Is Gold About To Crash?

“A trader's job is to take losses. A losing trade doesn't imply you did anything wrong. The hard part about trading is that you can do the right thing and still lose money. There is not a direct feedback loop that tells you, ‘good job.’ I only have control over the orders I place. I don't have control over the outcome of trades.” ~ Peter L. Brandt, via Unknown Market Wizards

Good morning!In this week’s Dirty Dozen [CHART PACK] we look at some fresh-off-the-press monthly charts, view oil from a number of angles, talk bitcoin and gold, and pitch the long case for a high growth tech stock with crowded shorts, plus more...Let’s dive in.

***click charts to enlarge***

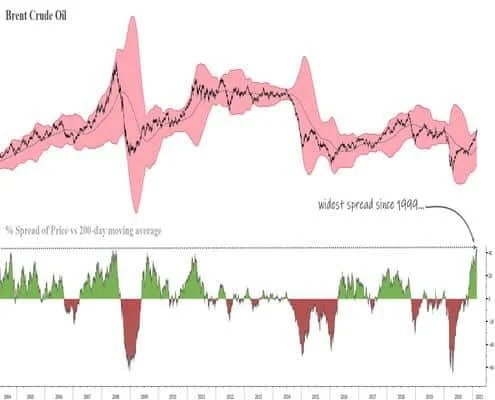

- Brent saw a strong close on the month. I’m bullish on oil’s long-term prospects but as I’ll show, it may be due for a bit of a pullback in the near-term.

- Brent’s spread from its 200-day moving average is at its widest point since 1999.

- Crude is also about to enter one of its weaker months from a seasonality perspective (note: March’s downside is skewed by last year’s fall).

- Though, longer-term, it’s supply and demand picture continues to improve. GS writes:

“Demand continues to accelerate the market rebalancing. The rally in oil prices this year remains driven by fundamentals, with a continued faster decline in inventories than even we expected (just like last month). This deficit remains driven by demand as we revise once again OECD demand levels higher as realized data in Europe, the US and Mexico for late 2020 exceeded our expectations (with EM demand for December comforting us in our recently raised forecasts). OPEC+ production in turn came below our expectations in January driven by sequentially lower exports from Saudi - even before its unilateral cut - as well as Nigeria, Angola and Kuwait.”

- The global vaccine rollout is picking up steam and driving the case count lower.

- The Greyscale Bitcoin Trust (GBTC) has traded at a premium to NAV for its entire history, until last week.

- This is a sign of souring investor enthusiasm which is confirmed by Sentix’s Bitcoin Sentiment Index.

Sentix writes “Bitcoin lost significant value over the course of the week. In the current sentix survey, we now measure a clearly gloomy sentiment, which is already close to a lower turning point. A stabilization is thus approaching. However, we have not yet measured a reversal in investors' value perception. A rising value perception would be desirable for a trend reversal scenario.”

- Semis continue to be one of the strongest areas of the market and WDC is no exception. The stock looks near to completing a 6-year coiling wedge (you can read our bullish semi thesis here).

- Deutsche Bank (DB) just closed above its 50-month moving average (blue line) for the first time in 8-years. I think the most hated financial in the world is going to surprise a lot of people in the years ahead (we are long).

- We pitched Twitter in the Dozen back in August when it was trading sub $40 a share (link here). The stock has since doubled and is trading at new all-time highs. February’s large bull candle reflects a buying frenzy which means we may be nearing a local top but we’re still liking this as a longer-term play.

- Gold closed near its lows on the month but speculator positioning remains extremely long. That’s not a good look… Gold and PMs, in general, are susceptible to more downside in the weeks ahead.

- FuboTV Inc (FUBO) is wedging on a monthly, weekly, and daily basis. It’s in breakout mode on the monthly chart. The company has a hot product, is growing revenues at a fast clip, and has high short-interest. FUBO reports earnings this week. Keep an eye on this one...