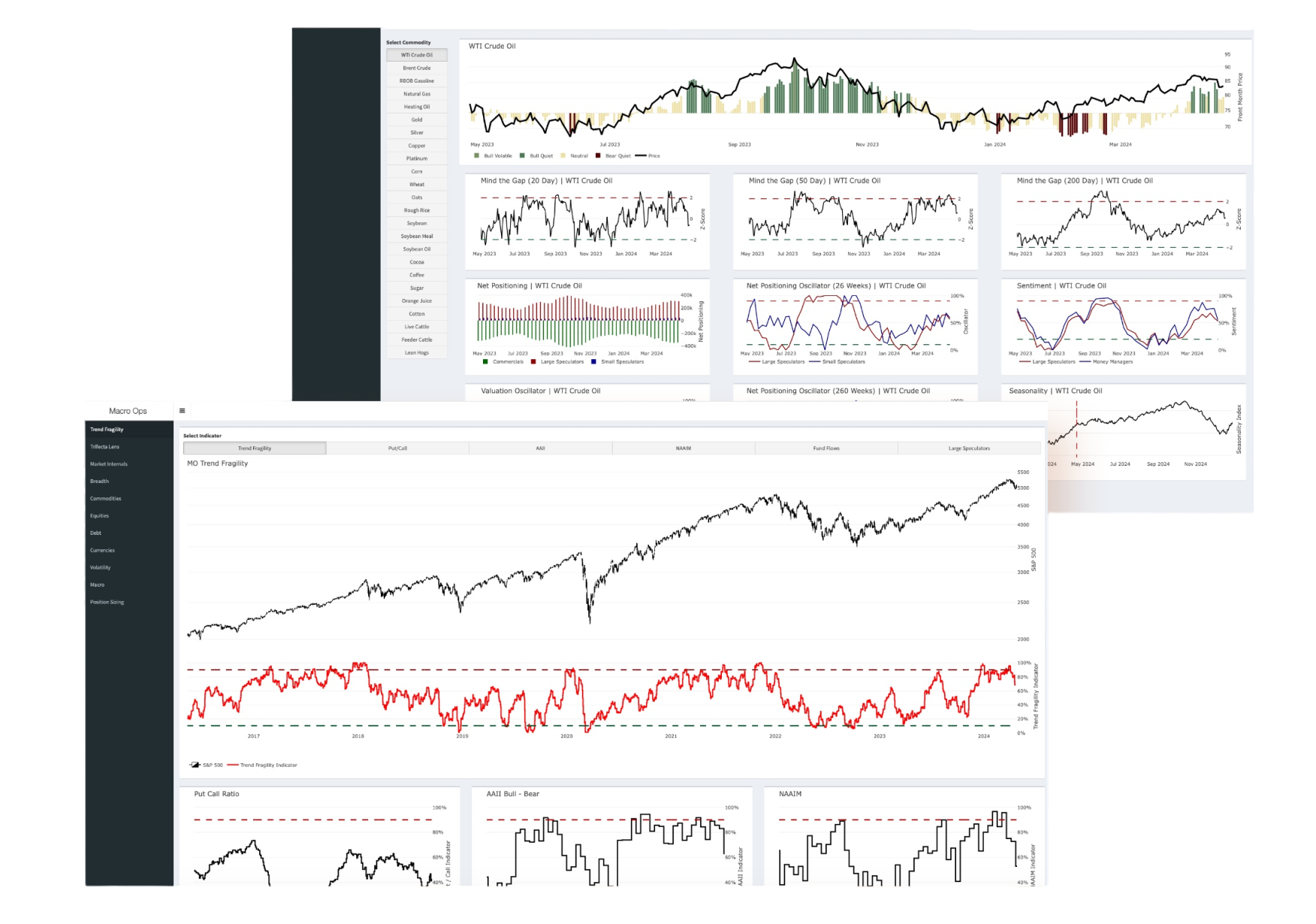

A Proprietary Macro Dashboard

An Engaging Online Community

Exclusive In-person Events

Diffrentiated returns require a diffrentiated approach

Neither just value, macro, or technical investors are we… rather we utilize all three in a full soup-to-nuts Trifecta approach that allows us to achieve high uncorrelated returns while tightly managing risk…

Triangulating to better outcomes

Cultivating Collective Wisdom

Navigating Trading and Life through Process and Insight

Exploring & iterating on every facet of the game

The Collective focuses on process over outcomes as we know the latter is a result of the former. Our community is continuously exploring how to improve and refine every facet of the game of trading, as well as the game of life.

A high signal, zero noise proprietary dashboard

The world is awash in noise… data, news, opinions, tweets, and on and on… The MO Heads-Up Display (HUD) is our one-stop solution for helping us make + expected value decisions week in and week out.

Attend exclusive online and in-person events

Private Collective-only webcasts with special guests (money managers, industry experts, CEOs, former intelligence specialists, etc..) along with twice-a-year Collective gatherings and research trips.

Cultivating Collective Wisdom

Navigating Trading and Life through Process and Insight

You become the average of the people you spend most time with. Our online slack community is comprised of smart and dedicated professionals all working towards the same goal: mastery.

A community devoted to mastery

Real money portfolio with real-time alerts

Investment picks are a dime a dozen. And any true Operator in this game will tell you that trade picks are maybe 20% of what matters - and that’s being generous. At MO we eat our cooking, every last bit of it. We run a 100% fully transparent real money portfolio (we also seperately run a hedge fund, Foundation Capital) with real-time trade alerts, position sizing, exits, profit targets, and all of our day to day trade management.

Play The Game At

The 2nd Level & Beyond…

Sign up to receive our macro takes, investment theory pieces, and deep dives into high convexity trade setups

The MO Team

-

Founder & MO Team Lead, CIO at Foundation Capital, macro junky, former Intelligence professional at FBI, DIA, and DOD, USMC Scout Sniper turned yogi/meditator.

-

Senior Partner at MO, PM at Foundation Capital, lead value investor, ValueHive podcast host, and a tennis nut.

-

Lead quant, Head of Quantitative Strategies at Foundation Capital, avid moviegoer and video game enthusiast.