What Is Tik Tok’s ARPU? [DIRTY DOZEN]

It will generally be found that men who are constantly lamenting their ill luck are only reaping the consequences of their own neglect, mismanagement and improvidence, or want of application.~ Samuel Smiles

Good morning!In this week’s Dirty Dozen [CHART PACK] we talk about sentiment, the path of relative factor performance following a large spike in bearish sentiment, and then we dive into weak seasonality in the SPX, discuss the bearish divergence in credit, and end with a look at the euro and natural gas, plus more…Let’s dive in.

***click charts to enlarge***

- Two key pillars of this rally off the March 23 lows has been the incredibly bearish sentiment and extreme under positioning in risk assets. Both of these bullish legs have been chipped away as sentiment and positioning have chased prices higher. They are now no longer tailwinds to risk assets (chart via Nomura).

- Over the last few weeks we’ve seen some rotation into small-cap/value versus growth and momentum. This graph from Nomura shows the average small-cap vs large-cap pattern following similar extremes in sentiment regimes. If there’s continued follow-through then small-caps should soon start to materially outperform.

- But there’s a good chance that outperformance will come from falling less versus rising more…

- The SPX has had a strong few months but is now in its weakest 2-month seasonal period of the year.

- In the Hierarchy of Markets, credit traders sit near the top, right below metal traders. This is why credit leads equities and as a result we should be concerned about widening credit spreads. I’m not calling a top here — my indicators still say its odds on we see the market run a bit higher — but if this divergence doesn’t soon reverse, it’ll be time to button up the hatches.

- Meanwhile, the median P/E has doubled since the March low and is now at a record high (chart via @MacroCharts).

- And positioning in the Nasdaq (blue line) is extremely elevated according to UBS.

- The macro backdrop to all this is a White House and Congress in recess till early September after failing to make any progress on fiscal talks. This is bad news, especially considering the fact that banks have essentially stopped lending.

Here’s Morgan Stanley discussing the latest Fed SLO survey “The Fed’s July Senior Loan Office survey indicates that banks reported much tighter lending standards across all loan categories, with the acceleration in tightening faster than anything seen during the Global Financial Crisis. Demand was also weaker in all categories except the residential mortgage, with Commercial & Industrial (C&I) loan demand falling sharply as companies pay down credit lines. Banks tightened standards across all loan categories at an accelerating pace.”

- If the US dollar bull market is indeed over, it would be the shortest one on record as measured from trough-to-peak, via CS.

- One of the most bullish developments for the euro (and thus bearish USD) is the recent creation of a European supranational fiscal program. Credit Suisse points out that there’s plenty of room for the euro to increase its role as a reserve currency.

- This is a great chart from Morgan Stanley showing the monetization levels (ARPU) of the big tech platforms. YouTube seems to me to be by far the most under-monetized digital asset out there.

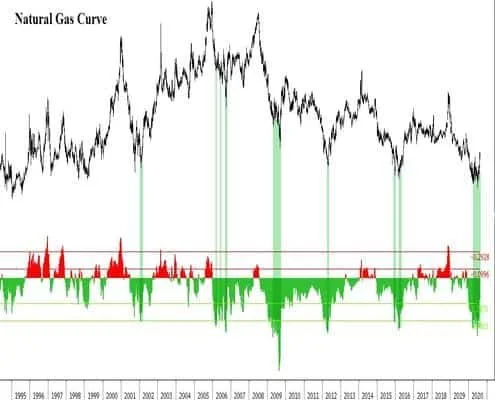

- There’s a LOT to like about natural gas and natural gas stocks right now. The Capital Cycle is supportive of a cyclical bottom, sentiment is about as dour it can get, and the curve is at levels that tend to coincide with cyclical bottoms.