Musings: Murder, Regression to the Mean, and a Stock Ripe for a Short...

Alex here with your latest Friday Macro Musings. Latest Articles — Your Monday Dirty Dozen [CHART PACK] — We look at MORE bearish positioning across equities, fund managers buying protection against a fall at a record rate, signs of an intermediate top in gold, and macro indicators that say a recession is still a long ways off, plus more.Value Hive: Sony Says No, AT&T Listens and China Talks! — Brandon, the value investor formerly known as Mr. Bean, talks Dan Loeb and Sony, AT&T and Elliot, and a trader who lost his shirt and some…Articles I’m reading — Alex Danco published a great piece titled The Founding Murder and the Final Boss (Danco is the one who did the excellent Rene Girard primer I shared a number of weeks ago). It’s another Girardian take, this time on the ritualistic narrative Silicon Valley partakes in when one of its own flounders and goes belly up.The idea is that the Valley subconsciously evolved a social contract in order to stave off the collective belief that we’re in the midst of another dot-com bubble — the Valley’s “Founding Murder”. Put another way, they ritualize the death of one of their own in order to “make sure that the struggle or failure of any one company would never be interpreted by the community as a warning sign that the whole undifferentiated bubble could collapse” as Danco puts it.It’s a thought-provoking piece and makes you question what other social rituals we may have evolved to distract us from the truth in order to serve a narrow purpose. Here’s the link and a section from the post.

As a community, we’ve gotten impressively good at collectively interpreting these failures in the healthiest way possible: founders are rarely demonized; there’s just the right amount of performative fretting, but no serious fear. For small failures, anyway, we’ve gotten really good at ritualizing them into the highest level of “failure interpretation”: not by panicking (the lowest, most dangerous level) or by isolating it as an ignorable one-time thing (the intermediate level, which works when used sparingly), but in an active form of kayfabe where failure is good!

The collective memory of the real founding murder (the dot com crash) is an essential part of keeping kayfabe. The stronger that memory, the more effectively we can say “up is down, black is white, failure is great” with a straight face, mean it, and actually perpetuate a desired outcome that is useful. It’s an remarkable conjuring trick, really; if enough of us believe that failure is good, then it becomes good.

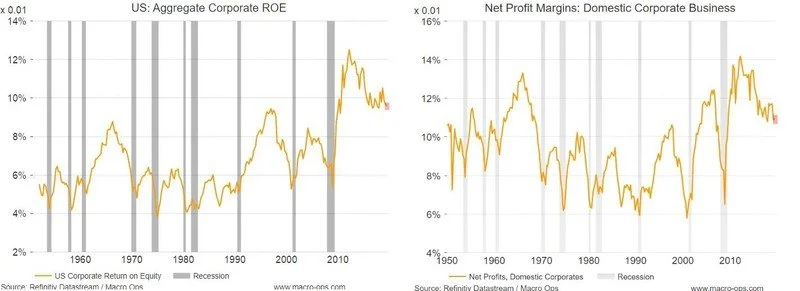

Here’s one for the mon-pol nerds.I recently came across a fantastic blog called “Concentrated Ambiguity” that dives into the nuts and bolts of international capital flows — he also has some great posts on the recent repo hysteria that has infected so many amongst us. It’s heady stuff but super interesting if you’re at all into learning how the international finance sausage is made (link here).Lastly, Bessemer Trust recently published a report looking at the Japanese stock markets (link here).The report is overall neutral on the country. They like some things, such as its improved capital discipline, governance, and rising buybacks, but are put off by the upcoming consumption tax increase. I myself am more bullish on Japanese stocks over the intermediate-term. There’s quite a lot to like from a purely technical and positioning standpoint. Plus, there are things like these two charts below from the report (1) buybacks are rocketing higher and (2) it’s trading on the cheap. Charts I’m looking at—The trend in these two charts below has me worried. Both aggregate return on equity (ROE) and net profit margins have rolled over again and are trending lower. There aren’t many times in history where we’ve seen margins and ROE contract this much and then not experience a recession.Just some food for thought. There’s a lot to be bullish about — at least in the near to intermediate-term — but there’s also increasing signs of trouble on the horizon.

Charts I’m looking at—The trend in these two charts below has me worried. Both aggregate return on equity (ROE) and net profit margins have rolled over again and are trending lower. There aren’t many times in history where we’ve seen margins and ROE contract this much and then not experience a recession.Just some food for thought. There’s a lot to be bullish about — at least in the near to intermediate-term — but there’s also increasing signs of trouble on the horizon. Video I’m watching — So I’ve just started watching this one and am only a few minutes in. I’ve been on somewhat of a Peter Thiel trip these last months and this interview seems interesting so far. Thiel is a strange creature. I certainly don’t agree with many of his views but he’s at least a thoughtful and incredibly bright guy. Plus, some of his ideas are so far out in left-field that I often find myself thinking about a topic in an entirely new way after hearing him speak.The video is titled “Peter Thiel on ‘The Straussian Moment’” and was put on by Stanford’s Hoover Institute (link here).Podcast I’m listening to — Earlier today I listened to David Perrell’s recent North Star interview with the critical thinking savant, Adam Robinson. Adam is a consultant to hedge funds and has quite an original approach to markets, some of which I’ve written about before (link here).I enjoyed the talk and think you will too. Here’s the link.Book I’m reading — The other week I finished reading Sutherland’s book “Alchemy: The Dark Art of Creating Magic…” after seeing a number of people rave about it on twitter. I don’t know how to describe this book because it’s so much more than a book about business and branding. It’s about the oddities of the human mind, the quirky things we do and the real reasons behind why we do them, and much more. It’s a fantastic book, the best one I’ve read this year. Read it. You won’t be disappointed.

Video I’m watching — So I’ve just started watching this one and am only a few minutes in. I’ve been on somewhat of a Peter Thiel trip these last months and this interview seems interesting so far. Thiel is a strange creature. I certainly don’t agree with many of his views but he’s at least a thoughtful and incredibly bright guy. Plus, some of his ideas are so far out in left-field that I often find myself thinking about a topic in an entirely new way after hearing him speak.The video is titled “Peter Thiel on ‘The Straussian Moment’” and was put on by Stanford’s Hoover Institute (link here).Podcast I’m listening to — Earlier today I listened to David Perrell’s recent North Star interview with the critical thinking savant, Adam Robinson. Adam is a consultant to hedge funds and has quite an original approach to markets, some of which I’ve written about before (link here).I enjoyed the talk and think you will too. Here’s the link.Book I’m reading — The other week I finished reading Sutherland’s book “Alchemy: The Dark Art of Creating Magic…” after seeing a number of people rave about it on twitter. I don’t know how to describe this book because it’s so much more than a book about business and branding. It’s about the oddities of the human mind, the quirky things we do and the real reasons behind why we do them, and much more. It’s a fantastic book, the best one I’ve read this year. Read it. You won’t be disappointed. Here’s a section from it:

Here’s a section from it:

One of the most important ideas in this book is that it is only by deviating from a narrow, short-term self-interest that we can generate anything more than cheap talk. It is therefore impossible to generate trust, affection, respect, reputation, status, loyalty, generosity or sexual opportunity by simply pursuing the dictates of rational economic theory. If rationality were valuable in evolutionary terms, accountants would be sexy. Male strippers dress as firemen, not accountants; bravery is sexy, but rationality isn’t. Can this theory be extended further? For instance, is poetry more moving than prose because it is more difficult to write? And is music more emotionally potent than normal speech because it is more difficult to sing than to talk?

Trade I’m considering — Short insanity… In other words, short incredibly overvalued crowded momo names like Coupa Software (COUP) that has an $8bn+ market cap and is trading for 26x sales. There’s a big unwind happening in these names and stocks like COUP have a long way to fall just to get back to normal overvalued levels. Quote I’m pondering —

Quote I’m pondering —

Mimicking the herd invites regression to the mean. ~ Charlie Munger

There are plenty of ways to play this game well. Doing what everybody else is doing is not one of them.If you’re not already, be sure to follow me on Twitter: @MacroOps. I post my mindless drivel there daily.Have a great weekend.