Emergent Properties of the Market Collective

One of the coolest things to watch in nature is a Starling murmuration.

If you’ve never seen one before then give this video a watch.

Starlings -- which are small and not particularly intelligent birds -- are somehow able to form these amazingly complex and beautiful airborne systems that are capable of extremely intricate flight patterns which shift and shape with near instantaneous coordination.

They do this apparently in response to threats; to thwart off and confuse predators.

I’m fascinated by systems that display emergent properties such as murmurations. Where a network operating off simple behavioral rules can emerge complex, seemingly intelligent, behavior.

Scientists have long been awed by the same and using the latest technology they’ve been able to gain a fuller understanding of exactly how Starlings accomplish this.

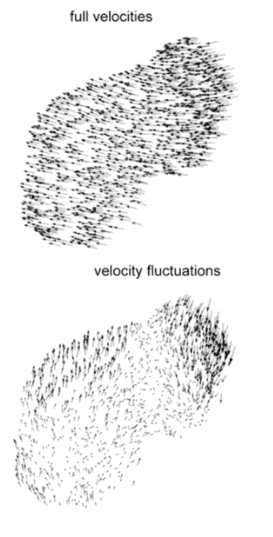

The following excerpt is from a paper on murmurations by Italian researchers. You can find the whole thing here (emphasis by me).

From bird flocks to fish schools, animal groups often seem to react to environmental perturbations as if of one mind… Here we suggest that collective response in animal groups may be achieved through scale-free behavioral correlations… This result indicates that behavioral correlations are scale-free: The change in the behavioral state of one animal affects and is affected by that of all other animals in the group, no matter how large the group is. Scale-free correlations provide each animal with an effective perception range much larger than the direct interindividual interaction range, thus enhancing global response to perturbations.

Scale-free correlations mean that the noise-to-signal ratio in a Starling murmuration does not increase with the size of the flock.

It doesn’t matter what the size of the group is, or if two birds are on complete opposite ends. It’s as if every individual is linked-up to the same network.

The Starlings accomplish this feat by following very simple behavioral rules. Wired magazine notes the following:

At the individual level, the rules guiding this are relatively simple. When a neighbor moves, so do you. Depending on the flock's size and speed and its members' flight physiologies, the large-scale pattern changes.

It's easy for a starling to turn when its neighbor turns – but what physiological mechanisms allow it to happen almost simultaneously in two birds separated by hundreds of feet and hundreds of other birds? That remains to be discovered, and the implications extend beyond birds. Starlings may simply be the most visible and beautiful example of a biological criticality that also seems to operate in proteins and neurons, hinting at universal principles yet to be understood.

A Starling murmuration is a system that is said to always be on the “edge”. These are systems that exist in what’s called a “critical state” and are always, at any time, susceptible to complete total change.

Wired writes that Starling murmurations are “systems that are poised to tip, to be almost instantly and completely transformed, like metals becoming magnetized or liquid turning to gas. Each starling in a flock is connected to every other. When a flock turns in unison, it’s a phase transition.”

What are the benefits of this emergent behavior?

The broader effective perception range combined with their existing in a constant state of criticality, provide Starlings with a strong competitive advantage for survival. The Italian researchers conclude that:

Being critical is a way for the system to be always ready to optimally respond to an external perturbation, such as a predator attack as in the case of flocks.

Individual Starlings operating off their own simple self-interested rules in aggregate create a vastly superior “collective mind” that broadens their perception range — and thus information intake — which enables them to operate in a continuously critical state. A state that’s optimal for responding to threats which helps raise their odds of survival.

You might be asking at this point, “Interesting stuff Alex, but what does this have to do with markets?”

Fair question…

Well, isn’t the market, and market flow just the actions of one big collective mind?

Similar to a murmuration, the market & market flows are just the aggregation of individual actors operating off simple inputs (prices, data, narratives) in order to try and avert danger (ie, lose money on the way down or miss out on the way up).

Like Starlings, market participants instinctively key off one another. Robert Prechter, the popularizer of Elliott Wave Theory, writes in his book “The Socionomic Theory Of Finance” that:

Aggregate investor thought (market flow) is not conscious reason but unconscious impulsion. The herding impulse is an instrument designed, however improperly for some settings, to reduce risk.

Human herding behavior results from impulsive mental activity in individuals responding to signals from the behavior of others. Impulsive thought originates in the basal ganglia and limbic system. In emotionally charged situations, the limbic system’s impulses are typically faster than the rational reflection performed by the neocortex… The interaction of many minds in a collective setting produces super-organic behavior that is patterned according to the survival-related functions of the primitive portions of the brain. As long as the human mind comprises the triune construction and its functions, patterns of herding behavior will remain immutable.

These simple inputs create a market that is collectively smarter than its individual constituents in price action movement and market flows.

It has a much broader perception range and exists in a critical state (always ready to phase shift from bull to bear regime) which allows it to more ably respond to changes in the environment.

When Stanley Druckenmiller first got into the game, his first mentor Speros Drelles -- the person he credits with teaching him the art of investing -- would always say to him that, “60 million Frenchmen can’t be wrong.”

What he meant by that is that the market is smarter than you. It knows more than you thus its message should be heeded because 60 million Frenchmen can’t be wrong…

Druckenmiller often says that “The best economist I know is the inside of the stock market. I’m not that smart, the market is much smarter than me. I look to the market for signals.”

We’ve known about the wisdom of crowds and the power of collective intelligence ever since Francis Galton — a British statistician and Charles Darwin’s cousin — discovered the phenomena while observing groups of people guess the weight of an ox at a county fair (the individual guesses were far off but the average of all guesses were spot on). There’s since been a significant amount of work done on the topic; The Wisdom of Crowds by James Surowiecki is a good summation of it.

But, there are a few key differences between markets, market flows, murmurations, and the unique impact and limitations of crowd intelligence in financial markets, specifically.

The first is — and this is a big one — that markets and market flows are reflexive.

George Soros was the first to discover this truth. He wrote that “Reflexivity sets up a feedback loop between market valuations and the so-called fundamentals which are being valued.” This means that the act of valuing a stock, bond, or currency, actually affects the underlying fundamentals on which they are valued, thus changing participants perceptions of what their prices should be. A process that plays out in a never-ending loop…

This is why Soros says that “Financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality.” And that the level of distortion is “sometimes quite insignificant, and at other times quite pronounced.”

This means that markets and market flows are efficient most of the time except for some of the times when they become wildly not so.

The key driver between low and high distortion regimes are the combined effect of (narrative adoption + price trends + time). These three inputs all work in unison. So when there’s a narrative that becomes broadly adopted, it drives steady price trends, and when these price trends last for a significant amount of time, they then drive more extreme narrative adoption. And so on and so forth…

This positive market flow feedback loop hits at the unconscious impulsion herding tendencies of investors and drives them to focus on trending prices in the act of valuation at the near exclusion of all other factors (ie, earnings, cash flows, valuation multiples etc…).

Most of the time, there are enough competing narratives which drive price volatility and keep the market fairly balanced.

Another major difference is that Starlings aren’t aware of the broader complex system they are an integral part of. It’s all instincts... evolutionary programming… they turn when the bird next to them does.

Whereas in markets & market flows, we can be aware of the system of which we form. We can consciously separate ourselves from the herd and view the whole objectively (at least to the best of our abilities).

This is important. Because as traders, we’re in competition for alpha with the rest of the flock. We don’t just want to turn when and where the others turn. We want to get to where they’re going before them. And to do this, we need to be able to develop a sense for where they’re headed…

Which brings us to the lesson I'm trying to impart.

The reason I’ve been chatting so much about birds, collective intelligence, and reality distortion and all that jazz… is because if we understand the signaling power of certain areas of the market, whether in a low or high distortion regime, we can eschew the need to try and predict all together and instead let the market tell us where things are headed.

I was reminded of this while listening to this Knowledge Project podcast interview with Adam Robinson. Here’s Part 1 and Part 2.

For those of you who don’t know him, Adam is a prodigy who “cracked the SAT” and created The Princeton Review. He now spends his time thinking, writing, and advising hedge funds on strategy. He’s the penultimate first principles thinker. He shared some of these principles in the above interview which we’ll cover now.

To begin with here’s Adam summarizing the lens in which he views markets (emphasis by me):

The fundamental view of investing is that you can figure out something about the world that no one else has figured out. It’s a bit like prospecting, right, gold prospecting. You can go out with your pan and find something that no one else has found. Well, the difference between investing and gold prospecting is that gold prospecting, you actually find gold that you can actually go sell, right? If you find a value that no one else has found, what makes you think... If people are irrational enough to believe that the price of gold is different from what you think it is or should be, what makes you think they’re going to become rational tomorrow? There’s that great quote by John Maynard Keynes, “Markets can stay irrational longer than you can stay solvent.” Good luck with that.

So, there’s a third way, and John Maynard Keynes said, “Successful investing is anticipating the anticipation of others.”

My approach to markets is simply this, to wait for different groups of investors to express different views of the future, and to figure out which group is right. I look for differences of opinion strongly expressed, and decide which one is right.

Whatever else you may think about the world, the world is the product of our thinking. So is the economy. So are our investments. If you think about it, an investment is nothing more than the expression of a view of the future. So when you buy Facebook, or you short the dollar-yen, or you buy gold or short US Treasuries, you are expressing a view of the future. Your view of the future can be right or wrong, and your means of expression can be right or wrong, but that’s what you’re attempting to do, right?

So, if you and I were to go to Columbia Business School or Harvard Business School right now and ask the assembled MBA students, “What is a trend?” They wouldn’t be able to define it at all. In fact, I don’t know that any investor in the world can define a trend. They can define it simplistically like this: “A trend is the continuation of a price series.” Yeah, well that’s great. What’s causing the continuation? Right? And I’ll tell you what a trend is—this is an investment trend—actually it’s true for all trends. A trend is the spread of an idea. That’s all a trend is. It’s the spread of an idea.

Adam doesn’t believe in the existence of intrinsic value but rather views markets and market flow as an evolutionary narrative continuum; where stories spawn, develop, spread, only to eventually get outcompeted and then wither and die.

This is similar to what The Philosopher said in Drobny’s The Invisible Hands which I discussed in my piece on How To Be a Smart Contrarian. Here’s the Philosopher in his own words (emphasis by me):

Market prices reflect the probability of potential future outcomes at that moment, not the outcomes themselves.

One way to think about my process is to view markets in terms of the range of reasonable opinions. The opinion that we are going to have declining and low inflation for the next decade is entirely reasonable. The opinion that we are going to have inflation because central banks have printed trillions of dollars if also reasonable. While most pundits and many market participants try to decide which potential outcome will be the right one, I am much more interested in finding out where the market is mispricing the skew of probabilities. If the market is pricing that inflation will go to the moon, then I will start talking about unemployment rates, wages going down, and how we are going to have disinflation. If you tell me the markets are pricing in deflation forever, I will start talking about the quantity theory of money, explaining how this skews outcomes the other way… People tell stories to rationalize historical price action more frequently than they use potential future hypotheses to work out where prices could be.

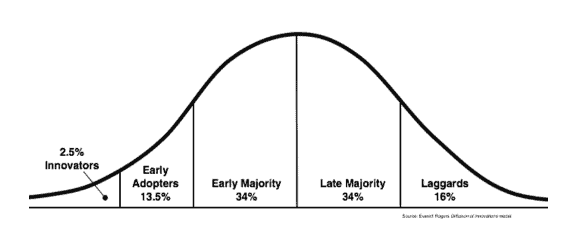

Adam references the work done by Everett Rogers in the study of the Diffusion of Innovations (Rogers has a book by the same title which is well worth a read). This line of study is about how the adoption of technology spreads but the work really can be applied to how everything spreads: narratives, ideas, social norms etc… Rogers breaks down the categories of adopters as: innovators, early adopters, early majority, late majority, and laggards. Well in markets there is a similar breakdown of participants who are consistently early or late to the adoption of narratives and thus trends.

Knowing which groups are which and what their signaling means has been a critical part of Druckenmiller’s process over the years. Here’s Druck in his own words:

One of my strengths over the years was having deep respect for the markets and using the markets to predict the economy, and particularly using internal groups within the market to make predictions. And I think I was always open-minded enough and had enough humility that if those signals challenged my opinion, I went back to the drawing board and made sure things weren’t changing.

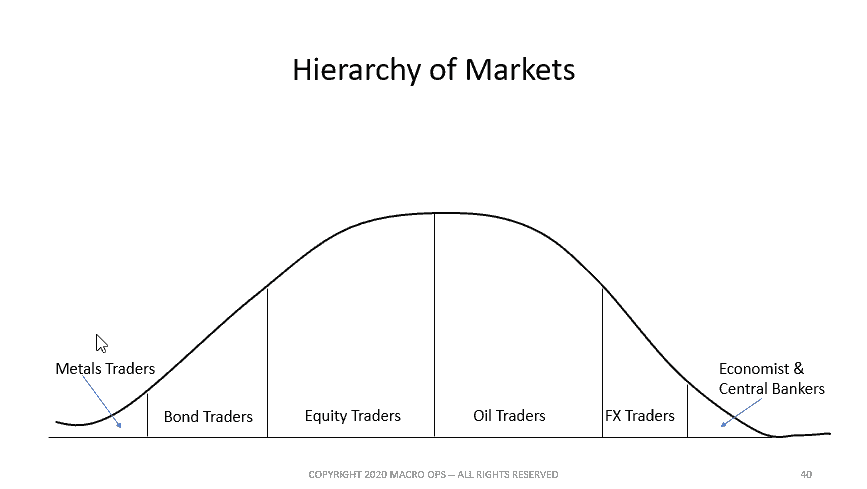

Adam breaks down these groups as follows, from earliest trend spotters to later adopters within market flow:

Metal traders

Bond traders

Equity Traders

Oil Traders

Currency Traders

Economists

Central Bankers

What does this mean in practical terms?

Well, metal traders tend to be the most farsighted of the group. They are usually right and early about changing trends in the economy.

Why is this?

Adam gives three reasons, “The first is, they [metal traders] are the Forrest Gumps of the investing world. Their view of the world is very simplistic. Are people buying copper? And if they are, thumbs up. All is good in the world’s economy. Great. I guess interest rates are going higher. That’s the way metal traders view the world. And if people are buying less copper, they go, ‘Oh, that’s bad. Economic slowdown’.”

Secondly, “People buy and sell copper. It’s used -- it’s a thing. It’s not just a number on a screen, which is all currency traders look at. Right?” And third is time frame, “Commercial metal traders look months to years ahead. Because if you want to take copper out of the earth, it’s going to take years to open that mine, right? So, metal traders are the most farsighted. They have the simplest model of the world, and they are actually in touch with the world economy.”

If getting into the weeds of this stuff is your type of thing then I highly recommend you come and check out our Collective (it’s a risk-free highly asymmetric opportunity).

My teammates (Tyler, Chris, Brandon) and I started Macro Ops (MO) with the aim of creating the trading community and research service we always wanted, but which didn’t exist.

Our goal is to build a virtual Commodities Corp. We want a place where traders from all over the world can come together and share ideas, theories, trade approaches, knowledge and so on. A place where those who are committed to mastery and possess a deep respect for the game, can push each other to grow and improve — where iron can sharpen iron.