Musings: GOATS: Druckenmiller and Soros Speak

Alex here with your latest Friday Macro Musings…As always, if you come across something cool during the week, shoot an email to alex@macro-ops.com and we’ll share it with the group.Latest Articles/Podcasts/Videos — Your Monday Dirty Dozen [CHART PACK] — I look at the technical picture for the SPX, go through some stats that show this bull is gonna keep running, talk about the latest data that suggests the global economy has troughed, and finish with some single stock setups we’re looking at.Poker and Investing: Lessons from a Professional Poker Player — Brandon talks with fellow Collective member and former poker pro, Macro Nakamoto (pseudonym). We at MO think of poker as one the best training grounds for trading and investing (outside of markets). And in this chat, the two dive into poker theory, what it takes to play at the pro level, similarities to trading and more.Articles I’m reading — Someone on Twitter (apologies I can’t remember who) shared this great paper by Peter Drucker titled “Managing Oneself”. Peter is legendary in the executive management coaching world. He basically invented the category and has authored numerous books on the topic including one of my favorites “The Effective Executive”.This one is a fairly quick read and it’s jam-packed with useful teachings on how to organize your life and get the results you want — tons of parallels for us as traders and investors. Here’s the link to the paper and an excerpt.

“Most people think they know what they are good at. They are usually wrong. More often, people know what they are not good at - and even then more people are wrong than right. And yet, a person can perform only from strength. One cannot build performance on weaknesses, let alone on something one cannot do at all.

Throughout history, people had little need to know their strengths. A person was born into a position and a line of work: The peasant's son would also be a peasant; the artisan's daughter, an artisan's wife; and so on. But now people have choices. We need to know our strengths in order to know where we belong.

The only way to discover your strengths is through feedback analysis. Whenever you make a key decision or take a key action, write down what you expect will happen. Nine or 12 months later, compare the actual results with your expectations. I have been practicing this method for 15 to 20 years now, and every time I do it, I am surprised.”

This past week Bloomberg published a collection of observations and predictions from leading “China Watchers” on where the country’s economy is headed in 2020 and the years following.I’ve been writing for the last few years now about how China is the most important macro variable this cycle. I believe this still to be true, especially considering the high wire act that the CCP is currently trying to perform; slowly deflating the debt monster it created while maintaining financial stability and high employment.I believe 2020 is going to be particularly interesting as the data is beginning to indicate that China has finally neared the Minsky cliff and growth is going to slow materially absent another hail-mary injection of credit. Which way things will go I do not yet know… The first half I believe will be fine as a recovery from the recent global recession should spur a short-lived global boom in CAPEX but in the second half and onwards, I’m having a tough time seeing where the net-investment is going to come from as per the Levy-Kalecki equation to keep the cycle going.We’ll need to keep a close watch to see what the CCP does. The 2021 centennial anniversary of the communist party does raise the specter of them giving the econ a bit more gas for one last hurrah. Anyways, here’s a cut from one of my favorite China Watchers, Michael Pettis, as well as the link.

“My worst call was to propose that Beijing would recognize the extent of investment misallocation and the inexorable rise in debt by 2015-16, and would begin to lower the GDP growth target rapidly after that. I did not recognize how politically difficult this would prove, and that it couldn’t happen until Xi Jinping and the people around him had done a lot more to consolidate political power.

Every historical precedent -- and the logic of the growth dynamics -- suggests it will be another Japan. GDP growth rates will drop consistently every year until China is growing at below 3%, and the longer it takes to get there, the more debt it will have to work off and the greater the macroeconomic financial distress costs it will have to absorb.”

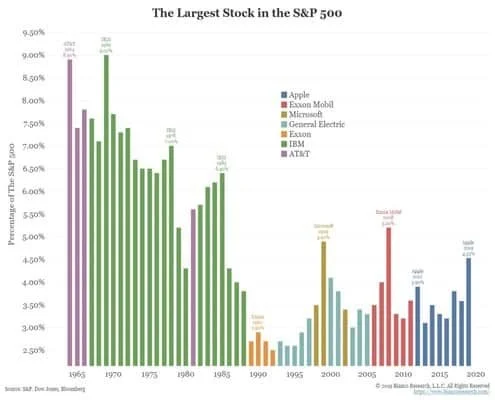

Charts I’m looking at— Bianco Research put out some great charts this week showing the weightings of the top stocks in the SPX throughout time.Take this first one for example. The bears are always yelping about how the weighting of the FAAMG stocks is now larger than the concentration of the largest tech companies during the dot-com bubble. But, as the chart below shows, if you pull back a bit we find that now is not that unusual at all and in fact, the index concentration of the big tech names is pretty vanilla compared to history.

Video I’m watching — The GOAT Stanley Druckenmiller was on Bloomberg this week and did a near hour. The entire thing is worth a watch.Stan talks about his performance year-to-date (just cracked double digits as he’s been playing it safe). Discussed his outlook going forward (he’s mildly bullish) and shared a few of the trades he’s most excited about (he really likes the UK and pound here). Here’s the link.I also watched this fantastic hour-long interview with Stan’s mentor, the palindrome himself, George Soros (h/t Sam for the find). The interview is from 95’ and a younger George Soros speaks with Charlie Rose about investing and markets. It’s killer and I highly recommend giving it a go. The good stuff comes after about the 10 min mark. Here’s the link and a line from the interview.

Video I’m watching — The GOAT Stanley Druckenmiller was on Bloomberg this week and did a near hour. The entire thing is worth a watch.Stan talks about his performance year-to-date (just cracked double digits as he’s been playing it safe). Discussed his outlook going forward (he’s mildly bullish) and shared a few of the trades he’s most excited about (he really likes the UK and pound here). Here’s the link.I also watched this fantastic hour-long interview with Stan’s mentor, the palindrome himself, George Soros (h/t Sam for the find). The interview is from 95’ and a younger George Soros speaks with Charlie Rose about investing and markets. It’s killer and I highly recommend giving it a go. The good stuff comes after about the 10 min mark. Here’s the link and a line from the interview.

“It’s different when you’re risking your principle than when you’re risking your profit. That’s how you get these runs, where you get it right and you can risk more and make more money. When you have lost it, when you’re doing poorly, you need to retrench. Risking your profit is much easier than risking your principle. The reason we have such a good record is we never lose our principle. Once we are in a bad position we retrench, so we might lose a little bit but we are never in danger.”

In trading and investing, the best offense is good defense.Podcast I’m listening to — I actually haven’t listened to this one yet but I’m excited to and will hopefully get to it this weekend. But it’s the Hidden Forces podcast which I’m a fan of and this particular episode is with Michael Green, a PM a Thiel Macro (@profplum99).Green is a regular on Real Vision and is one of the most original thinkers on there. I love watching his stuff as he’s always coming out of left field with something. In this chat, it looks like they get into how passive investing is changing the market and distorting price signals and the functioning of efficient capital allocation. Here’s the link.Book I’m reading — This week I’ve been reading Pierce Brown’s “Iron Gold”. It’s the fourth installment in the “Red Rising” series. This is sci-fi at its best. Pierce is a disgustingly good writer. If you pick this series up just be forewarned. You will lose sleep because they are nearly impossible to put down.Trade I’m looking at — So many breakouts this past week. GPRK broke out (talked about here). Shippers, such as DHT, EURN, STNG, are breaking out again. Match (MTCH) which I mentioned in Monday’s Dirty Dozen had a big breakout. Gotta love these end of year fireworks as under-positioned managers trip over themselves to add risk and performance chase into the new year.One chart that I’ve been closely watching for the last few months is the Chinese internet giant, Baidu (BIDU). After a year-plus long downtrend, the stock has been working its way out of a multi-month base and just crossed its 200-day moving average for the first time since July of 18’. There’s a big gap up to $150 that I wouldn’t be surprised to see BIDU quickly run up and fill — it’s currently trading at $128. Anyways, just a name I’m thinking about playing for a swing.Quote I’m pondering —

There’s a big gap up to $150 that I wouldn’t be surprised to see BIDU quickly run up and fill — it’s currently trading at $128. Anyways, just a name I’m thinking about playing for a swing.Quote I’m pondering —

When heaven is about to confer a great responsibility on any man, it will exercise his mind with suffering, subject his sinews and bones to hard work, expose his body to hunger, put him to poverty, place obstacles in the paths of his deeds, so as to stimulate his mind, harden his nature, and improve wherever he is incompetent. ~ Meng Tzu, 3rd century BC

Take your struggles as blessings. Thank the universe for them for they impart upon you gifts that you may not yet understand. Out of adversity greatness is born…That’s it for this week’s macro musings.If you’re not already, be sure to follow me on Twitter: @MacroOps. I post my mindless drivel there daily.Have a great weekend.