It’s A Trader’s Market Now

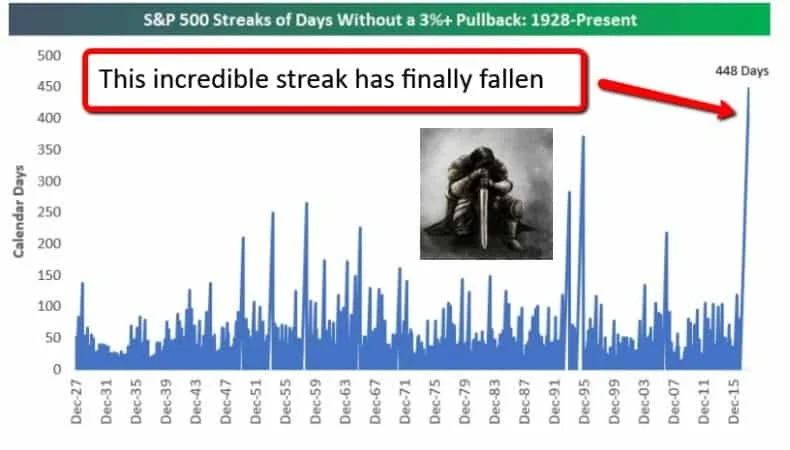

February volatility has clearly signaled a regime change. We’re no longer in a market that rewards ‘hodlers’ to think less and hold more. It’s a traders market now. The S&P finally snapped that ridiculous no pullback streak we’ve all been watching on Fintwit. (Picture below via Bespoke.) And that break caused the largest short volatility unwind in the history of the VIX complex. The one day move on February 5th set records for the largest point move and percentage move in the VIX index. This includes data from the 2008 financial crisis.

And that break caused the largest short volatility unwind in the history of the VIX complex. The one day move on February 5th set records for the largest point move and percentage move in the VIX index. This includes data from the 2008 financial crisis. This up move caused the VIX futures term structure to trade at levels last seen in the 2008 financial crisis.

This up move caused the VIX futures term structure to trade at levels last seen in the 2008 financial crisis. Now the big question is whether or not this volatility will persist. Will equities work off the uncertainty and resume the 2017 uptrend? Or will 2018 look like a giant volatile and choppy range?We’ve found it extremely helpful to watch the trend in credit spreads to determine the forward vol regime. When credit spreads widen volatility in the market will persist and stay high. When credit spreads tighten the opposite occurs — volatility comes down.A quick way to check out credit spreads is to plot the ratio between SHY and HYG (SHY/HYG).

Now the big question is whether or not this volatility will persist. Will equities work off the uncertainty and resume the 2017 uptrend? Or will 2018 look like a giant volatile and choppy range?We’ve found it extremely helpful to watch the trend in credit spreads to determine the forward vol regime. When credit spreads widen volatility in the market will persist and stay high. When credit spreads tighten the opposite occurs — volatility comes down.A quick way to check out credit spreads is to plot the ratio between SHY and HYG (SHY/HYG). Credit spreads are on the precipice of breaking out and reversing the down trend from 2015. If this chart can breakout and hold then we should expect more volatility in the months ahead.Right now it’s sort of in “no-man’s land.” In response, we’ve cut back on our aggressive short vol stuff and have started to move our focus into trades that will benefit if this chart breaks out. This is in line with our macro view that higher volatility is ahead. Unfortunately, monetizing a forecast for higher volatility is tough. Pretty much anything that benefits from higher vol has a negative carry along with it (short high yield bonds, long VIX calls, long puts on SPX, long VXX etc.). All of these long vol trades slowly bleed you to death unless you happen to get in at the perfect time. It’s possible to do — but tough. Luckily, there’s an alternative way to monetize higher vol if you’re willing to do some tactical trading. Historically speaking, long only mean reversion systems with one day holds have worked fantastic on equity indices during volatile conditions.Tactical strategies in stock indices that buy on panic closes, hold overnight, and sell on the next day’s close can harvest a liquidity premium that appears when market participants freakout and dump their exposure. There’s hundreds of way to write strategy logic that takes advantage of the overnight liquidity premium.We have access to a genetic algorithm (hat tip to our friends at Build Alpha) that can scan for the top ones. Here’s what it spit out for the S&P.

Credit spreads are on the precipice of breaking out and reversing the down trend from 2015. If this chart can breakout and hold then we should expect more volatility in the months ahead.Right now it’s sort of in “no-man’s land.” In response, we’ve cut back on our aggressive short vol stuff and have started to move our focus into trades that will benefit if this chart breaks out. This is in line with our macro view that higher volatility is ahead. Unfortunately, monetizing a forecast for higher volatility is tough. Pretty much anything that benefits from higher vol has a negative carry along with it (short high yield bonds, long VIX calls, long puts on SPX, long VXX etc.). All of these long vol trades slowly bleed you to death unless you happen to get in at the perfect time. It’s possible to do — but tough. Luckily, there’s an alternative way to monetize higher vol if you’re willing to do some tactical trading. Historically speaking, long only mean reversion systems with one day holds have worked fantastic on equity indices during volatile conditions.Tactical strategies in stock indices that buy on panic closes, hold overnight, and sell on the next day’s close can harvest a liquidity premium that appears when market participants freakout and dump their exposure. There’s hundreds of way to write strategy logic that takes advantage of the overnight liquidity premium.We have access to a genetic algorithm (hat tip to our friends at Build Alpha) that can scan for the top ones. Here’s what it spit out for the S&P.

- Mon,Tues = 1

- rateofChange(close,3)[0] < rateofChange(close,3) [2]

- Stochastics(4) <= 20

- If true, buy market and sell after 1 day

Basically, it’s telling us to buy when markets get really oversold on Monday or Tuesday and then to sell on the next day’s close. The graph below shows the equity curve for the strategy all the way back to 1998. Performance has been strong throughout time — and the strongest during 2008. That highlighted part of the equity curve on the right is the performance of the algo on “out of sample” data. When using a genetic algo it’s important to make sure you test it on unseen data to make sure it’s robust. The fact that this logic has continued to perform on unseen data is a great sign. It means the overnight liquidity premium in volatile conditions is real and not some spurious relationship dug up by a machine.The next plot shows a breakdown in performance per year.

That highlighted part of the equity curve on the right is the performance of the algo on “out of sample” data. When using a genetic algo it’s important to make sure you test it on unseen data to make sure it’s robust. The fact that this logic has continued to perform on unseen data is a great sign. It means the overnight liquidity premium in volatile conditions is real and not some spurious relationship dug up by a machine.The next plot shows a breakdown in performance per year. 2002 did fantastic. As well as 2007-2008 and 2014-2015. All of these periods were characterized by high volatility and choppy price action — the exact type of environment were expecting in 2018.The above trading strategy can be executed on either the SPY ETF or the E-mini S&P 500 futures. Consider adding this tactical trading strategy into your trading book this year especially if credit spreads breakout and hold.The above was an excerpt from our Macro Intelligence Report (MIR). If you'd like to learn more about the MIR, click here.

2002 did fantastic. As well as 2007-2008 and 2014-2015. All of these periods were characterized by high volatility and choppy price action — the exact type of environment were expecting in 2018.The above trading strategy can be executed on either the SPY ETF or the E-mini S&P 500 futures. Consider adding this tactical trading strategy into your trading book this year especially if credit spreads breakout and hold.The above was an excerpt from our Macro Intelligence Report (MIR). If you'd like to learn more about the MIR, click here.