Macro Ops 2017 Portfolio Review: Pain + Reflection = Progress

Macro Ops Portfolio

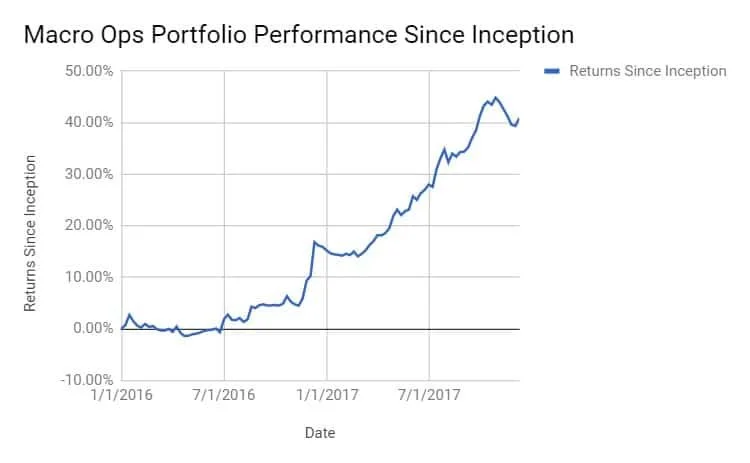

Return Metrics *Through December 8th 2017YTD: 22.19%12-Month Return: 20.57%Inception (Jan 1st, 2016): 40.88%Annual Vol: 7.85%Sharpe Ratio: 2.29Max DD: -3.97%

To others, being wrong is a source of shame; to me, recognizing my mistakes is a source of pride. Once we realize that imperfect understanding is the human condition, there is no shame in being wrong, only in failing to correct our mistakes. ~ George Soros

I learned that everyone makes mistakes and has weaknesses and that one of the most important things that differentiates people is their approach to handling them. I learned that there is an incredible beauty to mistakes, because embedded in each mistake is a puzzle, and a gem that I could get if I solved it, i.e. a principle that I could use to reduce my mistakes in the future. ~ Ray Dalio

Alex here. Every six months we sit down and pore over our trade logs, journal, and public writings from the previous two quarters. We review what we thought markets would do, how we placed and managed bets on these opinions, and then compare them to how reality actually unfolded. It’s a ruthless study of our mistakes; in thinking and in execution. It’s without a doubt the most valuable exercise we do. Sharing this review process is unusual for a trading site. We’re one of the few services that are transparent with our performance. I know of many that tout their BS records by pulling gimmicks on a paper account, claiming nonsense 80% win rates, 350% annual returns, etc. We’re traders first and foremost. And as traders, all we have is our risk-adjusted P/L. One of our principles when starting MO was to be completely transparent… to bare our warts and all (this year I feel like a leper). At the end of the day, like you, we just want to become better traders. Being fully transparent helps us do that. For those of you who aren’t familiar with our approach to markets, let me give you a quick rundown of how we do things. The Macro Ops Portfolio consists of two broad strategies — big bet macro and volatility carry. The goal is for these two strategies to balance each other’s return streams like a barbell.This is important because all strategies perform well or poorly in different market regimes. And since distinct market regimes can last years, it helps to utilize multiple strategies that perform well in opposing environments. This smooths your equity curve, making your returns more stable. And there’s a psychological benefit as well, in that it keeps you from pressing a strategy ill-fit for the environment because you’re hungry for returns. Big bet macro trading focuses on placing asymmetric bets on large market mispricings caused by a misinterpretation of the fundamentals, technicals, and/or sentiment.This strategy is structured to have a low win rate with high return potential. The aim is to capitalize on the inherent 90/10 return distribution of markets by maximizing Pareto’s Law and letting positive compounding do its work. The returns on this trading strategy are naturally bunchy; meaning they tend to experience long periods of flat returns followed by a large jump in NAV over a short period of time. Volatility carry thrives in the opposing regime, one of low volatility and smooth price movements. Its primary aim is to generate positive carry by harvesting the volatility premium. We increase and reduce its leverage in accordance with our macro framework. It’s a more efficient and lucrative means of collecting risk premium from the market versus sitting in a passive diversified portfolio.This philosophy of opposing strategies has served us well as proven by our investment results since we started Macro Ops two years ago. We’ve managed to produce slightly over 40% in gains while only taking a max drawdown of 4%.Now onto a critical assessment of our 2017 performance...

Our Biggest F*ck Up

Our biggest f*ck up this year was not immediately cashing out of our business, liquidating all our boring equity, commodity, and FX trades and then using that cash to buy as much crypto coins we could safely leverage up to our eyeballs for purchase. This would have been the smart and responsible thing to do. Had we done it we’d have similar returns to all the visionary crypto twitter bros… the Buffetts of the digital age… who had the insight early on to see that bitcoin is worth at least the total market cap of the world or more or whatever… because the amazing thing that these investors discovered is that assets with no intrinsic value (ie, no cash flows or real utility) are the most valuable things of all. Because everybody says so and so it is... The big takeaway from this experience is to always buy and HODL… always. To be honest, we’re still peeling back this gem of investing wisdom, trying to unlock its eternal truth. What does it mean and where did it come from? We don’t know but we’ll continue to study it diligently in the hopes that we too can someday properly HODL in markets.Moving on, this was a shit year for me personally. Relative to the opportunity set, it’s been one of the toughest years for me in some time. The following are the complete stats for the macro trades:

To be honest, we’re still peeling back this gem of investing wisdom, trying to unlock its eternal truth. What does it mean and where did it come from? We don’t know but we’ll continue to study it diligently in the hopes that we too can someday properly HODL in markets.Moving on, this was a shit year for me personally. Relative to the opportunity set, it’s been one of the toughest years for me in some time. The following are the complete stats for the macro trades:

Macro Trades

Return Metrics *Through December 8th 2017YTD: 6.80%12-Month Return: 4.01%Inception (Jan. 2016): 23.52%Annual Vol: 11.26%Sharpe Ratio: 1.02Max DD: -9.50% The mediocre 2017 performance is largely due to the fact that we’ve been in a market regime that doesn’t lend itself to macro trading.

The mediocre 2017 performance is largely due to the fact that we’ve been in a market regime that doesn’t lend itself to macro trading.

The market had a sharpe ratio of over 5 this year. That’s insane.... The strategy for Hindsight Capital this year would have been to buy everything on January 1st, leverage up, and then go on vacation. This type of macro environment is a killer for active managers and it’s why big name macro funds have been dropping like flies.

The market had a sharpe ratio of over 5 this year. That’s insane.... The strategy for Hindsight Capital this year would have been to buy everything on January 1st, leverage up, and then go on vacation. This type of macro environment is a killer for active managers and it’s why big name macro funds have been dropping like flies.

(Image via @sentimenttrader)

(Image via @sentimenttrader)

Paul Tudor Jones shuttered his flagship macro fund this year, as did Hugh Hendry. Brevan Howard’s AUM shrunk to a fraction of what it once was. John Burbank surrendered and killed off his macro fund only to start another fund trading crypto and digital kittens (I assume). Tiger cubs have been getting gored left and right with the latest being John Griffing announcing that he’s quitting the game. Even the GOAT, Stanley Druckenmiller, recently said on CNBC that he’s had the worst year of his career and has come close to having his first down year in over 30+ years of trading. This again, is why we diversify strategies. Over the last two years the market has awarded passive holders of risk. Stock pickers and traders have had a rough go. But to be honest, this is an excuse and excuses don’t pay the bills nor allow for valuable lessons learned. Despite it having been a tough environment for macro trading I’m more disappointed in my execution and I could have and should have done much better this year. What’s tough to stomach is is that we nailed most of the major themes throughout the year. Here’s a breakdown of the calls we put out in our monthly reports (MIR).

- January: We wrote, “the US market will likely go on a tear higher from here… European and Japanese stocks should also perform well.” We were leaning bullish the dollar but remained open to its direction and noted that should the “dollar turn, we’ll buy up emerging markets and commodities, hand over fist.”

- February: We noted that we hadn’t yet “seen the level of frothiness or excitement that’s indicative of a market top” and that at “Macro Ops we’ll continue to play the US market to the long side until we see the bond/stock spread go over 1.

- April: We talked about how we thought pessimism was overblown in Europe and the markets should rebound. We predicted a Macron win and believed that the European stock market would embark on a Soros style false trend and outperform.

- May: Our MIR titled “A Three Legged Bull” we wrote “During the last few years of the 90’s tech boom, sentiment clearly reached euphoric levels. This market is missing that component... This is why we refer to this market as a three-legged bull. It has until very recently, lacked the fourth leg of the bull which is extreme optimism. While we’re seeing small pockets of excessiveness in some parts of the market, it’s still a ways from the heady euphoria that typically marks the end of the 5th stage. This is one of many reasons we believe there’s still plenty of room for stocks to run. With only three legs this bull has walked more slowly than past cycles, and because of its missing leg, it’s also likely to endure longer.”

- July: We pitched Chinese equities noting that “(a.) China is starting to benefit from a weaker yuan which can been seen through a rise in exports. (b.) A strengthening global economy is leading to increasing demand for Chinese goods. (c.) China’s all-important Congress is coming up in November. This makes it likely they’ll ease off this recent period of tightening to juice the economy.”

- August: We criticized market perma bears who had for years been citing the high valuation multiples without understanding the context behind them. Writing:

- September: We wrote about the turning of the ‘Investment Clock’. And how we should begin to see growth and inflation pick up over the coming quarters. And how this should drive the outperformance of energy and value stocks in the months ahead.

- November: We talked bitcoin and discussed about how it’s purely a speculative vehicle at this point. But we noted that it was likely to head much higher because global liquidity is flush, it’s an illiquid asset and there’s still probably lots of untapped global demand for it (ie, Greater Fools).

We were right on most of the big trends throughout the year. We started the year bullish and remained bullish throughout (though I’ll admit, at times, I became too cautious and held more cash when I should have pushed harder. I should have just focused on my liquidity indicators which were saying BUY and not on the vertical persistence (overbought) nature of the trend). We called the rebound in Europe and China while also hitting the bottom in the energy sector. And in addition to the macro, we researched and pitched a number of stocks that went on to kill it, but we either never got a position on or were sized too small relative to the opportunity. Here’s some of the names we covered but didn’t fully exploit. AAAP we covered in our April MIR when it was trading for $38. It went on to rise over 110% and now trades for $82 — we never got a position on. In that same report we pitched FCAU when it was trading at just over $10. It’s now up over 80% at $18+. There was GAIA in March, now up 60% — sized too small. In August we pitched IBKR which went on a tear of 65% — sized too small and too slow on the trigger. In November I wrote about PANL which quickly ran up 257% — no position.Considering how much we got right on our macro calls and micro picks, this should’ve been a great year for the macro trades. But again the poor performance all comes down to execution error on my part. We didn’t fully take advantage of the opportunity set we uncovered from our research. I mean, it’s always going to be the case that you’re sized too small in your winners and too large in your losers. That’s just a reality of trading. But, after studying all the macro trades for this year it’s clear that execution could have been much much tighter.My sloppy execution dragged on our returns in the second half of the year. Where in the first half, which we talked about in our mid-year review, was decent. The macro trades were up 10.5% and beating the market. My takeaway then on where I performed poorly was “Failing to execute and size up on solid macro themes.” This has been a creeping issue in my trading this year and I need to work to develop the systems necessary to dial in my execution so we produce the results that we deserve from our research. Our second half performance was also hit by a stupid large long put option position against TSLA (2% of capital). I broke one of my rules, which is to never bet against the one-percenters like Elon Musk because even if they can’t pull off their high wire act they can still inspire a rabid investor fan base. We still have plenty of time on these options and I think there’s a good chance the trade will finish in the money. But it wasn’t worth the capital drag. Not to mention, worth breaking my rules for. The brightside going into 2018 is that the signs are pointing to a coming regime change in markets and a return of volatility. Sentiment and positioning are stretched and credit spreads can’t get much tighter. Meanwhile, inflation is set to trend higher which is going to drive yields up next year. We’re not predicting the end of the bull market in 18’ but we do have high conviction that this period of low-vol melt up is coming to an end.So my money is on our macro trades having a much better year in 18’.

Vol Trades

Return Metrics *Through December 8th 2017YTD: 37.82%12-Month Return: 37.82%Inception (Jan. 2016): 58.40%Annual Vol: 8.49%Sharpe Ratio: 2.83Max DD: -4.46% Tyler here. Vol carry has been the easiest trade of 2017 — which is quite comical considering this time last year every single analyst on Wall Street thought Trump’s first year in office would create extremely high volatility.Literally the exact opposite happened.Take a look UVXY, the ultra short vol ETF. I think it wins the prize for best mega-trend of the year. (Outside of crypto!)

Tyler here. Vol carry has been the easiest trade of 2017 — which is quite comical considering this time last year every single analyst on Wall Street thought Trump’s first year in office would create extremely high volatility.Literally the exact opposite happened.Take a look UVXY, the ultra short vol ETF. I think it wins the prize for best mega-trend of the year. (Outside of crypto!) Our volatility strategy nailed most of this trend, while also managing to stay out of the market during the large spike in August.One thing that separates our vol trading from the pack is that we just don’t sit blindly shorting these products into oblivion. We carefully assess the macro environment and then tweak position sizing and even go long volatility depending on the macro read.All 4 of our short vol trades were winners. And we actually still won on 60% of the long vol trades. So all in all a great year. The macro reads helped the vol trading tremendously.But performance wasn’t perfect and there’s still room for improvement which is why I want to dissect some trades for nuggets of info that we can take with us in the years ahead.

Our volatility strategy nailed most of this trend, while also managing to stay out of the market during the large spike in August.One thing that separates our vol trading from the pack is that we just don’t sit blindly shorting these products into oblivion. We carefully assess the macro environment and then tweak position sizing and even go long volatility depending on the macro read.All 4 of our short vol trades were winners. And we actually still won on 60% of the long vol trades. So all in all a great year. The macro reads helped the vol trading tremendously.But performance wasn’t perfect and there’s still room for improvement which is why I want to dissect some trades for nuggets of info that we can take with us in the years ahead.

Short Vol

The first three vol cycles I sold played out in a conventional manner. The overpriced futures slowly rolled down the curve as SPX floated higher. Buyers of volatility paid sellers of volatility for hedging a risk event that never happened. The highlight of our performance came after Trump struck a last minute deal with the Dems to move the debt ceiling deadline further out in time.I figured short-term vol would get crushed with the only macro catalyst kicked down the road. I upped leverage and aggressively sold volatility at the beginning of September. That call ended up paying off and was the largest winner of the year. After a very profitable October cycle, I couldn’t bring myself to sell futures for the next cycle at extremely low prices. I also thought that debt ceiling fears were going to creep back in towards the end of the year and send the price of fear higher.That never panned out. The debt ceiling was ignored and instead investors continued buying the market on hopes of tax reform. I should have kept with the program and continued to ride the trend. All of our macro liquidity indicators were in bullish territory and the data said to keep selling vol. I overrode those signals and succumbed to the bear narrative that vol was “due to blow up.”Lesson: stick to the process and ignore the noise of the Twiterrati.All in all I’m satisfied with our performance on the short side this year. We hit this trend hard in the right spots and fully exploited this low vol market regime.

After a very profitable October cycle, I couldn’t bring myself to sell futures for the next cycle at extremely low prices. I also thought that debt ceiling fears were going to creep back in towards the end of the year and send the price of fear higher.That never panned out. The debt ceiling was ignored and instead investors continued buying the market on hopes of tax reform. I should have kept with the program and continued to ride the trend. All of our macro liquidity indicators were in bullish territory and the data said to keep selling vol. I overrode those signals and succumbed to the bear narrative that vol was “due to blow up.”Lesson: stick to the process and ignore the noise of the Twiterrati.All in all I’m satisfied with our performance on the short side this year. We hit this trend hard in the right spots and fully exploited this low vol market regime.

Long Vol

There were 5 times in 2017 where I took a stab at going long VIX

- Pre-French elections

- The August N. Korea scare

- The pre-debt ceiling deadline

- November super lows

- End of year debt ceiling rehash

I won on the first three, got cocky, and then went on to give back those profits on the last two long vol trades of the year. As traders we have to constantly battle emotional pulls towards fear AND greed. Experience helps to control things, but maintaining proper balance is always a challenge. I could of better managed my emotional highs during the late fall of this year. Position sizing was the other thing that killed me here. I played smaller in the beginning of the year and bigger at the end of the year. If your small on your wins and large on your losses it doesn’t matter how good of a hit rate you have. Your P&L won’t look good. I want to focus on using more consistent position sizing next year. To sum up, I think I can walk away from 2017 content with the performance. I’m not ecstatic — things could of been better going into the end of the year. But overall the process here is working.

Conclusion

Excellence is an art won by training and habituation. We do not act rightly because we have virtue or excellence, but we rather have those because we have acted rightly. Excellence, then, is not an act, but a habit. ~ Aristotle

We started MO two years ago with the aim of building a trading service/site that we always wanted but that didn’t exist. We plan to continue busting our asses improving and evolving our service so that it stands head and shoulders above the other sites out there; we want to be the best when it comes to education, trade theory, analysis tools, trading returns, and quality of its community. We don’t aim to grow into a giant Motley Fool-type business because that would mean serving the common denominator. We want to foster a community of diehards — of traders, who, like us, are singlemindedly focused on becoming the absolute best; who think differently than the average market participant and strive for a deeper understanding of how this game works. The MO community is still small, but I think we’ve been successful in our hunt for quality.