The Stock Market's Sleight of Hand

The market is like a magician. It pulls your attention to one hand while stealing your watch with the other. The biggest trends kick-off when no one’s looking. The most contested areas of the market — the stocks everyone is talking about — do nothing.Markets are funny like that.Unlike a magician though, the market isn’t a sentient being. It doesn’t have grand designs and isn’t out to steal your money. It simply reflects the collection of our thoughts, opinions, and beliefs… in real-time… in an endless reflexive loop.The fact that our hive mind is instantly embedded into the market price inherently means that most large moves will surprise most participants. After all, if everyone was already expecting it, it would have already happened.Luckily, there’s an easy way to catch this magician in the act. Watch what everyone is talking about and compare that to the tape. In this note, we’re going to run through the Hierarchy of Technicals to contrast what everyone is focusing on against what the market is actually doing. And by doing so, I’ll show you that while the mainstream narrative remains pessimistic the tape has quietly built itself a base for another major thrust higher.Let’s start with a look at sentiment.The SF Fed’s News Sentiment Indicator, which tracks the economic/market sentiment of 16 major US newspapers, shows that the media continues to push an incredibly dour picture of the economy. Three things dominate our news cycle right now. They’re all bad…

Three things dominate our news cycle right now. They’re all bad…

-

- COVID case numbers (funnily enough, the news no longer reports new deaths or hospitalizations. Both of which continue to drop)

- Election mess (everyone is bracing for a drawn-out contested election)

- Failure of fiscal and all the bad things that means for our weak economy

I’m going to write the positive counterpoints to the above in a follow-up note. But, for now, I think we can agree that the general sentiment in the air is one of agitated apprehension. If you remember my Dirty Dozen Note from the other week where I discussed how our news has structurally become more deleterious over the last 75-years, then this shouldn’t surprise you.This negative news loop is partly cause and partly the result of the enduring bearishness we’re seeing in investor sentiment. AAII net bull-bear is in one of its longest stretches of negative readings in the survey’s history. The NAAIM Exposure Index, which had become elevated a few weeks ago, has reverted back to levels typically seen after much larger selloffs.

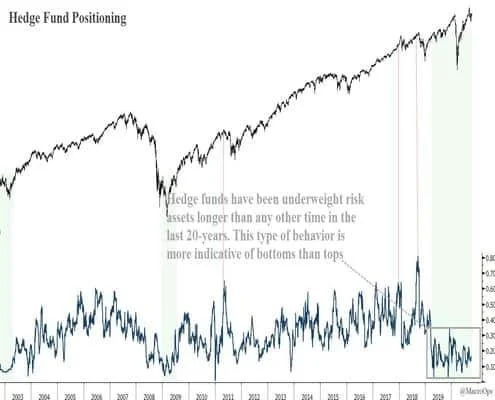

The NAAIM Exposure Index, which had become elevated a few weeks ago, has reverted back to levels typically seen after much larger selloffs. Hedge Funds have been more underweight risk assets longer than any other time in the last 20-years. This type of behavior is more indicative of long-term bottoms than it is of tops.

Hedge Funds have been more underweight risk assets longer than any other time in the last 20-years. This type of behavior is more indicative of long-term bottoms than it is of tops. Aggregate net commercial positioning in major US indexes is at levels that have only been seen three other times over the last 9-years, indicating broad short speculative positioning.

Aggregate net commercial positioning in major US indexes is at levels that have only been seen three other times over the last 9-years, indicating broad short speculative positioning. That’s a pretty clear cut picture of sentiment and positioning. And this is despite “one of the greatest stock market rallies of all time” according to BofA. Few believe the trend up will continue. Most are on the sidelines, sitting in cash, watching the rise in utter disbelief. Now let’s get a bit deeper into the market structure and have a look at liquidity and the relative attractiveness of stocks versus bonds.Everything in markets is relative. Stocks are no different. Their attractiveness is influenced by what’s on offer in other assets, such as bonds. This is why stocks and bonds tend to see-saw in a constant back and forth. One rallies relative to the other thus sowing the seed for a reversal in relative performance.With that said, the stock/bond ratio is currently at 20+ year lows.

That’s a pretty clear cut picture of sentiment and positioning. And this is despite “one of the greatest stock market rallies of all time” according to BofA. Few believe the trend up will continue. Most are on the sidelines, sitting in cash, watching the rise in utter disbelief. Now let’s get a bit deeper into the market structure and have a look at liquidity and the relative attractiveness of stocks versus bonds.Everything in markets is relative. Stocks are no different. Their attractiveness is influenced by what’s on offer in other assets, such as bonds. This is why stocks and bonds tend to see-saw in a constant back and forth. One rallies relative to the other thus sowing the seed for a reversal in relative performance.With that said, the stock/bond ratio is currently at 20+ year lows. The equity risk premium is well above levels where the market has topped over the last 60-years.

The equity risk premium is well above levels where the market has topped over the last 60-years. We have the easiest financial conditions since early 2014, according to the ANFCI.

We have the easiest financial conditions since early 2014, according to the ANFCI. Credit Suisse shows that the US composite standardized policy score is twice as loose as it was at the height of the GFC.

Credit Suisse shows that the US composite standardized policy score is twice as loose as it was at the height of the GFC. We’re building a picture here…We’ve got a bearish consensus in sentiment and positioning. Stocks at 20yr+ lows relative to bonds. A fat risk premium. And some of the easiest liquidity conditions we’ve seen in years.Not bad.But these are just a few pieces of the puzzle. They mean little if the tape is telling a different story. So let’s take a look at what’s going on under the hood of the market.This week, the MSCI World Index saw 62% of its stocks climb above their 200-day moving average. That’s the strongest breadth reading in 8-months.

We’re building a picture here…We’ve got a bearish consensus in sentiment and positioning. Stocks at 20yr+ lows relative to bonds. A fat risk premium. And some of the easiest liquidity conditions we’ve seen in years.Not bad.But these are just a few pieces of the puzzle. They mean little if the tape is telling a different story. So let’s take a look at what’s going on under the hood of the market.This week, the MSCI World Index saw 62% of its stocks climb above their 200-day moving average. That’s the strongest breadth reading in 8-months. The NSYE New Highs/Lows index has rebounded and is back near highs.

The NSYE New Highs/Lows index has rebounded and is back near highs. Our indicator of short-term breadth has seen a strong positive thrust this week, showing budding underlying strength.

Our indicator of short-term breadth has seen a strong positive thrust this week, showing budding underlying strength. Recovering breadth is being reflected in the tape as well. Dow Transports are just breaking out to new all-time highs this week.

Recovering breadth is being reflected in the tape as well. Dow Transports are just breaking out to new all-time highs this week. Semis are following in step. They’re within a hair’s breadth of new all-time highs.I don’t know how anybody can look at this stuff and come to the conclusion that now is a good time to be extraordinarily cautious… yet, that’s the consensus take.

Semis are following in step. They’re within a hair’s breadth of new all-time highs.I don’t know how anybody can look at this stuff and come to the conclusion that now is a good time to be extraordinarily cautious… yet, that’s the consensus take.![]() Lastly, we have the SPX. It’s in a Bull Quiet regime less than 5 percent from all-time highs. In a bull quiet, you want to be long. You want to buy dips, buy new highs, buy because it's sunny out etc… Furthermore, our TL Score has completely reversed from negative to positive and is now giving a solid reading of +2 — I expect we’ll see this score increase further before the end of the week.

Lastly, we have the SPX. It’s in a Bull Quiet regime less than 5 percent from all-time highs. In a bull quiet, you want to be long. You want to buy dips, buy new highs, buy because it's sunny out etc… Furthermore, our TL Score has completely reversed from negative to positive and is now giving a solid reading of +2 — I expect we’ll see this score increase further before the end of the week. Bearish consensus, defensive positioning, flush liquidity, rebounding breadth, leading indices breaking out to new highs, a Bull Quiet regime, and a positive TL score…People make this game a lot tougher than it needs to be. They allow themselves to get distracted by the market’s sleight of hand.In my follow up note, I’ll lay out the fundamental macro case for why we should expect stocks to move much higher over the next 6-months. We’ll then dive into the sectors and plays that we are most excited about, so stay tuned.Stay safe and keep your head on a swivel!

Bearish consensus, defensive positioning, flush liquidity, rebounding breadth, leading indices breaking out to new highs, a Bull Quiet regime, and a positive TL score…People make this game a lot tougher than it needs to be. They allow themselves to get distracted by the market’s sleight of hand.In my follow up note, I’ll lay out the fundamental macro case for why we should expect stocks to move much higher over the next 6-months. We’ll then dive into the sectors and plays that we are most excited about, so stay tuned.Stay safe and keep your head on a swivel!