Musings: The Market, To Be Commanded, Must Be Obeyed

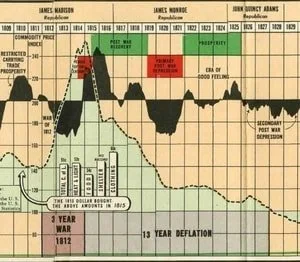

Alex here with your latest Friday Macro Musings. Latest Articles — Your Monday Dirty Dozen [CHART PACK] — We look at the trend in global PMIs and what that’s meant for sector returns going forward, plus we look at falling oil demand and dropping rig counts, and end with a look at some lending data and a coiling high carry FX trade.Value Hive: Q3 Letters, Russian Stocks and P/E Misconceptions — Brandon shares the Q3 Investor Letters he’s reading, discusses Elliot Management’s latest idea, Canadian bank stocks, and pitches the bull case for a Russian financial.Ditch the Predictions and Play the Odds — I go on a bit of a rant about the huge difference between odds-based scenarios and needlessly gaudy predictions (ie, constant recession forecasting).Part 1: The Tape Tells All and It’s Odds On We’ve Started a 10%+ Correction — I imagine alternate market scenarios and evaluate the weight of the evidence by running through the technicals, internals, and sentiment in this post.Part 2: #Recession2020, Really? A Review of the Data — I talk recession and how we should think about them as traders and investors. I then share my Recession Dashboard along with what it’s currently telling me.Articles I’m reading — Morgan Housel’s latest post titled “Three Big Things: The Most Important Forces Shaping the World” might well be his best. Which is saying something since he seems to only produce great work.In the post, Morgan talks about three subjects that are near and dear to my heart (1) demographics (2) inequality and (3) access to information. Using WW2 as an analogy in how BIG events echo through time, creating all types of unpredictable outcomes decades later. He writes how these three forces are sure to shape the future in ways that are unimaginable to us today.Here’s the link, make sure to give it a read.You can follow up Morgan’s piece with this complimentary one from Ben Carlson titled “World War II: The Economic Anomaly”.Carlson talks about how WW2 essentially created the middle class. The post is filled with some great anecdotes and charts. For instance, did you know that by 1945 US GDP was 2.4 times its size from just five years earlier? Carlson quotes the author Frederick Lewis Allen who called it “the most extraordinary increase in production that had ever been accomplished in five years in all economic history.” Here’s the link along with one of the many great charts. Lastly, I might be confirming my bias here but I think this macro outlook by Joe Little (Joe’s a good follow on the twitters, you can find him here) and the HSBC asset management team is solid — it’s right in line with what I’m seeing.The gist of the report is that there’s a big “bull market in pessimism” at the moment and investors are spending too much time fretting over a recession. Sure, there are risks… global growth has been slowing and political uncertainty is on the rise. But most of this and some has been discounted in the market and the risk premia that’s now on offer on global equities relative to UST 10-years is pretty fat.This is at least my quick take from the report. You can, and should, read the whole thing here. Here’s a clip.

Lastly, I might be confirming my bias here but I think this macro outlook by Joe Little (Joe’s a good follow on the twitters, you can find him here) and the HSBC asset management team is solid — it’s right in line with what I’m seeing.The gist of the report is that there’s a big “bull market in pessimism” at the moment and investors are spending too much time fretting over a recession. Sure, there are risks… global growth has been slowing and political uncertainty is on the rise. But most of this and some has been discounted in the market and the risk premia that’s now on offer on global equities relative to UST 10-years is pretty fat.This is at least my quick take from the report. You can, and should, read the whole thing here. Here’s a clip.

“The fundamental outlook remains tricky. Political uncertainty has imposed an economic cost. Our Nowcast – a big data economic model – indicates that global growth is running just above 2%. This is not strong, but it looks broadly stable. We believe we are in the “cyclical slowdown” phase of the economic cycle – growth and profits are coming under pressure, but are not yet compromised. Global labour markets and services sectors remain firm. Importantly, there is a concerted effort underway to ease policy in the US, China and Europe. Low inflation gives policymakers a free-hit to focus on stabilising the macro cycle and revitalize animal spirits. Of course, we have to be realistic about what policy stimulus can achieve – we shouldn’t expect a return to the “Goldilocks economy” of 2017- early 2018. But – critically – policy activism is largely pre-emptive and insures us against the worst macro outcomes.”

Oh, and one more thing. Take a few minutes and give this short FT article on the Hong Kong protest a read. It’s a well written and sobering take on what's likely to transpire next. Actually, one more last thing, promise. Ben Thompson’s latest post on the NBA/China controversy is excellent and a must-read (link here).Charts I’m looking at—Here’s a cool graph from the above report. It’s a narrative map. Apparently they use fancy NLP software to crawl millions of news articles to see what the global collective is worrying about. The answer? Recession, the Fed, and trade policy. In that order. This chart from RENMAC shows that SPX net-surprises are in the top 20% of their historical average, which is generally bullish (marked by the green up arrows on the chart if you couldn’t guess). With consensus estimates predicting negative 3.4% EPS growth this quarter we might be seeing another easy earnings layup in Q3.

This chart from RENMAC shows that SPX net-surprises are in the top 20% of their historical average, which is generally bullish (marked by the green up arrows on the chart if you couldn’t guess). With consensus estimates predicting negative 3.4% EPS growth this quarter we might be seeing another easy earnings layup in Q3. Podcast I’m listening to — My friend Kean Chan (@keanferdy) recommended this older episode of NPR’s Hidden Brain podcast. The episode is called “How Science Spreads: Smallpox, Stomach Ulcers, And 'The Vegetable Lamb Of Tartary’”. It’s about how beliefs and narratives spread. There’s a lot in here that can be directly applied to markets. It’s a short listen, less than 40-minutes and worth the time.The main takeaway? We can never be absolutely sure about anything. On top of this, our brains are packed full of biases and blind spots. So we should think about our beliefs in terms of degrees and probabilities rather than certainty. That’ll help us get to better answers over time. Here’s the link.And for those of you interested in learning more about the study in how narratives and beliefs spread, I recommend picking up the seminal textbook on the subject titled “Diffusion of Innovations” by Rogers. It’s a favorite of mine.Book I’m reading — A while back I wrote a post (link here) on Amos Hostetter. If you’re not familiar with the name, Amos was one of the original co-founders of Commodities Corp — the trading shop that birthed many of the original greats: Kovner, Marcus, PTJ, and Seytkota to name a few.Amos was considered the wise mentor of the group. Nearly all the traders would go to him when they were working on a problem or riding a rough patch. As you could imagine, he was quite the wellspring of knowledge.Following his untimely death in 77’, management at CC decided to compile all of his trading wisdom that was remembered through talks, written on memos and letters, and jotted down in his own personal trading journal. The result was an internal booklet titled “A Successful Speculator’s Approach to Commodities Trading”.

Podcast I’m listening to — My friend Kean Chan (@keanferdy) recommended this older episode of NPR’s Hidden Brain podcast. The episode is called “How Science Spreads: Smallpox, Stomach Ulcers, And 'The Vegetable Lamb Of Tartary’”. It’s about how beliefs and narratives spread. There’s a lot in here that can be directly applied to markets. It’s a short listen, less than 40-minutes and worth the time.The main takeaway? We can never be absolutely sure about anything. On top of this, our brains are packed full of biases and blind spots. So we should think about our beliefs in terms of degrees and probabilities rather than certainty. That’ll help us get to better answers over time. Here’s the link.And for those of you interested in learning more about the study in how narratives and beliefs spread, I recommend picking up the seminal textbook on the subject titled “Diffusion of Innovations” by Rogers. It’s a favorite of mine.Book I’m reading — A while back I wrote a post (link here) on Amos Hostetter. If you’re not familiar with the name, Amos was one of the original co-founders of Commodities Corp — the trading shop that birthed many of the original greats: Kovner, Marcus, PTJ, and Seytkota to name a few.Amos was considered the wise mentor of the group. Nearly all the traders would go to him when they were working on a problem or riding a rough patch. As you could imagine, he was quite the wellspring of knowledge.Following his untimely death in 77’, management at CC decided to compile all of his trading wisdom that was remembered through talks, written on memos and letters, and jotted down in his own personal trading journal. The result was an internal booklet titled “A Successful Speculator’s Approach to Commodities Trading”. We’ve had it hung up in our Collective Vault for a while but I found myself turning back to it this week for a piece on theory and execution that I’m writing. It’s 44 pages of pure gold.Here’s the link to the pdf.Let me know what your favorite takeaways are. Here’s one of mine.“Sometimes it is hard to draw a sharp line between trading principles and money-management principles. If I were to paraphrase a famous saying, I think it would provide an accurate summary of one of Mr. Hostetter’s most important trading and money-management principles: the market, to be commanded, must be obeyed.”Trade I’m considering — Global ex.US markets might be in a protracted slump and US markets may have gone mostly sideways for the better part of two years, but there’s always a bull market somewhere. That is... if you know where to look. That somewhere is shipping, a sector we at MO have been writing about since the start of the year.Many shipping stocks are up 50%+ on the year (STNG, our largest position, is up 70%ytd) and the party is just getting started. I love this trade because the charts and fundamentals have been playing out beautifully but there’s still hardly anybody talking about the sector.I don’t know what it is. Maybe it’s misconceptions about how the trade war will affect the industry (hint: it’s bullish as it reroutes shipping lanes from traditional routes, meaning more nautical miles travelled) or maybe it’s overblown concerns about slowing global growth. Whatever it is, there’s still incredible opportunity in the space.Here’s DSSI, a company our value guy Brandon wrote about a few months back (link here). The stock is up roughly 50% over the last two weeks. If this shipping bull market is anything like the others past, then this is not even the first inning of what will be a wild game (read: lots of money to be made).

We’ve had it hung up in our Collective Vault for a while but I found myself turning back to it this week for a piece on theory and execution that I’m writing. It’s 44 pages of pure gold.Here’s the link to the pdf.Let me know what your favorite takeaways are. Here’s one of mine.“Sometimes it is hard to draw a sharp line between trading principles and money-management principles. If I were to paraphrase a famous saying, I think it would provide an accurate summary of one of Mr. Hostetter’s most important trading and money-management principles: the market, to be commanded, must be obeyed.”Trade I’m considering — Global ex.US markets might be in a protracted slump and US markets may have gone mostly sideways for the better part of two years, but there’s always a bull market somewhere. That is... if you know where to look. That somewhere is shipping, a sector we at MO have been writing about since the start of the year.Many shipping stocks are up 50%+ on the year (STNG, our largest position, is up 70%ytd) and the party is just getting started. I love this trade because the charts and fundamentals have been playing out beautifully but there’s still hardly anybody talking about the sector.I don’t know what it is. Maybe it’s misconceptions about how the trade war will affect the industry (hint: it’s bullish as it reroutes shipping lanes from traditional routes, meaning more nautical miles travelled) or maybe it’s overblown concerns about slowing global growth. Whatever it is, there’s still incredible opportunity in the space.Here’s DSSI, a company our value guy Brandon wrote about a few months back (link here). The stock is up roughly 50% over the last two weeks. If this shipping bull market is anything like the others past, then this is not even the first inning of what will be a wild game (read: lots of money to be made). Quote I’m pondering —

Quote I’m pondering —

The self is the friend of a man who masters himself through the self, but for a man without self-mastery, the self is like an enemy at war. ~ The Bhagavad Gita

Perspective is everything. Alter your perspective, alter your reality. All mastery begins and ends at the self. Da Vinci said it well, “One can have no smaller or greater mastery than mastery of oneself”.Turn inwards and take the journey.