IT’S ALL MONTE CARLO

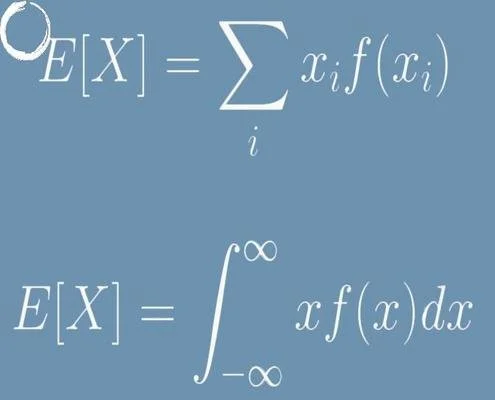

In the original Market Wizards, commodities trader Larry Hite talked about four types of bets: Good Bets, Bad Bets, Winning Bets, and Losing Bets.Hite’s point was that a winning bet is not always a good one, and a losing bet is not always a bad one. We can see why through the lens of Expected Value (EV). It’s possible to do something smart and still lose money. It’s also possible to do something dumb and make a profit. But only in the short run — in the long run, the law of averages settles all accounts.Expected Value gets down to the deep nitty-gritty difference between winning players and losing players:Winning players strive to always take positive EV actions (make “good bets”) without concern for the immediate outcome.Winning players seek to AVOID negative EV actions at all costs.Losing players routinely indulge in negative EV actions, i.e. make “bad bets,” because they don’t know any better… aren’t disciplined enough to avoid temptation… or just want to have fun.Consider the city of Las Vegas. (or Macau, which now has more than nine times the gambling revenue of Las Vegas.)Vegas and Macau are, quite literally, funded by negative EV activities. Tourists engage in games of chance where the odds, on an expected value (EV) basis, are either slightly against them or greatly against them. The casinos are on the other side of this — which explains why most Vegas casinos are publicly traded with revenues in the billions.Not everyone who goes to “Lost Wages” for a little gambling is irrational of course. Losing money in a fun way, surrounded by friends and coaxed by free drinks, can be a worthwhile vacation activity. Many who come to the strip and drop their $500 or $1,000, or whatever amount is designated for the trip, feel they got their money’s worth in terms of a good time.Many traders and poker players are the same way. Having a good time, either consciously or subconsciously, is the driving point of why they play. And that bias strongly favors unprofitable decision making. In trading and poker, the positive EV decision is often the emotionally hard thing to do… whereas the negative EV decision is the emotionally easy thing to do. Calling with a draw where you should’ve folded? Negative EV, but more fun. Playing too many hands preflop? Negative EV, but less boring (and thus more fun). Playing too passively or with too small a stack? Negative EV, but less scary (and thus more fun). Shorting Tesla (TSLA) when it’s shooting the moon and you’re getting repeatedly blundered, but you're part of the hip $TSLAQ crowd (and thus more fun... I guess?)And so on and so forth… the desire to be entertained is antithetical to profitable play. The antidote is to redefine “fun” as something else — the fun of training, the fun of being a true competitor, and the fun of winning.IT’S ALL MONTE CARLOThe “Monte Carlo method” is used by scientists and mathematicians. It is also used by poker players and traders on an intuitive basis.To run a Monte Carlo simulation in your head, do the following:

-

- Imagine a situation where your opponent has a potential range of holdings

- Imagine all variables are fixed except which cards your opponent actually has

- Insert various possibilities based on you knowledge of the likely range

- Insert various probabilities based on future turn, river, and bet scenarios

- Estimate the average across all results

- Determine whether EV is positive or negative for various decisions

- Make the decision with the highest EV based on your analysis

To put it another way: In any poker or trading situation, you want to figure out what the reasonable parameters are for that situation — what your opponent could be holding — and then you want to run that simulation in your head a thousand times. Not literally “a thousand times,” but that is the mental picture.The “Monte Carlo” aspect of this is traversing the range of probabilities. You also weight various scenarios in occurrence with their likelihood. So, for example, if you think there is a 10% chance your opponent is stone-cold bluffing, you factor that in at 10 percent. If you have pocket queens, and you think there is a 30% chance your opponent has pocket kings or aces, you factor that accordingly as well. You must get comfortable with “probability weighting.” This type of scenario-based Monte Carlo simulation, in order to deliver a weighted expectation result, is what winning poker players and traders do constantly. It is their analytical bread and butter in the quest to make positive EV decisions.For winning poker players and traders, “everything is Monte Carlo” because all decisions are constantly weighted and assessed in respect to EV. Outcomes have an element of randomness and will display meaningful variation at any given time. But the PROCESS is always relentlessly positive EV.You have probably heard the phrase “process over outcome.” Gearing all decisions toward positive EV is a literal interpretation of process over outcome. If your decision was plus EV, it doesn’t matter whether the short-term result was unprofitable (as long as you can handle short-term volatility). The process trumps all over time. With patience, the law of large numbers (aka the law of averages) delivers the goods.This further explains why winning players are not perturbed by temporary setbacks or negative results. When you understand probability distribution, you also understand that X percent of the time, you will get the negative result rather than the positive one. This is not a bad thing — it is simply part of poker and trading.And in fact, it is a very good thing, because if negative expectation bets did not pay off a fair percentage of the time, bad players/traders would stop making them!Do you know why there is almost no money in chess? Because all the weak chess players know that they are weak. There aren’t enough instances of negative expectations payoff to fool them and entice them. If you are bad at chess you will get your butt whipped dozens of games in a row, and then you will work hard to get better or quit.In poker and markets, though, the randomly distributed payoff of negative expectation bets — coupled with the fact that the untrained human brain is fundamentally bad at math — means that bad players can persist in playing for years, or even decades, mistakenly convincing themselves they are good. And thankfully that’s the case because, in the zero-sum games of poker and markets, it’s the players who consistently make negative EV bets, that fill our pockets.