A Record-Breaking Market

Back in October, I wrote a piece for Real Vision titled Market Tops and Archimedes’ Lever. I talked about why I was bullish the market. If you can remember, those four very long months ago, people were very — and I mean very — bearish. I believe I was one of the only bulls on RV at the time.Here were my concluding thoughts from the report:

We’re moving off the backend of the fiscal impulse into better base effects (the past data in which YoY% is measured against). This means easier hurdle rates going forward.

And finally, auto-demand. It was a one-off event and global demand for car vehicles will improve going forward (the data is already showing this).

So, yeah, spiking repo rates, ISM in free-fall, and inverted yield curves are scary things. But this is the market; there’s always something to fret about. That’s what builds the wall in which stocks climb.

The market is a discounting machine and looking out 6-12 months, things look better than they are today. China will stabilize, the Fed will stay easy, the global manufacturing recession will soon end. And we’ll return to a very low but positive growth world -- which just so happens to be the best type of environment for risk assets.

I know that probably reads as complacent head-in-the-sand thinking to some of you. It’s not easy taking this position, which means it’s more than likely the correct one. Markets are funny like that.

Trends are fed by disbelief in the prevailing fundamentals. A market climbs or falls by the incremental adoption of the narrative that spawns around these fundamentals. A bullish trend rises because bears keep getting caught short and forced to cover while former bears and those on the sidelines decide to get long.The more people buy into a trend the more convincing and pervasive the narrative supporting that trend becomes, creating a feedback loop. Eventually, that feedback loop drives prices to a local extreme. This leads to bulls taking profits and bears testing shorts. Prices swing back in the other direction, and the process begins again. This is the proverbial wall of worry in which the market climbs. A constant swing of the pendulum along a direction trend.Well… the pendulum has swung quite a ways since last October.We’ve gone from staring down the barrel of recession to taking out the Jan 18’ all-time record high spread on the U Michigan Stock Market Confidence Survey (chart via SentimenTrader). We’re also seeing:

We’re also seeing:

-

- Options market gone wild

- According to SentimenTrader “leveraged traders of expiring contracts have never held so much exposure to a rally in stocks… With the surge in call buying, their total outlay has exceeded more than $7 billion in premiums paid each of the last two weeks.” Which is “far beyond anything we’ve ever seen before.”

- 20-day Put/Call ratio at lows hit only 3 other times over the last 6-years.

- According to Charlie McElligott “Investors have gotten extraordinarily (and mechanically) long the market via options and the overall index trade to ATH, with Delta across the S&P 500 currently in the 99.5th percentile”

- And Goldman Sachs points out that single stock option notional volumes as a percentage of shares are at 91%. The highest level ever.

- Short interest in the SPY is at its lowest point since early 2007.

- Speculative retail plays such as SPCE and TSLA are seeing record-breaking trading volume

- Options market gone wild

And on and on it goes…So a few things are true right now:

-

- Speculation is reaching a fever pitch

- The SPX is in a buy climax but buy climaxes tend to last longer than anyone expects

- Bulls are still in control and the path of least resistance remains up, though this could change any day

Long bonds have so far given us a free hedge against our long positions. As long as price stays above the center-line of that wedge (call it the 162’06 level), I’m sitting in my large long position. If it falls below, I’m cutting back to my core holding.

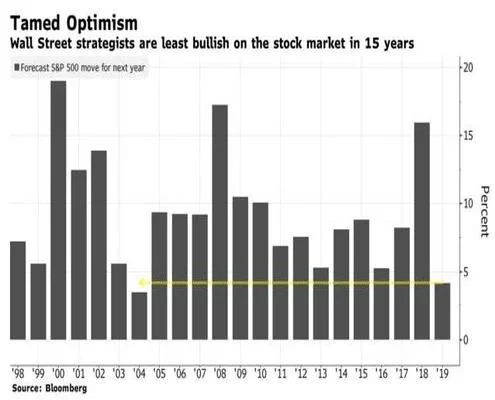

Long bonds have so far given us a free hedge against our long positions. As long as price stays above the center-line of that wedge (call it the 162’06 level), I’m sitting in my large long position. If it falls below, I’m cutting back to my core holding. My current base case is that the market is about to enter a period of extended weakness. This won't be the market top everyone is looking for but could turn into a significant retrace due to the extreme trend fragility.The longer-term path of least resistance remains up. It’s important to remember we came into this year with Wall Street strategists the most pessimistic on the stock market in 15-years.

My current base case is that the market is about to enter a period of extended weakness. This won't be the market top everyone is looking for but could turn into a significant retrace due to the extreme trend fragility.The longer-term path of least resistance remains up. It’s important to remember we came into this year with Wall Street strategists the most pessimistic on the stock market in 15-years. The market has a way of making fools out of those in the consensus. This year will be no different.

The market has a way of making fools out of those in the consensus. This year will be no different.