Cascade Effects: How the Coronavirus Can Tip The World Into Recession...Or not

***This is an excerpt taken from a note sent to Collective members over the weekend***

Wikipedia describes a cascade effect as “an inevitable and sometimes unforeseen chain of events due to an act affecting a system”.A cascade effect occurs in markets when an event or connection of events kickstarts a positive feedback loop, which then goes on to dominate price action until it burns itself out and the process goes into reverse.George Soros touches on this particular dynamic in his book “The Alchemy of Finance”, writing:

At any moment of time, there are myriads of feedback loops at work, some of which are positive, others negative. They interact with each other, producing the irregular price patterns that prevail most of the time; but on the rare occasions that bubbles develop to their full potential they tend to overshadow all other influences.

In today’s piece, we’re going to explore the increased potential for major cascading effects in markets and the global economy. And we’ll finish with a discussion on how we can best position ourselves to manage this increasingly uncertain environment.To kick things off, I want to go over some of the key points covered in Bridgewater’s roundtable discussion titled “Assess the Coronavirus” that was released last week since it serves as a useful roadmap for our discussion today.If you haven’t seen it, here’s the link. It’s 22 minutes long and worth watching in its entirety. Below is my paraphrasing of their discussion on the potential coronavirus impacts on markets and the economy.

-

- We already know the global economy is going to take a major hit in Q1. The big question going forward is how long will this impact last?

- Historically, most pandemics have tended to have shorter-term impacts on the economy. These were then followed by very strong recoveries due to global monetary and fiscal responses.

- The key determinant however in whether a shock comes and goes or cascades into a longer-term impact is whether or not it flows into the credit system.

- If it doesn’t have a second-order impact in creating credit problems then its ultimate impact will be muted.

- Two things are true right now

- (1) Never before in the history of the world have central banks been more plugged into the global financial system and able and willing to provide liquidity to where it’s needed.

- (2) At the same time, the world is holding record-high levels of debt and the efficacy of monetary policy going forward is limited with rates already at the lower bound and the world flush with liquidity.

- We know we’re going to see a large Q1 global shock. What matters is how things play out from there... how does the virus spread, how do people and governments respond, etc…

- Key questions going forward:

- China’s coronavirus outbreak followed a temporal arc. This led to a dramatic slowdown in China’s economy but now that the infection rate has dropped, its economy is beginning to recover; albeit slowly and from very low levels.

- Does China experience a second wave of infections as people go back to work?

- Do the arcs in other countries play out like the one in China?

- Markets tend to under discount events in the beginning and over discount them as they mature.

- When trying to discern the implied impact of profits that the market is pricing in, it’s difficult to say what’s due to profit expectations and what’s due to a change in risk premium (the premia spread of equities over other assets, such as bonds).

- Bridgewater thinks the market is pricing in roughly a 20% decline in earnings across global markets for the entire year, as a result of the virus.

- Looked at another way, if you don’t assign half the impact to risk premium then the market is pricing in a 40% decline in earnings for the year.

- That’s a large impact being discounted when compared to past pandemics unless this one ends up being closer to the Spanish Flu in its economic severity.

- So a big ongoing economic impact and hit to profits are already priced into global markets.

The market has already discounted a big drop in profits for the year. This discount is much larger than past pandemics outside of the 1918 Spanish Flu. This means stocks are cheap here as long as the economic impact doesn’t feed into the credit system and cause a cascade in the credit markets.There’s lot of big ifs here… That’s to be expected since the cone of plausible outcomes has been blown wide by this virus. This is fine. Our job here as traders and investors is not to try and predict the future but rather to be informed of the various possible outcomes, know what characteristics are unique to each one, and formulate a game plan for all.This is Bruce Kovner’s trick that helped him to become one of the greatest living traders. He said:

One of the jobs of a good trader is to imagine alternative scenarios. I try to form many different mental pictures of what the world should be like and wait for one of them to be confirmed. You keep trying them on one at a time. Inevitably, most of these pictures will turn out to be wrong — that is, only a few elements of the picture may prove correct. But then, all of a sudden, you will find that in one picture, nine out of ten elements click. That scenario then becomes your image of the world reality.

Let’s start with a look at credit markets, which after this weekend’s news of the OPEC+ breakdown, is facing a double whammy of sorts. And this is troubling since they’re already in quite the precarious spot as I’ll show you.Mohammad El-Erian, an economist (and one of the few that I actually find is worth listening to), wrote in an op-ed last week for the FT about the dangers lurking beneath the surface of the US debt markets, saying (emphasis mine):

Sudden sell-offs in markets have a nasty way of exposing vulnerabilities that take on a disruptive life of their own, and risk amplifying the initial shock through a self-feeding cycle.

It is important to remember, in this context, the large amount of US investment-grade corporate debt that hangs over the high-yield market like a Damoclean sword. Much of it is now facing a considerably higher risk of downgrade, given the inevitable global economic slowdown caused by coronavirus.

The greater the movement down to junk status, the higher the risk of a waterfall of funding dislocations that makes everything worse, financially and economically.

Years of easy money and financial leveraging have led to high profits and an enduring bull market. But the thing about operating leverage is that it’s a sharp knife which can cut both ways. The severity of which is susceptible to exponential shocks simply due to the size of the numbers we’re talking about. According to Blackrock, the US corporate bond market is over $10tn size, 5x larger than it was two decades ago.El-Erian goes onto explain what this could mean for the bond market, writing:

The result is that corporate debt has risen significantly faster than earnings growth and cash balances, resulting in a significant downward ratings migration that now has half of the total investment-grade market clinging to that status with a triple B rating, up from less than one-fifth in 2001. Among the companies on that bottom rung, a third are already rated triple B minus, and thus at greater risk of a downgrade to junk.

The likelihood of a growing number of “fallen angels” comes at a time when the longstanding structural deficiency of the $1.2tn high-yield market — that is, a small base of dedicated investors, relative to the amount of outstanding bonds — is more apparent. Liquidity stress could be exacerbated by a lack of funds willing to cross over into junk territory, put off by sudden spikes in credit spreads and less-friendly trading conditions.

Now, both companies and investors must navigate the economic and financial effects of the coronavirus that heighten credit risk while sucking liquidity out of the bond markets. The longer it takes to contain these spillovers, the larger the credit downgrades, the higher the threats of default — and the greater the likelihood of financial markets contaminating the economy.

Debt ultimately creates fragility in the system. It makes it the entire system much more susceptible to shocks and non-linear cascading effects — feedback loops run amok. As El-Erian points out, Fallen Angels — investment-grade getting downgraded to junk status — is not a simple step function event. Mandates and regulations mean that a mass downgrade from IG to HY would create large forced selling as most holders of IG can’t legally own HY paper. This would create more downgrades and liquidity seizures within the market, thus spawning a feedback loop with menacing results.The coronavirus has the potential to be an angel killer.The virus represents two major shocks to the system. Both a supply shock and a demand one. Credit Suisse’s financial plumbing expert Zoltan Pozsar hit on a crucial point in how the virus affects the credit system through the supply chain, writing (emphasis by me):

Debt is agnostic to your circumstances – it must be serviced, otherwise you are bankrupt. Factory closures and an abrupt halt in the assembly and shipment of final goods and quarantined metropolises therefore matter for firms as debts must be serviced regardless, and if dollars don’t flow in from sales and payments, they have to be raised from banks.

...“the supply chain is a payment chain in reverse” and when output is not being shipped, the assembler/seller of final goods in China does not have inflows to pay the suppliers of intermediate goods, so firms in Japan, Korea and Taiwan are not having inflows either – every firm along the chain starts to become a deficit agent.

Beyond the initial deficit entry – not getting paid for components already shipped – deficits will multiply over time due to fixed costs. Think about servicing assets – plants, offices, ships, other transportation fleets – and servicing the debt that’s financing these assets.

The question is how much financial damage is done by the current IP [industrial production] shock and the fact that it coincides with a shock in services – a sector which is seldom volatile or cyclical. Missed payments in manufacturing are one thing. Missed payments in manufacturing and services at the same time are another.

Our global supply chain has been optimized over decades for just-in-time manufacturing. The virus has exposed the vulnerabilities of such a system. Another consequence is that it’s also resulted in a global just-in-time payment system.The difference is, that when the just-in-time manufacturing system breaks down, companies don’t get their needed parts and a supply shock ensues… while when a just-in-time payment system gets jammed up debt payments are missed, loans go into default, and the credit system grinds to a halt.Combine these stresses with the spread of government-enforced social-distancing and mass quarantines that we’re starting to see implemented in countries outside of China.Take Italy for example, they’ve just quarantined the entire Lombardy region…So you know what a big deal this is, the Lombardy region, and it’s capital Milan, is the engine of the Italian economy. It’s home to over 16m people… A population twice the size of NYC’s is now banned from “entering or exiting the area and also movement inside it won’t be allowed if not for “undeferrable” business or health reason… the so-called ‘security zone’ restrictive measures will include school closures and suspending skiing and public events, and closing museums, swimming pools, and theatres… Bars and restaurants will have to maintain a distance of at least a meter between people or will be closed. Work meetings have to be suspended” according to a report by Bloomberg.Whether or not these are overreactions are irrelevant. Similar actions are coming to a city near you.The reason: incentive cascades.We live in a social media amplified world where the global mob greatly increases the costs of not overreacting to a disaster. God help you if you’re the one University President, City Mayor, or Company CEO that doesn’t take the drastic actions your peers implement and that subsequently results in a single death from the coronavirus. You can go ahead and kiss your job goodbye… you’ll be chased out of your position by a mob of hysterically righteous twitter justice warriors.How long can our over-indebted service-based economy weather a mass social-distancing storm? I don’t know the answer to that question but I can tell you that the credit market will figure it out before anybody else does.Indices such as Markit’s North American CDX Investment Grade Index have gone vertical in recent weeks as they begin to sniff out the repercussions here. Bloomberg Barclays High Yield Credit index is at its third widest point in its history.

Bloomberg Barclays High Yield Credit index is at its third widest point in its history. WTI Crude finished last week at $41.28. The average breakeven for a US fracker is $50/bbl.

WTI Crude finished last week at $41.28. The average breakeven for a US fracker is $50/bbl. We’re experiencing the largest commodity demand shock since 2008 right now. Goldman Sachs estimates that the “unprecedented disruption to economic activity in China has resulted in an estimated 4 million b/d of lost oil demand compared to 5 million b/d during the Great Recession in 2008/2009.”What a time to start a pricing war in oil…Over the weekend, Russia essentially pulled out of OPEC+. The Sauds were arguing for further production cuts to match the decline in demand. Russia said no. The Ruskies don’t want to facilitate favorable conditions for US producers who continue to boost output.Mikhail Leontiev, a spokesman for Rosneft (a large Russian oil producer) told Bloomberg reporters following the meeting that “If you always give in to partners, you are no longer partners, It’s called something else… Let’s see how American shale exploration feels under these conditions.”Russia’s estimate breakeven price is around $45 and the country has built up reserves over the last few years and can manage an extended price war.The House of Saud is not taking this lying down and it looks like they’ll be responding in kind. Saudia Arabia announced that it plans to boost its oil output to well over 10m barrels a day next month. They also went and slashed their pricing by the most in 30-years and according to Bloomberg, “Saudi Aramco is offering unprecedented discounts in Asia, Europe and U.S. to entice refiners to use Saudi crude.”

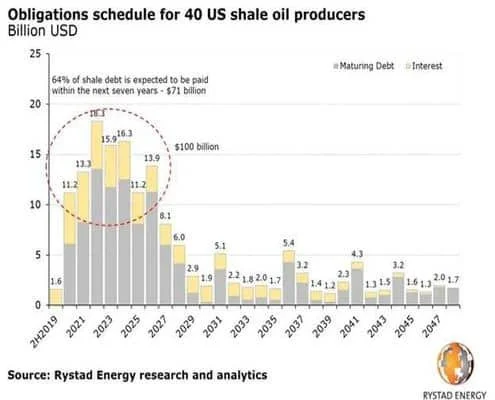

We’re experiencing the largest commodity demand shock since 2008 right now. Goldman Sachs estimates that the “unprecedented disruption to economic activity in China has resulted in an estimated 4 million b/d of lost oil demand compared to 5 million b/d during the Great Recession in 2008/2009.”What a time to start a pricing war in oil…Over the weekend, Russia essentially pulled out of OPEC+. The Sauds were arguing for further production cuts to match the decline in demand. Russia said no. The Ruskies don’t want to facilitate favorable conditions for US producers who continue to boost output.Mikhail Leontiev, a spokesman for Rosneft (a large Russian oil producer) told Bloomberg reporters following the meeting that “If you always give in to partners, you are no longer partners, It’s called something else… Let’s see how American shale exploration feels under these conditions.”Russia’s estimate breakeven price is around $45 and the country has built up reserves over the last few years and can manage an extended price war.The House of Saud is not taking this lying down and it looks like they’ll be responding in kind. Saudia Arabia announced that it plans to boost its oil output to well over 10m barrels a day next month. They also went and slashed their pricing by the most in 30-years and according to Bloomberg, “Saudi Aramco is offering unprecedented discounts in Asia, Europe and U.S. to entice refiners to use Saudi crude.” I can’t even begin to tell what a big deal this is. The combined supply and demand shock to the oil markets make sub $30 oil not just a possibility but a probability… That’s huge and its repercussions are going to be far-reaching.And this all couldn’t be coming at a worse time for US shale producers who have a staggering $100bn in debt and interest payments coming due over the next 6-years. Over 60% of the debt that matures over the next 4 years is speculative. No way these companies are going to be able to refinance and roll over these debts… Not in this environment.

I can’t even begin to tell what a big deal this is. The combined supply and demand shock to the oil markets make sub $30 oil not just a possibility but a probability… That’s huge and its repercussions are going to be far-reaching.And this all couldn’t be coming at a worse time for US shale producers who have a staggering $100bn in debt and interest payments coming due over the next 6-years. Over 60% of the debt that matures over the next 4 years is speculative. No way these companies are going to be able to refinance and roll over these debts… Not in this environment. This means we should expect wide-scale defaults and belly ups in energy space. Russia just basically took a kill shot at US producers and hit them square between their leveraged cash-burning oily eyes…There’s going to be some incredible deals once the smoke clears. I’m chomping at the bit because there are some fantastic companies in the space. One’s with Fort Knox like balance sheets, and incredible assets that produce strong FCF. But we need to be patient here as this will almost certainly be a baby getting tossed out with the frack water situation.

This means we should expect wide-scale defaults and belly ups in energy space. Russia just basically took a kill shot at US producers and hit them square between their leveraged cash-burning oily eyes…There’s going to be some incredible deals once the smoke clears. I’m chomping at the bit because there are some fantastic companies in the space. One’s with Fort Knox like balance sheets, and incredible assets that produce strong FCF. But we need to be patient here as this will almost certainly be a baby getting tossed out with the frack water situation. And this, of course, brings us back to one of our original questions which is whether or not we see a credit cascade result from all of this. While lower oil prices certainly benefit the American consumer, I expect the shock to the economy and subsequently the credit market to far outweigh the benefit of lower prices at the gas pump.Will that be enough to tip us over the edge… to kickstart a feedback loop of liquidation? Or will the virus burn itself out in the next couple of months, and stimulus from the Game Masters (central banks and governments) suffice to keep the system from locking up, thus setting up markets for an incredible buying opportunity?Only time will tell… Until then, we need to keep managing our risks and listen to what the market is telling us.

And this, of course, brings us back to one of our original questions which is whether or not we see a credit cascade result from all of this. While lower oil prices certainly benefit the American consumer, I expect the shock to the economy and subsequently the credit market to far outweigh the benefit of lower prices at the gas pump.Will that be enough to tip us over the edge… to kickstart a feedback loop of liquidation? Or will the virus burn itself out in the next couple of months, and stimulus from the Game Masters (central banks and governments) suffice to keep the system from locking up, thus setting up markets for an incredible buying opportunity?Only time will tell… Until then, we need to keep managing our risks and listen to what the market is telling us.

You can't build in a feedback or reactive model, because you don't know what to model. And if you do know — by the time you know — the odds are the market has changed. That is the whole point of what makes a trader successful — he can see things in ways most others do not, anticipate in ways others cannot, and then change his behavior when he starts to see others catching on. ~ Richard Bookstaber

Portfolio Review

Our portfolio is up 12.5% ytd. We’re currently net short in our equity book after adding the new positions last week.Bonds have been a big producer for us since the start of the year and we continue to sit in our 50% Core position. If the market looks like it’s putting in an intermediate term bottom which could happen in the next few days or weeks, then I may consider taking full profits.The one change I’m making is I’m getting back into gold and upping my position to 50% of NAV after going flat the other week. Gold finished strong on Friday and if we see more follow through in the days ahead, then it likely means gold is resuming its bull trend.Regarding the equity positions. I’m going to be quick to cut and minimize risk should my longs look like they’re going to dip or my shorts rip. I’m not looking to get overly cute in this environment. Priority one, is playing defense here and protecting capital while we wait for some setups. Thank you for reading.

Thank you for reading.