The Oil Market’s Massive Repricing

The following is an excerpt from our Macro Intelligence Report (MIR). If you’d like to learn more about the MIR, click here.Seeking out asymmetric trades today is a bit tougher than normal because of where we are in the cycle. We’re in the latter stages and valuations are high (very high) so upside is somewhat limited on the whole and completely dependent on sentiment. But it’s not late enough in the cycle where it makes sense to start pressing shorts — the trend is still up and could persist for another couple of years. The large vampire squid (aka, Goldman Sachs) noted recently that the “average valuation percentile across equity, bonds and credit in the U.S. is 90 percent, an all-time high.” A good approach in environments such as these is to stick with the large trends that are running, but to start toeing the water in the few discarded and unloved assets that have upside asymmetry and a relative margin of safety. For our team at Macro Ops, the asset that fits the bill is oil. Back in August we wrote about why we thought the puzzle pieces were coming together for a bullish oil rebound — a veritable “Marcus Trifecta” of macro, sentiment, and technicals signaling major upside asymmetry. We made the argument that the market was overestimating oil’s future supply growth while understating demand. Furthermore, we remarked how the market was headed for a supply constrained environment due to a record level of cuts in CAPEX (ie, reduction in the investment into future supply) to the global oil market over the past few years. Lastly, we wrote how the bullish case for oil was made even more delectable by the trend rates in GDP growth and inflation. The “Investment Clock” framework has us entering the “Overheat” phase of the business cycle. In this phase, commodities and oil and gas stocks in particular historically perform very well. The chart below shows energy’s relative total return outperformance in the final year(s) of a bull market.

A good approach in environments such as these is to stick with the large trends that are running, but to start toeing the water in the few discarded and unloved assets that have upside asymmetry and a relative margin of safety. For our team at Macro Ops, the asset that fits the bill is oil. Back in August we wrote about why we thought the puzzle pieces were coming together for a bullish oil rebound — a veritable “Marcus Trifecta” of macro, sentiment, and technicals signaling major upside asymmetry. We made the argument that the market was overestimating oil’s future supply growth while understating demand. Furthermore, we remarked how the market was headed for a supply constrained environment due to a record level of cuts in CAPEX (ie, reduction in the investment into future supply) to the global oil market over the past few years. Lastly, we wrote how the bullish case for oil was made even more delectable by the trend rates in GDP growth and inflation. The “Investment Clock” framework has us entering the “Overheat” phase of the business cycle. In this phase, commodities and oil and gas stocks in particular historically perform very well. The chart below shows energy’s relative total return outperformance in the final year(s) of a bull market. This was, and remains, a very contrarian call. And that’s all for the better. Since our August report, WTI crude has climbed from $49/bbl to a high of $59/bbl last week. The basket of three oil and gas stocks that we recommended is up over 12%; roughly double the S&P’s return over the same time. So we’re off to a decent start. But as we’ve continued to dig into the energy story we’ve become more convinced that there’s incredible asymmetry building in the space. Today we’re going to reiterate our bullish call for oil and gas equity outperformance going into 2018 and update the evidence on why it’s nearing time strike it rich.

This was, and remains, a very contrarian call. And that’s all for the better. Since our August report, WTI crude has climbed from $49/bbl to a high of $59/bbl last week. The basket of three oil and gas stocks that we recommended is up over 12%; roughly double the S&P’s return over the same time. So we’re off to a decent start. But as we’ve continued to dig into the energy story we’ve become more convinced that there’s incredible asymmetry building in the space. Today we’re going to reiterate our bullish call for oil and gas equity outperformance going into 2018 and update the evidence on why it’s nearing time strike it rich.

There Will Be… Bull? — The Coming Oil Bull Market

One of the more difficult, yet important, jobs of a trader is tease out what’s likely to happen versus what’s already priced in. It’s at this intersection of the unfolding path of reality and embedded expectations where trades are born and die. But getting inside the head of every other market participant and weighing their thinking against the price of the market is tough going for obvious reasons. A workaround we use is paying attention to the popular stories that market participants are telling. And more importantly, how these stories evolve and react to new information, and then how these reactions get reflected in prices. Narratives are the human way of trying to make sense of a chaotic, complex, system. The stories we tell ourselves are often wrong, incomplete, and sometimes crazy. But nonetheless our ability to believe in them has been so powerfully ingrained in us because it’s helped us thrive as a species. Author of the book Sapiens, Yuval Harari, notes the following:

Sapiens rule the world, because we are the only animal that can cooperate flexibly in large numbers. We can create mass cooperation networks, in which thousands and millions of complete strangers work together towards common goals. One-on-one, even ten-on-ten, we humans are embarrassingly similar to chimpanzees. Any attempt to understand our unique role in the world by studying our brains, our bodies, or our family relations, is doomed to failure. The real difference between us and chimpanzees is the mysterious glue that enables millions of humans to cooperate effectively.

This mysterious glue is made of stories, not genes. We cooperate effectively with strangers because we believe in things like gods, nations, money and human rights. Yet none of these things exists outside the stories that people invent and tell one another. There are no gods in the universe, no nations, no money and no human rights—except in the common imagination of human beings. You can never convince a chimpanzee to give you a banana by promising him that after he dies, he will get limitless bananas in chimpanzee Heaven. Only Sapiens can believe such stories. This is why we rule the world, and chimpanzees are locked up in zoos and research laboratories.

We are genetically programmed to buy into the popular narratives that are shared by the crowd. That’s why it’s so damn hard to be a contrarian… it’s literally against our biological programming to go against the herd. Similar to how species react, adapt, and evolve slowly in response to environmental stresses, so too do the popular narratives adjust slowly over time as new information enters the picture that challenges their validity. This is why popular market narratives always lag the market. And once the market finally acknowledges the faults in the prior narrative, we see violent surges and reversals in price. We want to identify the popular story that’s embedded in prices and look for instances where new information signals a diverging outcome. The more divergent, the more lucrative the trade. We want to be ahead of this narrative adoption. If we can lead the story then we can make money. Going back to the oil markets:

The popular story over the last three years of the oil bear market rested on two things (1) that the world is awash in oil thanks to the introduction of fracking and (2) the adoption of electric vehicles was going to soon kill the internal combustion engine, thus clipping off a big source of demand for oil.

But the data doesn’t support this narrative.

Like most popular stories, this one was born in some truth. But that truth, or rather its supporting facts, have evolved. And the popular narrative of the oil market has not yet fully awoken to the new reality. Once it does we’re likely to see $80, even $100/bbl oil in the coming year. Here’s why. The consensus in oil is predicated on the belief that fracking and the introduction of shale oil has led to a new paradigm of sustainable drilling productivity growth, making the US a major swing producer in the global market.But recent data isn’t backing this up. Supply forecasts have been predicated on the belief that improvements in fracking technology will continue to increase well productivity at the growth rates we’ve seen over the last few years. The expectations are that this rate will compound, bringing ever more supply growth online. The problem is that these forecasters have mistaken the source of that “well productivity growth”.For example, output in the Bakken shale (one of the most productive shale regions in the US) more than tripled from 2012 to 2015. Recent research done by MIT suggests this rise in well productivity was not actually due to improved fracking technology and efficiency gains… but rather because shale companies abandoned their less productive fields following the market slump and instead pumped from their prime acreage. In addition, the E&Ps have been tapping their drilled but uncompleted (DUCs) wells.

The combination of only pulling from Tier 1 fields, along with draining pre-drilled wells, led to forecasters greatly overestimating future supply growth by misattributing the excess supply to technology driven productivity gains.

So while forecasters have been modeling out continuous well productivity growth of roughly 10%, the real number is likely closer to 6% or less. And while that difference may not seem like a lot, when you think about the compounding effect that 40% less growth has over time… it’s huge. This has led to forecasters continuously overestimating US production over the last year. Commodity Hedge Fund, Goehring & Rozencwajg Associates (GRA), wrote the following in their latest quarterly letter (emphasis mine):

Commodity Hedge Fund, Goehring & Rozencwajg Associates (GRA), wrote the following in their latest quarterly letter (emphasis mine):

Most oil analysts at the start of 2017 believed US crude production would grow by approximately one million barrels per day between January 1st and December 31st. That level of growth would imply full-year 2017 oil production of 9.3 million barrels per day or 450,000 b/d above 2016 levels... Many analysts felt these estimates would ultimately be revised higher.

Even with substantial OPEC production cuts, the energy analytic community has vigorously argued that because of strong US shale oil growth, global oil markets would remain in long-term structural surplus...

However, data has now emerged suggesting that US crude production growth is rapidly slowing...

Between September 2016 and February 2017, US crude production grew by 100,000 barrels per day per month, but since then US production has ground to a near standstill. Between February and July, US production has only grown by 33,000 barrels per day per month – a slowdown of 67%. Moreover, preliminary weekly data for August and September (adjusted for the impact of Hurricanes Harvey and Irma) suggest that production growth has slowed even more.

The slowdown in US onshore production growth is even more puzzling given the huge increase in drilling that took place over that time. The Baker Hughes oil rig count is up 130% since bottoming in May of last year. In spite of a surging rig-count, onshore production growth is now showing signs of significant deceleration.

Although it is still early in the production history of the shales, it now appears the growth in US shale production may not be nearly as robust as originally expected. If our observations and analysis are correct, then the oil market will be even more under-supplied that we expected in the 4th Q of the year and incredibly undersupplied into 2018. The ramifications are going to be huge.

The deceleration in production growth has led to a large comparative drawdown in inventories.

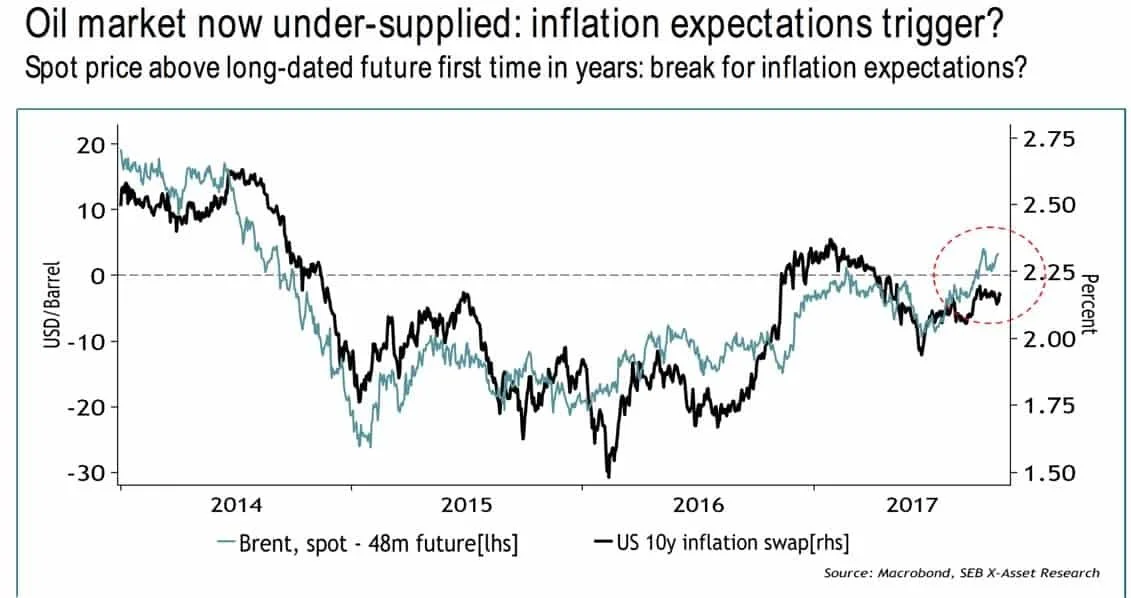

GRA notes that “inventories have now drawn down to critical points where further inventory reductions will result in severe upward price pressure” and, “If our inventory extrapolation is correct and inventories reach these levels (and they should — our modeling has been correct over the past nine months), then prices have historically surpassed $100 per barrel.” Signs of a tightening supplies are beginning to show in the futures market where the spot price has recently pushed above long dated futures for the first time in years.

GRA notes that “inventories have now drawn down to critical points where further inventory reductions will result in severe upward price pressure” and, “If our inventory extrapolation is correct and inventories reach these levels (and they should — our modeling has been correct over the past nine months), then prices have historically surpassed $100 per barrel.” Signs of a tightening supplies are beginning to show in the futures market where the spot price has recently pushed above long dated futures for the first time in years. Despite this new data indicating a market moving closer to a supply deficit, the market continues to operate under the old narrative and faulty assumptions. The irony is that these faulty assumptions (wrongly extrapolating shale productivity growth into the future) has driven OPEC to extend their output cuts — where compliance has been strong — for another year. On top of this, oil companies are beginning to focus more on cash flows and less on production which means even less CAPEX (investing into future production). And this is all following the largest reductions to CAPEX in the history of the oil and gas market over the time for which we have data.

Despite this new data indicating a market moving closer to a supply deficit, the market continues to operate under the old narrative and faulty assumptions. The irony is that these faulty assumptions (wrongly extrapolating shale productivity growth into the future) has driven OPEC to extend their output cuts — where compliance has been strong — for another year. On top of this, oil companies are beginning to focus more on cash flows and less on production which means even less CAPEX (investing into future production). And this is all following the largest reductions to CAPEX in the history of the oil and gas market over the time for which we have data.  This is setting the market up for a massive repricing sometime in the coming year(s). None of this is priced in. Despite crude’s recent rally, the most bullish piece put out by the Street has come from Goldman Sachs which went out on a caveat filled limb saying they expected WTI to finish the year at a whopping $57.50 (it’s trading at $56 right now). Oil trader and fund manager Pierre Andurand of Andurand Capital (who’s fund has returned over 560% since 2008) noted the following in his recent investment pitch in Sohn, London (summary via marketfolly):

This is setting the market up for a massive repricing sometime in the coming year(s). None of this is priced in. Despite crude’s recent rally, the most bullish piece put out by the Street has come from Goldman Sachs which went out on a caveat filled limb saying they expected WTI to finish the year at a whopping $57.50 (it’s trading at $56 right now). Oil trader and fund manager Pierre Andurand of Andurand Capital (who’s fund has returned over 560% since 2008) noted the following in his recent investment pitch in Sohn, London (summary via marketfolly):

Oil prices will go much higher than consensus. In the last 18 months there has been a lot of negative hype about oil prices. The two most discussed factors have been US shale production and electric vehicles. US shale has been called the internet of oil.

Demand for oil has rarely been as strong as it is today. Demand is as high as it was 10 years ago when there was a lot of talk about the super cycle and demand growth. New oil discoveries are at all-time lows.

Supply will peak before demand at current oil prices. Oil demand will peak sometime between 2027 and 2035, much later than the consensus view. The supply of electric vehicles will be constrained by a shortage of batteries.

Supply will peak in 2020. Oil discoveries peaked in the 1960s. They stabilised in the 1990s making a lower peak with US shale discoveries in the early 2000s but they have been declining since then. We are finding 10x less oil than we were 20 years ago. Global reserves are going down fast. We have a 100bn barrels (or 10% less) of reserves than we had 10 years ago when everyone was worried about peak oil. The largest declines have been in ex-US small oil fields. The rate of decline will quicken and supply will be less than expected.

Nobody wants to invest in oil projects that take 6 years to come to market and 20 years to make a profit. Against expectations, US production is flat this year. Productivity per well will go down. We could need $100 a barrel oil to mitigate the fall in supply.

If OPEC goes back to full production, there would still be a deficit of half a million barrels per day. Inventories are low.

OPEC is unlikely to go back to full production leaving a deficit of 1m barrels per day. In this scenario oil could easily reach $80 per barrel.

While the “Death of the Combustion Engine” narrative sounds compelling, the data again doesn’t support it.Even under the most bullish adoption estimates, EV’s impact is expected to be limited in the coming decade. Bridgewater notes that “in even the most bullish scenarios, only 0.2-0.3 mb/d of oil are expected to be displaced over the next five years.” (charts below via BW) That’s a drop in the bucket.

That’s a drop in the bucket.

While EV’s will undoubtedly change the energy landscape in the distant future, it’s not going to have a material impact within the next decade, which is the timeframe we’re investing in.

In any case, EV’s impact pales into comparison to the growth in the global car stock that we’ll see over the next decade. Charts below again via BW. This goes back to the powerful impact of Asia, which led by India, is hitting the wealth S-curve that we talked about in the October MIR.

This goes back to the powerful impact of Asia, which led by India, is hitting the wealth S-curve that we talked about in the October MIR.

We’re going to see the global middle-class balloon to over 4 billion people in the coming years. This means EXPONENTIAL growth in commodity consumption… and a lot more gas guzzling cars on the road.

Which brings us to our current cycle. We are hitting that sweet spot in the global business cycle where the world economic engine is firing on all cylinders. The OECD Growth Indicator below shows all 35 OECD countries are in growth and/or accelerating expansion mode for the first time since 2007. And this has led to GDP forecasts being continuously revised upward.

And this has led to GDP forecasts being continuously revised upward. The demand forecast for oil is also being continuously revised higher.

The demand forecast for oil is also being continuously revised higher. It’s frequent data surprises like these that eventually force new narrative adoption and drive new trends.Under this backdrop of greater than expected rising demand and significantly lower than expected supplies, we have oil and gas equities priced near secular lows, and completely out of favor with the market.

It’s frequent data surprises like these that eventually force new narrative adoption and drive new trends.Under this backdrop of greater than expected rising demand and significantly lower than expected supplies, we have oil and gas equities priced near secular lows, and completely out of favor with the market. Do you think there may be some asymmetry here?

Do you think there may be some asymmetry here? Now of course, there’s potential downsides that may delay our bullish oil thesis. The big unknown is China. With President Xi having consolidated power there’s now talk he’s going to make some moves to deleverage the economy. And there’s evidence in the data of this effort (look at the recent selloff in metals). It’s unclear how aggressive the communist party will be in cleaning up China’s balance sheet. Since the CCP’s number one priority is maintaining social order, it’s unlikely they’ll move too swiftly and risk blowing up the system. But China remains a black box. All we can do is look at the data available and adjust fire as we go. Besides, there are numerous potential geopolitical shocks that could light a fire under our bull case. There’s potential war brewing between Saudi Arabia and Iran using Lebanon and Hezbollah as proxies. Not to mention the new Saudi crown prince seriously shaking things up at home. Then there’s North Korea always on the brink of war and Venezuela which is quickly becoming a failed state. And the list goes on...Arguably none of this is priced into the market at the moment. But there are signs that the popular story is changing… albeit slowly. This change is being led by the rise in price (as always). And we can bet that sometime next year, a reflexive loop will form where the rise in prices spurs adoption of our bullish oil thesis which further drives prices. John Percival’s quip, “Listen to what the market is saying about others, not what others are saying about the market” perfectly applies here. Summary

Now of course, there’s potential downsides that may delay our bullish oil thesis. The big unknown is China. With President Xi having consolidated power there’s now talk he’s going to make some moves to deleverage the economy. And there’s evidence in the data of this effort (look at the recent selloff in metals). It’s unclear how aggressive the communist party will be in cleaning up China’s balance sheet. Since the CCP’s number one priority is maintaining social order, it’s unlikely they’ll move too swiftly and risk blowing up the system. But China remains a black box. All we can do is look at the data available and adjust fire as we go. Besides, there are numerous potential geopolitical shocks that could light a fire under our bull case. There’s potential war brewing between Saudi Arabia and Iran using Lebanon and Hezbollah as proxies. Not to mention the new Saudi crown prince seriously shaking things up at home. Then there’s North Korea always on the brink of war and Venezuela which is quickly becoming a failed state. And the list goes on...Arguably none of this is priced into the market at the moment. But there are signs that the popular story is changing… albeit slowly. This change is being led by the rise in price (as always). And we can bet that sometime next year, a reflexive loop will form where the rise in prices spurs adoption of our bullish oil thesis which further drives prices. John Percival’s quip, “Listen to what the market is saying about others, not what others are saying about the market” perfectly applies here. Summary

- The popular narrative surrounding oil over the last 3 years has been:

- 1) Supply is rapidly growing due to fracking driven productivity growth

- 2) Electric vehicles are taking away a huge source of demand

- But the latest data doesn’t support this narrative…

- Forecasters have been misattributing increased oil supply to productivity gains when it was really from tapping Tier 1 fields and DUCs.

- Drillers have cut production and CAPEX and are now experiencing large drawdowns in inventories.

- The most bullish scenario for electric vehicles displaces only a miniscule amount of oil demand over the next decade. Oil demand is actually set to rapidly grow as Asia hits the wealth S-curve

- The market is slowly waking up to this reality and there will be a massive repricing once it does.

The above was an excerpt from our Macro Intelligence Report (MIR). If you’d like to learn more about the MIR, click here.For more on the oil bull market, watch the video below!