It’s Time To Get Back On The Uranium Bull… [Dirty Dozen]

“You can make a good living selling hype, but you can get rich by buying truth.” ~ Larry Hite’s book “The Rule”

In this week’s Dirty Dozen [CHART PACK] we look at potential sell signals firing but contrast that with neutral-to-slightly-supportive internals. We then discuss the ongoing rotation we’re seeing across sectors, another long setup in BTCUSD, and a bottom in the Uranium pullback, plus more…

1. No new primary signals triggered last week though our weekly Nervous & Numb signal is a hair’s breadth from triggering a sell signal.

2. N&N’s current reading sits at 1.96 (yellow line) and a sell signal requires a reading of 2 or above.

3. The SPX tends to see below average returns with greater downside variance following a sell signal. But the N&N by itself isn’t a perfect timing tool and needs additional context.

4. The Qs broke down from their coiling 2 week wedge on Friday. It’s in a Bull Volatile regime where heightened volatility (hence the name) is to be expected.

We dramatically reduced our risk last week after being leveraged long all year. We haven’t seen enough to turn outright bearish. We’re more neutral to slightly bullish with expectations for greater chop in the near-term. So we’ve been adjusting our book accordingly.

5. We’re seeing some negative divergences in our market internals (ie, high vs low beta, QQQ vs SPY, etc…) but overall they’re in neutral territory according to our aggregate oscillator.

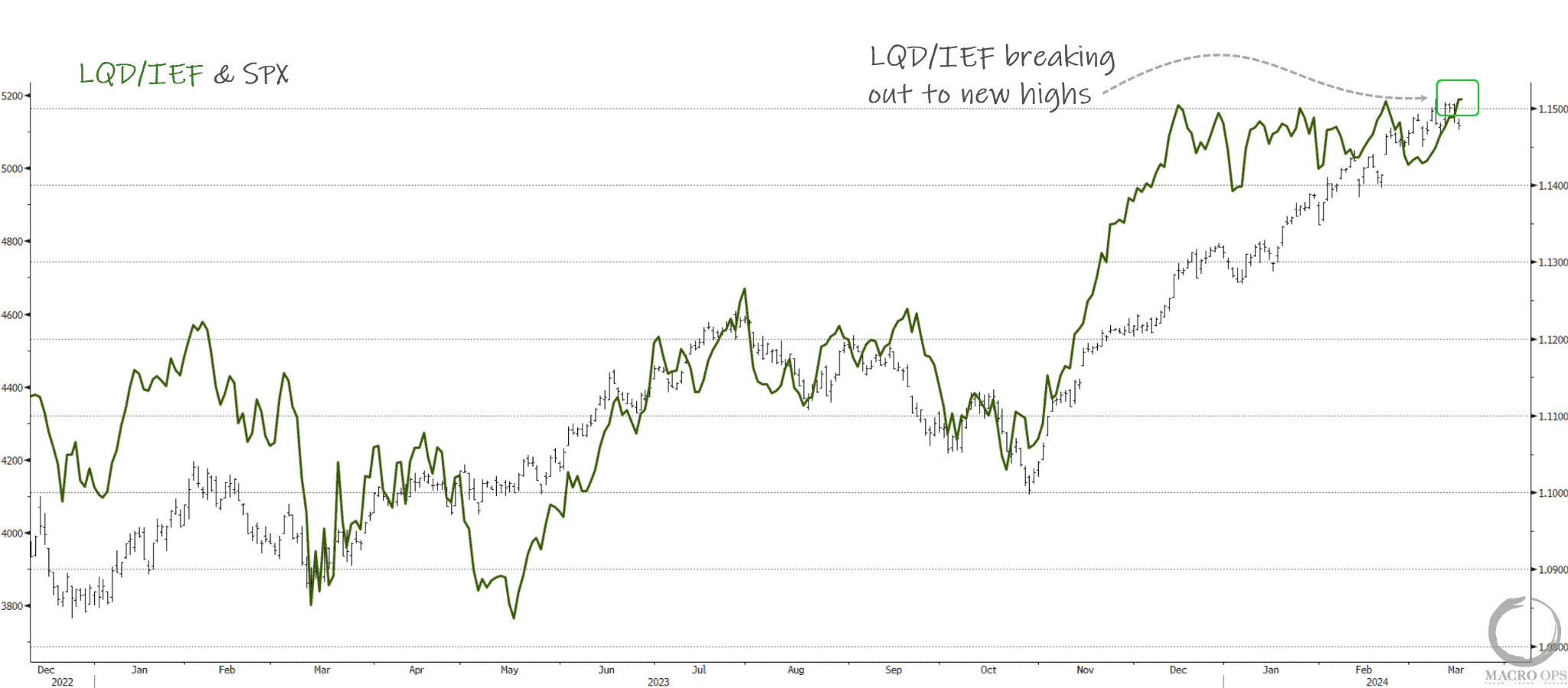

6. And one of my go-to internals (LQD/IEF) broke out to new highs last Friday after being in a sideways range for the past 4-months. This suggests that the overall backdrop is still favorable to risk assets, albeit one that’s deteriorating slowly at the margins. And we’re likely seeing some rotation away from high beta (tech/growth) into real asset plays (commodities, materials, etc..).

7. The BofA’s Bull & Bear indicator inched up a 1/10th of a point from last week but remains in neutral territory.

8. We can see signs of rotation in our returns heatmap below. Oil and gas with the best performance last week and improving relative momentum over the past month and quarter as well, while semis starting to lose some steam.

9. Here’s the latest CoT speculative positioning on a 6-month oscillator basis. GBPUSD and silver have the most crowded large specs at the moment. While heating oil, Soybean & bean oil, and the Nasdaq 100 have the lightes.

10. We got stopped out of our long BTCUSD position last week. But we’ve now seen a pullback reversal to the midline which gives us a good place to put in a buy stop right above Sunday’s highs (stop right below its lows) and see if the market pulls us back in.

11. NFIB small business survey shows businesses are becoming more concerned about poor sales (white line on top chart) which suggests a deceleration in the labor market (orange line = unemployment rate) (h/t @renmacllc).

12. We took profits on our uranium holdings back in early February when we saw the technicals start to deteriorate amidst a backdrop of retail euphoria. Both have since improved in the bulls favor and we remain extremely bullish the sector for fundamental reasons.

The latest price action provides us with a good entry point to get back in with large size and small risk.

Thanks for reading.