The Narrative Pendulum

Fractalized sine waves are encoded into the very fabric of our reality. Like the Golden Ratio and the second law of thermodynamics, they appear throughout the universe on nearly every level of scale and function. It’s no surprise then that they underlie the structure of our market.

This makes intuitive sense because a sine wave is just a continuously swinging pendulum. And crowd dynamics naturally follow the path of a pendulum. Swinging from one local extreme to another.

The market is in effect a large complex information transmission system. All acting participants make bets using their particular knowledge set which then in aggregate sets the market price. This, then, provides new information for the actors to incorporate into their decision-making process so they can then make new bets. Thus, creating a neverending feedback loop of information, assessment, action, new information.

These infinite feedback loops, when combined with group psychology and crowd dynamics, necessitate the constant back and forth we see in markets.

Each rally sows the seeds for a reversal and each reversal sows the seeds for a rally. Ad infinitum.

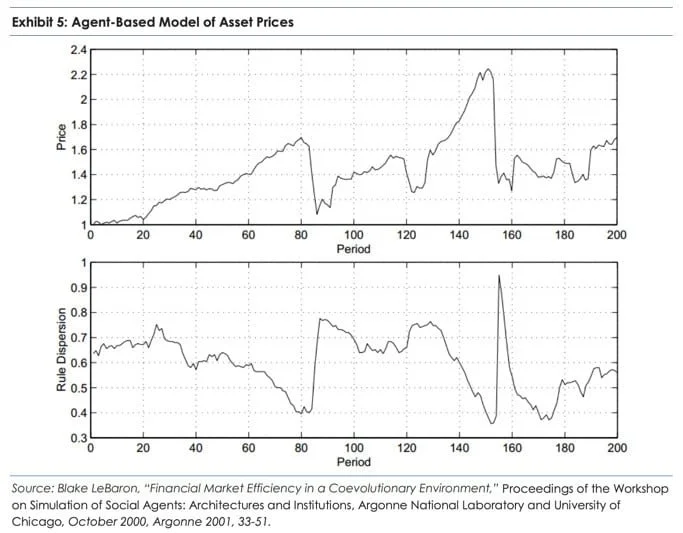

Michael Mauboussin discusses how this dynamic creates a neverending process of market trends and crashes in a paper titled “Who Is On the Other Side?”. In it, he shares work done by economist Blake LeBaron which animates this concept using an agent-based model (here’s a link to the original paper).

The model is computer generated and the “agents” are imbued with decision-making rules and objectives similar to those that drive market participants (i.e., make money, try not to lose money, don’t underperform the average for long periods, etc…)

Here’s a section from the paper (emphasis by me):

LeBaron’s model replicates many of the empirical features of markets, including clustered volatility, variable trading volumes, and fat tails. For the purpose of this discussion, the crucial observation is that sharp rises in the asset price are preceded by a reduction in the number of rules the traders used (see exhibit 5). LeBaron describes it this way:

"During the run-up to a crash, population diversity falls. Agents begin to use very similar trading strategies as their common good performance begins to self-reinforce. This makes the population very brittle, in that a small reduction in the demand for shares could have a strong destabilizing impact on the market. The economic mechanism here is clear. Traders have a hard time finding anyone to sell to in a falling market since everyone else is following very similar strategies. In the Walrasian setup used here, this forces the price to drop by a large magnitude to clear the market. The population homogeneity translates into a reduction in market liquidity.

"Because the traders were using the same rules, diversity dropped and they pushed the asset price into bubble territory. At the same time, the market’s fragility rose."

Really grokking this concept and understanding how this plays out in markets is critical to learning to play this game at the second and third levels and beyond.

It’s the fundamental difference between being a reactionary self-proclaimed contrarian that routinely gets steamrolled by price trends. And an effective contrarian who knows how to read something I call the "Narrative Pendulum", which allows you to get on and stay on the right side of the trend.