Why Bond Yields Are Headed Lower…

“War, battles, and conflicts of all kinds (including poker) set in motion forces that quickly become unpredictable. Small defects or problems that are present at the beginning can quickly spiral out of control. And if small problems can do this, think what starting out with large problems means.” ~ Zen and the Art of Poker

Good morning! In this week’s Dirty Dozen [CHART PACK] we cover a budding buy setup in small-caps, bullish breadth reversal in the major indices, a big breakout in Japan, the bull case for bonds, and an update on weed plays, plus more… Let’s dive in.

***click charts to enlarge***

- Last week we noted the McClellan Summation Index was close to triggering a buy signal, which it did. Taking a closer look at small-caps this week, we have the Russell 2000 (RTY) probing the upper range of its year-to-date sideways range while net Spec positioning is its most short since early Aug 2019.

- Makes you wonder if semis are signaling the way for R2K? We still favor Qs over small-caps as they should continue to lead.

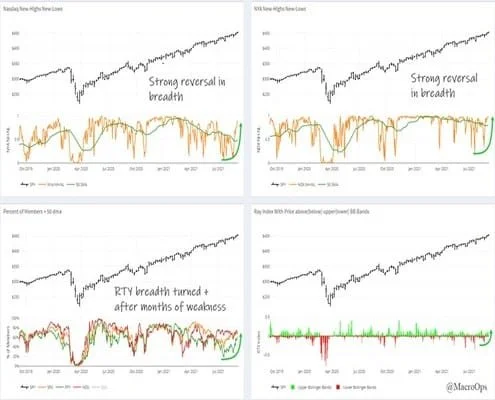

- Last week, we saw breadth strongly reverse from oversold levels. Small-cap breadth is catching up to the stronger breadth in Nasdaq, which is a positive for the broader market. Means this Buy Climax should have some legs…

- Japan’s Prime Minister Yoshihide Suga announced that he will not be seeking the leadership of the LDP in the upcoming election, effectively resigning his position as PM. Former LDP Policy Research Council chairman Fumio Kishida is the favorite to take his seat. The market likes the news as it’d mean a continuation of Abe’s stimulus and greater fiscal spending in the near-term.

The Nikkei rejoiced by breaking out of its 7-month bull flag. It’s overextended in the short-term but I’d be interested in initiating longs on pullbacks near the 21-day MA.

- UST 10yr bonds are trading in a sideways consolidation within a Blended Bull regime. A number of factors are helping keep a bid under bonds (relative value, COVID/Delta concerns, global safe asset shortage, etc…). I’m a buyer in the green zone.

6.Our yield indicator is disagreeing with the recent jump.

- The relative value case…. Wide USvEU yield spreads make UST’s more attractive to European investors on an FX hedged basis.

- With peak global liquidity behind us and our global growth composite signaling a cycle transition to Slowdown from Recovery, the peanut gallery is likely being overly optimistic with their forecasts…

- The Delta variant first popped up in India earlier in the year. Which is why the country was the first to see a large Delta wave spread throughout, which is what the US as well as many other countries are currently going through now. Hopefully, India will also serve as a guide for how quickly the Delta variant burns itself out (india is bottom yellow on chart below).

- A bunch of viewers must be tuning in to season 2 of the Netflix original Too Hot to Handle because the stock is breaking out its 14-month sideways trading range. $675ish is its measured move target.

- One of my favorite Canna investors Todd Harrison posted a high minded update to the bull thesis this past weeked. As always, it’s worth a read (link here) . Below is a chart pulled from the piece that shows the incredible growth at value you can find in the space. We remain very bullish on the industry long-term though we have zero clue where it trades over the short-term (and don’t care much, for that matter).

- GreenThumb Industries (GTII) is our favorite play on this theme. Brandon recently had its CEO Ben Kovler on a twitter space. We’ll be releasing the recording of that soon.

If you enjoy reading these Dirty Dozens each week then please feel free to share them on the Twitters, forward them to a friend, or translate them via smoke signal, etc… Every bit helps us get our name out there. Thanks for reading.Stay safe out there and keep your head on a swivel.

If you enjoy reading these Dirty Dozens each week then please feel free to share them on the Twitters, forward them to a friend, or translate them via smoke signal, etc… Every bit helps us get our name out there. Thanks for reading.Stay safe out there and keep your head on a swivel.