Keep An Eye On Gold...

There are very few people who can develop the skills to get the edge, and far fewer still who can withstand the losses emotionally and still stick with the system. Probably only one in five hundred people have the necessary discipline to be successful. ~ Blair HullGood morning! In this week’s return of the Dirty Dozen [CHART PACK] we look at the budding setup in gold, the path forward for bonds, discuss what net bearish conference board stock expectations mean for the S&P, and end with technical breakouts in two stocks with powerful fundamental drivers, plus more...

***click charts to enlarge***

- Precious metals need to be on your radar. Gold’s monthly chart is setting up for its next leg higher...

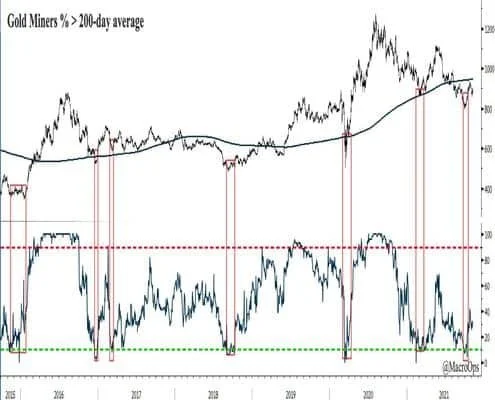

- The percentage of gold miners trading above their 200-day moving average fell below 10% a few weeks ago. Readings such as these tend to mark selling exhaustion which creates the conditions for longer-term bottoms.

- Net small speculator positioning in gold is also around levels that tend to coincide with longer-term bottoms, especially when gold remains in a technical uptrend.

- Our commercial short-term oscillator recently swung back below its red line which is a bullish condition while seasonality remains highly supportive over the next few months.

- Our leading yield indicator and 10-year yields diverged quite a bit over the last few months. Yields have been starting to catch down over the last two weeks and there’s good reason to think this will continue.

- Sentiment remains overly bearish on bonds, suggesting there’s probably a good bit of offsided positioning to fuel a move lower in yields.

- TLT short interest tells a similar story...

- The SPX is in a Buy Climax and our Trend Fragility indicator is in the 99th percentile of its 3-year range. The thing about buy climaxes is that they tend to last longer than most think. SPX has now put in 5 consecutive weekly bull bars. This is the 30th time in its history that its seen this type of momentum. Strong momentum like this positively skews the follow-on 10-week returns.

- One interesting thing to note is that consumers have turned bearish on the outlook for stocks for the first time since July of last year.

- SentimenTrader pointed out last week that “some of the most significant monthly rebounds have occurred when consumers had been negative on stocks, so the S&P 500's annualized return when there are more bears than bulls is almost double what it is when bulls are in the majority.”

- The Florida real estate company JOE is breaking out from an extended range. This stock has a confluence of powerful tailwinds. We’re long and will be adding to our position this week.

- Another holding of ours Wheels Up (UP) is making a move out from its base. This company is positioning itself to be the Uber of flying private. It’s run by a talented and experienced leadership team that has plenty of skin in the game. There’s a lot to like about UP as long as the team keeps executing on their vision.

Thanks for reading.Stay safe out there and keep your head on a swivel.

Thanks for reading.Stay safe out there and keep your head on a swivel.