Momentum Versus Mean Reversion

*** The following is an excerpt from Alex's weekly Market Note ***

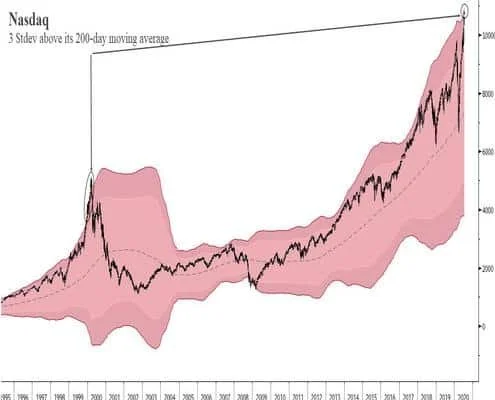

The Nasdaq is 3 standard deviations above its 200-week moving average. The trend has only been this stretched a handful of times over the last 30-years. Fund flows into tech are nearly 2.5 standard deviations above their 12-month average. A point at which has marked intermediate tops over the past 3-years (red highlights below).

Fund flows into tech are nearly 2.5 standard deviations above their 12-month average. A point at which has marked intermediate tops over the past 3-years (red highlights below). Breadth in the tech sector has been narrowing but is still not at levels that typically precede large-scale weakness. Though that could quickly change.

Breadth in the tech sector has been narrowing but is still not at levels that typically precede large-scale weakness. Though that could quickly change. The latest BofA Global Fund Manager Survey (you can find the report hung up in the Comm Center #Research channel) had the largest percentage of respondents call Long US Tech & Growth the “most crowded trade” in the survey’s history.

The latest BofA Global Fund Manager Survey (you can find the report hung up in the Comm Center #Research channel) had the largest percentage of respondents call Long US Tech & Growth the “most crowded trade” in the survey’s history. The only other instance that comes close is “Long US Dollar” in February of 2015, which happened to precede a top and 5-years of sideways chop.But… while the trend is stretched, the trade crowded, valuations high, and short-interest at record lows. The path of least resistance remains up — at least for now.The Nasdaq is in a buy climax and buy climaxes last longer than anybody expects them too (see 99’-00’, the last time Nasdaq was this far above its 200wma.The bullish thrust off of the March lows has been incredibly strong and is dominated by large bullish candles. The tape reflects a large imbalance between demand and supply, which the bullish trend is working to correct.Strong thrusts such as these tend to go through a distribution phase (a topping process) that plays out over a couple of weeks before we see a change in trend. It’s during these times that we see breadth materially deteriorate and the tape chop sideways. The Nasdaq made new all-time highs this week and though breadth has weakened it’s not yet giving a sell signal.In an old research paper (link here), Michael Mauboussin recalled a study titled “Crowd Synchrony on the Millennium Bridge” that was published in Nature. Michael wrote:

The only other instance that comes close is “Long US Dollar” in February of 2015, which happened to precede a top and 5-years of sideways chop.But… while the trend is stretched, the trade crowded, valuations high, and short-interest at record lows. The path of least resistance remains up — at least for now.The Nasdaq is in a buy climax and buy climaxes last longer than anybody expects them too (see 99’-00’, the last time Nasdaq was this far above its 200wma.The bullish thrust off of the March lows has been incredibly strong and is dominated by large bullish candles. The tape reflects a large imbalance between demand and supply, which the bullish trend is working to correct.Strong thrusts such as these tend to go through a distribution phase (a topping process) that plays out over a couple of weeks before we see a change in trend. It’s during these times that we see breadth materially deteriorate and the tape chop sideways. The Nasdaq made new all-time highs this week and though breadth has weakened it’s not yet giving a sell signal.In an old research paper (link here), Michael Mauboussin recalled a study titled “Crowd Synchrony on the Millennium Bridge” that was published in Nature. Michael wrote:

On June 10, 2000, the Millennium Bridge opened to the public with great fanfare. London’s first bridge across the Thames in over a century, it had a sleek design—the architect wanted it to look like a “blade of light.” However, when thousands of people stepped on the bridge that day, it started to sway from side to side so much that people had to stop or hold on to the rails. Fearing for the public’s safety, officials closed the bridge two days later and, following a retrofitting, it reopened in February 2002.

What led to this high-profile failure? People exert a small amount of lateral excitation when they walk. Normally, these excitations cancel out when a group crosses a bridge. However, the Millennium Bridge initially had insufficient lateral dampeners, which allowed a little swaying when a sufficient number of people were on the bridge. That swaying forced people to change their gait by widening their steps, leading to greater lateral excitation and more swaying. The wobbling and crowd synchrony emerged simultaneously.

The crucial insight is the existence of a critical point. Simulations show that roughly 165 people can walk on the bridge with little impact on the wobble amplitude (see Exhibit 1). But adding just a few more pedestrians causes the amplitude to change dramatically, especially as the feedback between gait adjustment and wobble amplitude kicks in (see the dashed line in Exhibit 1). For the first 165 bridge crossers, there’s little wobble and no sense of any potential hazard even though the bridge is on the cusp of a state change.

The crucial insight is the existence of a critical point. Simulations show that roughly 165 people can walk on the bridge with little impact on the wobble amplitude (see Exhibit 1). But adding just a few more pedestrians causes the amplitude to change dramatically, especially as the feedback between gait adjustment and wobble amplitude kicks in (see the dashed line in Exhibit 1). For the first 165 bridge crossers, there’s little wobble and no sense of any potential hazard even though the bridge is on the cusp of a state change.

The study helps illustrate how critical tipping points are reached in complex non-linear systems, of which the market is one.Recursive action drives feedback loops which leads to amplification and eventually tipping points from critical states.The current trend in the Nasdaq can be looked at through this lens. The stretched trend and the increasing absence of sizable dips show that the primary rule “buy dips, buy highs” is becoming more widely adopted. More agents (traders and investors) are adopting it because it’s been profitable to do so.At some point, adoption of this rule will reach a critical mass and the lack of rule diversification will set the stage for the feedback loops to run in the other direction.We’re not there yet but we’re getting closer with each passing day. Until then, play the trend until it bends.