Multiple Buy Signals… [Dirty Dozen]

For eighteen years I followed the sea, took what it offered. It has brought me shipwreck and success, sorrow, danger, and unutterable happiness.~ Henry de Monfreid

In this week’s Dirty Dozen [CHART PACK] we look at a combination of multiple buy signals in stocks in conjunction with both bonds and USD bumping up against critical technical levels, indicating a high chance for mean reversion. We then talk Utes, an Ag play, and more…

1. Here’s last week’s Flow Show summary with highlights by me.

2. Also from BofA: “stocks oversold: contrarian ‘buy signal; triggered when 88% of global equity indices trading below 200 & 50-day moving averages; it hit 80% on Tuesday; global stocks up 4% in 4 weeks after 14 buy signals since 2011.”

3. The Qs reversed right near their lower weekly Bollinger Band, still well within the expected range of a healthy ABC pullback/consolidation pattern.

4. Our Total Put/Call oscillator also triggered a buy signal on Friday as the indicator fell below 10% (green shaded areas mark past signals).

5. Falling bonds (rising yields) have been driving the USD higher and stocks lower. But the technicals suggest that bonds have maybe hit a near-term low. 10yrs are reversing off their monthly band and have put in a double bottom on the daily chart.

This should be caveated with the fact that bonds have put in five consecutive monthly bear bars. This is rare sign of negative momentum and any pullback/consolidation period is likely to be somewhat brief (a few weeks or so).

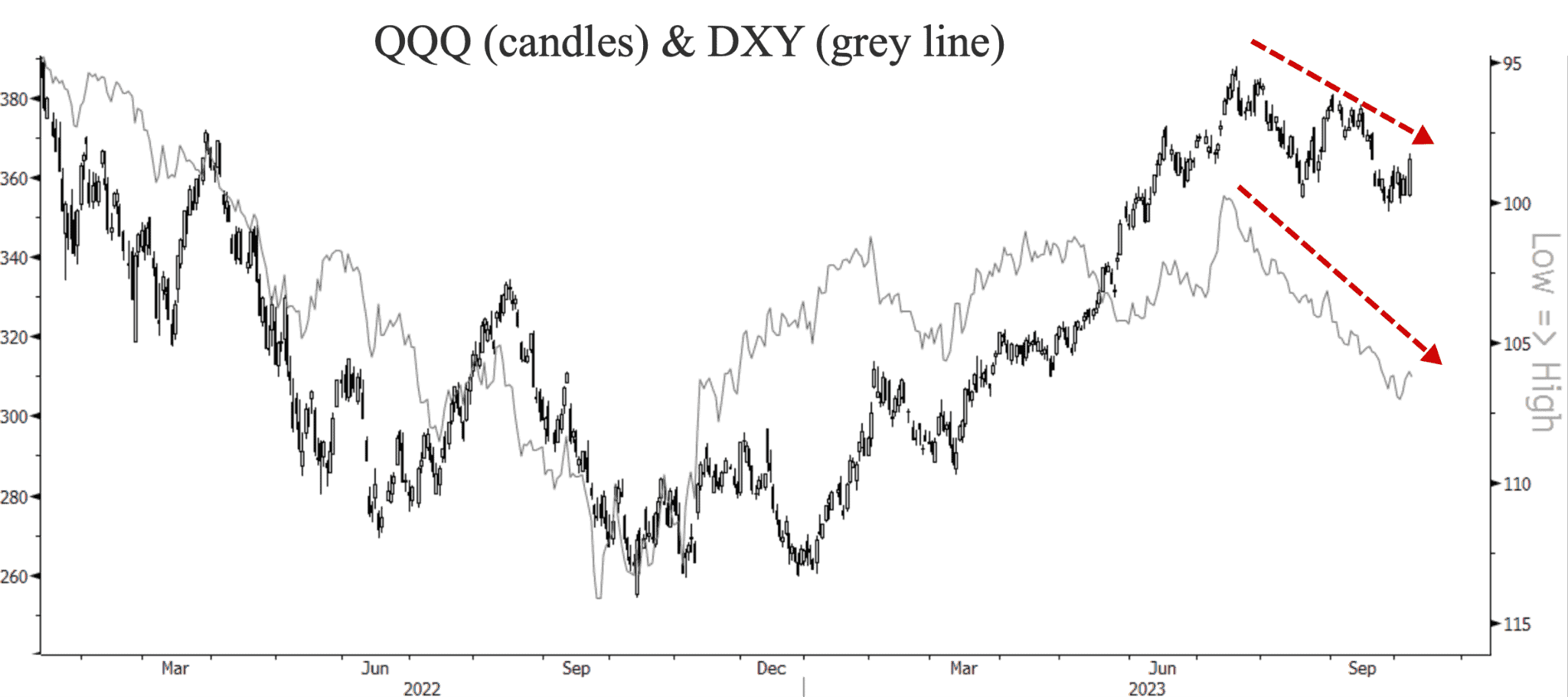

6. The DXY has put in 11 weekly bull bars. This rare streak ended last week with a shooting star reversal candle. If yields slow their roll here then we’ll likely see the DXY start a multi-week pullback.

7. And this will flip a headwind into a tailwind for stocks as a rising USD driven by higher yields, is what has largely been driving this correction in risk assets.

8. This chart from SentimenTrader shows the trends in employment for the construction, trucking, and temporary hires relative to their 12 month moving averages. It’s an n of three so take with a grain of salt. But this does correlate well with the main recession leads we track, which all continue to point to a material slowdown beginning around the turn of the year.

9. Utes (XLU) are bombed out. SentimenTrade writes: “When the composite score falls below -35%, the downside momentum in the S&P 500 Utility sector tends to persist over the following week but median returns, win rates, and z-scores show outstanding results across medium and long-term horizons.”

10. Here’s the returns table following past signals, again via SentimenTrader.

11. Similar to bonds, going long Utes here is fading extreme momentum so positioning sizing and risk management are key. However, if you wanted to play for some short-term reversion, you can take a position will low risk and decent size in the leverage utility etf (UTSL).

12. December Corn is breaking out of a major volatility compression zone. We’re buyers on a move above last week’s highs. Positioning, sentiment, valuation, and seasonals are all supportive of a breakout higher.

Thanks for reading.